Region:Europe

Author(s):Shubham

Product Code:KRAB1242

Pages:92

Published On:October 2025

By Type:The market is segmented into Online Training, In-Person Workshops, Blended Learning Programs, Certification Courses, Corporate Training Programs, Leadership Development, Vocational and Technical Training, Soft Skills and Language Training, and Compliance and Regulatory Training. These segments reflect the diverse learning preferences and organizational needs in Ukraine. Online Training and Blended Learning have gained significant traction due to increased remote work and digital adoption, while Vocational and Technical Training is prioritized for economic recovery and alignment with labor market needs .

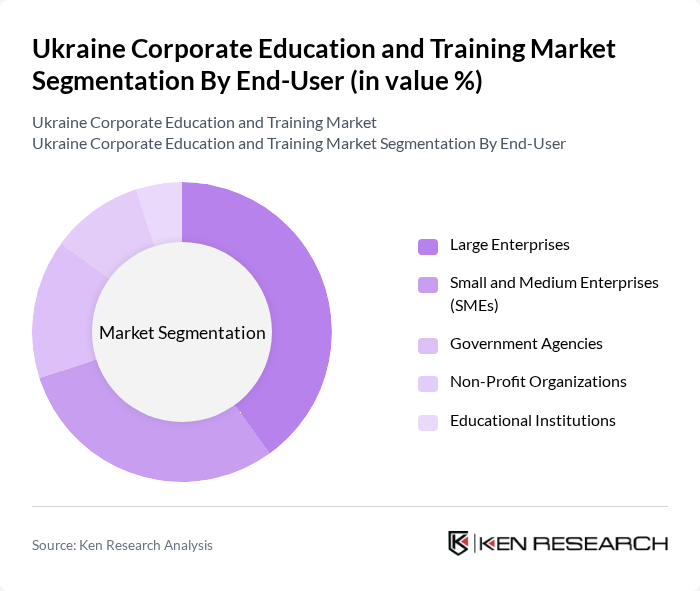

By End-User:The end-user segmentation comprises Large Enterprises, Small and Medium Enterprises (SMEs), Government Agencies, Non-Profit Organizations, and Educational Institutions. Large enterprises and SMEs are the primary drivers of market demand, with government agencies and educational institutions increasingly investing in workforce development and digital skills training to support national economic goals .

The Ukraine Corporate Education and Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prometheus, EdEra, Skillbox Ukraine, IT Step Academy (????'?????? ???????? IT Step), Projector Institute, Talent Academy Ukraine, SoftServe, GBS Corporate Training, UFuture, Ukrainian Leadership Academy (?????????? ???????? ?????????), Dnipro Business School, Kyiv School of Economics, Lviv Business School (LvBS), Ukrainian Institute of Management, Business School of the National University of Kyiv-Mohyla Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and training market in Ukraine appears promising, driven by technological advancements and a growing emphasis on employee development. As companies increasingly recognize the importance of upskilling their workforce, investments in digital learning and customized training solutions are expected to rise. Additionally, partnerships between corporations and educational institutions will likely enhance the quality and relevance of training programs, ensuring alignment with industry needs and fostering a culture of continuous learning.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Programs Certification Courses Corporate Training Programs Leadership Development Vocational and Technical Training Soft Skills and Language Training Compliance and Regulatory Training |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions |

| By Industry | IT and Software Manufacturing Healthcare Finance and Banking Retail and E-commerce Telecommunications Logistics and Transportation Energy and Utilities Others |

| By Training Methodology | Instructor-Led Training Self-Paced Learning Virtual Classrooms Simulation-Based Training On-the-Job Training |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications International Certifications |

| By Delivery Mode | Online Delivery Offline Delivery Hybrid Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in IT | 100 | Training Managers, IT Directors |

| Leadership Development Initiatives | 80 | HR Managers, Executive Coaches |

| Compliance Training in Finance | 70 | Compliance Officers, Financial Analysts |

| Soft Skills Training Across Industries | 90 | Training Coordinators, Employee Development Specialists |

| Technical Skills Development in Manufacturing | 60 | Operations Managers, Training Supervisors |

The Ukraine Corporate Education and Training Market is valued at approximately USD 1.1 billion, reflecting a significant investment in workforce development driven by the demand for skilled labor and digital transformation across various industries.