Region:Europe

Author(s):Dev

Product Code:KRAB3113

Pages:80

Published On:October 2025

By Type:The market is segmented into various types of training offerings, including Online Training, In-Person Workshops, Blended Learning, Corporate Training Programs, Certification Courses, Leadership Development Programs, and Others. Online Training has gained significant traction due to its flexibility and accessibility, especially in the wake of the COVID-19 pandemic. In-Person Workshops remain popular for hands-on learning experiences, while Blended Learning combines the best of both worlds. Corporate Training Programs are tailored to meet specific organizational needs, and Certification Courses are essential for professional development. Leadership Development Programs are increasingly prioritized as companies seek to cultivate future leaders.

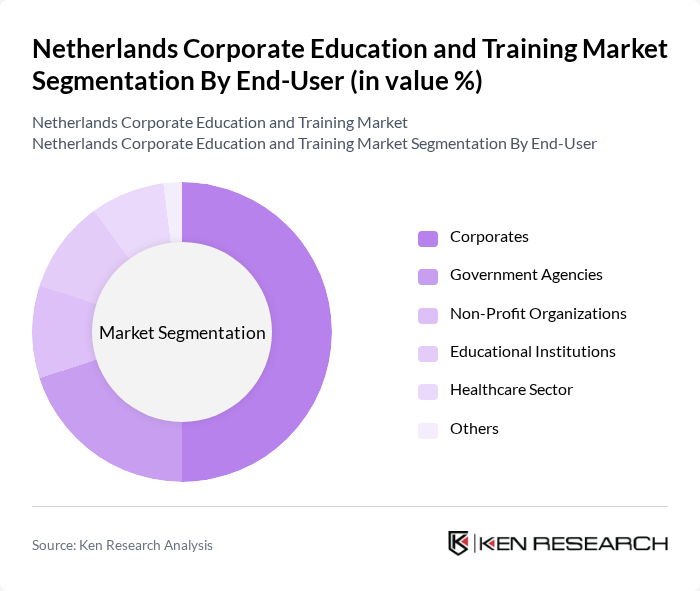

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Healthcare Sector, and Others. Corporates are the largest segment, driven by the need for continuous employee development to keep pace with industry changes. Government Agencies also invest significantly in training to enhance public service efficiency. Non-Profit Organizations and Educational Institutions focus on specialized training programs, while the Healthcare Sector requires ongoing education to comply with regulations and improve patient care.

The Netherlands Corporate Education and Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCOI Opleidingen, LOI, Skillsoft, Schouten & Nelissen, The Learning Network, Springest, GoodHabitz, Learnit, ICM Opleidingen & Trainingen, NTI, TNO, E-learning Academy, Academie voor de Rechtspraktijk, KPN Training, AOG School of Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and training market in the Netherlands appears promising, driven by ongoing technological advancements and a strong emphasis on employee development. As organizations increasingly recognize the value of a skilled workforce, investments in training are expected to rise. Additionally, the integration of artificial intelligence and data analytics into training programs will enhance personalization and effectiveness, ensuring that training outcomes align closely with organizational goals and employee needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Corporate Training Programs Certification Courses Leadership Development Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Healthcare Sector Others |

| By Industry Sector | Information Technology Finance and Banking Manufacturing Retail Hospitality Others |

| By Training Format | Workshops Seminars Webinars E-Learning Modules Coaching Sessions Others |

| By Duration | Short-Term Courses Medium-Term Courses Long-Term Programs Ongoing Training Others |

| By Delivery Method | Instructor-Led Training Self-Paced Learning Virtual Classrooms Hybrid Models Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Compliance Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training in IT Sector | 100 | HR Managers, Training Coordinators |

| Healthcare Employee Development Programs | 80 | Training Directors, Compliance Officers |

| Manufacturing Skills Enhancement Initiatives | 70 | Operations Managers, Safety Trainers |

| Soft Skills Training in Corporate Environments | 90 | Learning and Development Specialists, Team Leaders |

| Leadership Development Programs | 60 | Executive Coaches, Senior Management |

The Netherlands Corporate Education and Training Market is valued at approximately USD 2.5 billion, reflecting a significant investment in employee development driven by the need for upskilling and reskilling in a rapidly evolving job market.