Region:Asia

Author(s):Dev

Product Code:KRAA3559

Pages:86

Published On:September 2025

By Delivery Format:The delivery format of corporate education and upskilling programs is crucial in determining how effectively training is imparted. The market is segmented into various formats, including Virtual Instructor-Led Training (VILT), In-Classroom Training, Self-Paced Recorded Training, Blended Learning Programs, Mobile and Social Learning, Online or Computer-Based Methods, and Others. Each format caters to different learning preferences and organizational needs, influencing the overall effectiveness of training initiatives. Instructor-led and blended learning formats are particularly prominent, reflecting the continued importance of interactive and flexible training solutions in the Australian market .

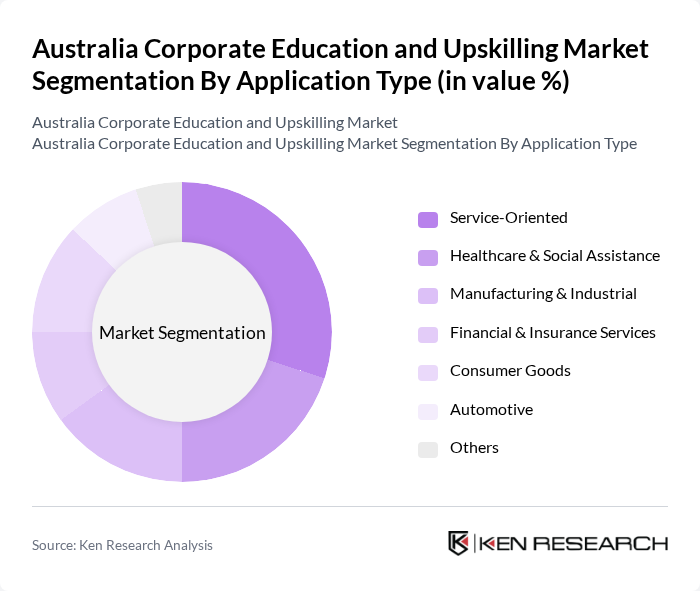

By Application Type:The application type segment of corporate education and upskilling encompasses various industries, including Service-Oriented, Healthcare & Social Assistance, Manufacturing & Industrial, Financial & Insurance Services, Consumer Goods, Automotive, and Others. Each application type reflects the specific training needs and regulatory requirements of different sectors, driving the demand for tailored educational programs. Service-oriented and healthcare segments are leading due to ongoing requirements for compliance, customer service, and technology integration .

The Australia Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEEK Learning, Open Colleges, Upskilled, TAFE Queensland, Coursera, LinkedIn Learning, Australian Institute of Management (AIM), RMIT Online, BSI Learning, Dale Carnegie Training, FranklinCovey, The Dream Collective, Academy Xi, General Assembly, The Learning Network contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and upskilling market in Australia appears promising, driven by technological innovations and a strong emphasis on workforce development. As organizations increasingly prioritize employee skill enhancement, the integration of AI and personalized learning experiences will become more prevalent. Additionally, the focus on soft skills and mental well-being in training programs is expected to gain traction, aligning with the evolving needs of the workforce and enhancing overall employee satisfaction and productivity.

| Segment | Sub-Segments |

|---|---|

| By Delivery Format | Virtual Instructor-Led Training (VILT) In-Classroom Training Self-Paced Recorded Training Blended Learning Programs Mobile and Social Learning Online or Computer-Based Methods Others |

| By Application Type | Service-Oriented Healthcare & Social Assistance Manufacturing & Industrial Financial & Insurance Services Consumer Goods Automotive Others |

| By Region | New South Wales Queensland Victoria South Australia Western Australia Others |

| By Mode of Learning | Blended Learning Instructor-Led Classroom Only Mobile and Social Learning Online or Computer-Based Methods Virtual Classroom Others |

| By Types of Training Services | Brand Training Customer Management Leadership Managerial Quality Training Sales Soft Skills Technical Training Others |

| By Deployment | On-Site Off-Site Others |

| By Designation of Employee | Integrated Managerial Non-Managerial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | HR Managers, Training Coordinators |

| Upskilling Initiatives in IT | 80 | IT Managers, Learning & Development Specialists |

| Healthcare Sector Education | 60 | Healthcare Administrators, Training Managers |

| Financial Services Training | 50 | Compliance Officers, Financial Analysts |

| Employee Skill Development Programs | 70 | Operations Managers, Employee Engagement Officers |

The Australia Corporate Education and Upskilling Market is valued at approximately USD 5.1 billion, reflecting significant growth driven by the demand for skilled labor and the need for continuous professional development among employees across various sectors.