Region:Central and South America

Author(s):Shubham

Product Code:KRAB6578

Pages:83

Published On:October 2025

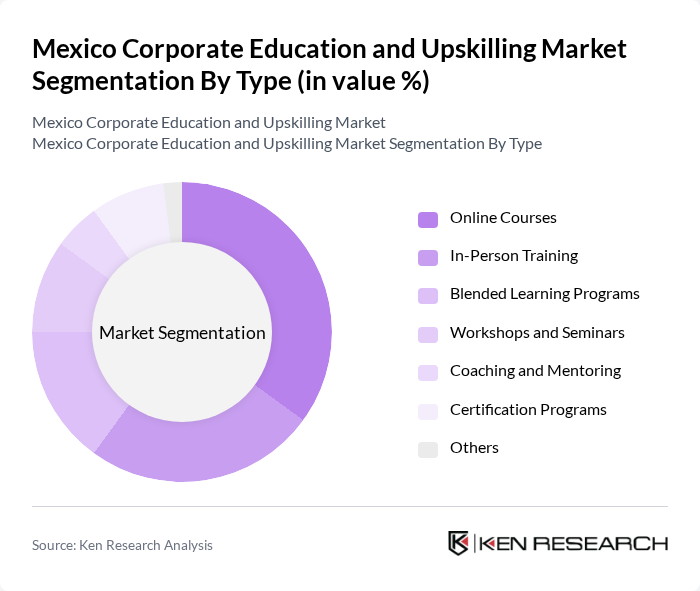

By Type:The market is segmented into various types of educational offerings, including Online Courses, In-Person Training, Blended Learning Programs, Workshops and Seminars, Coaching and Mentoring, Certification Programs, and Others. Each of these subsegments caters to different learning preferences and organizational needs, with online courses gaining significant traction due to their flexibility and accessibility.

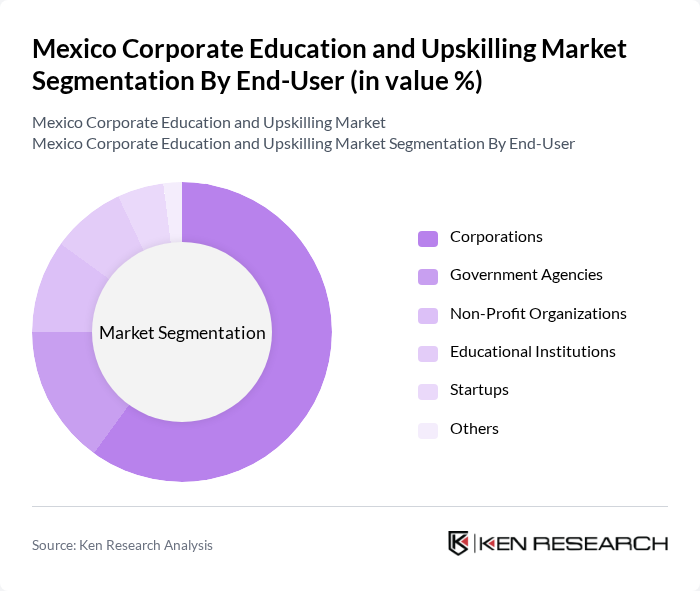

By End-User:The end-users of corporate education and upskilling services include Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporations are the primary consumers, driven by the need to enhance employee skills and maintain competitiveness in the market.

The Mexico Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Educativo CEDVA, Tecnológico de Monterrey, Universidad Anáhuac, Coursera, Udemy for Business, LinkedIn Learning, Pluralsight, Skillshare, EdX, Kuepa, Crehana, Capacitación Empresarial, Aprende Institute, CECyTE, Instituto Politécnico Nacional contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and upskilling market in Mexico is poised for transformation, driven by technological advancements and changing workforce dynamics. As companies increasingly recognize the importance of continuous learning, the integration of artificial intelligence and personalized learning experiences will become more prevalent. Furthermore, the emphasis on soft skills and leadership training will shape educational offerings, ensuring that employees are equipped to navigate complex challenges in a rapidly evolving business landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses In-Person Training Blended Learning Programs Workshops and Seminars Coaching and Mentoring Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Industry | Technology Healthcare Finance Manufacturing Retail Others |

| By Delivery Mode | Virtual Learning Face-to-Face Learning Hybrid Learning Mobile Learning Others |

| By Duration | Short Courses (Less than 1 month) Medium Courses (1-6 months) Long Courses (More than 6 months) Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | Training Managers, Business Development Executives |

| HR Departments in Large Enterprises | 150 | HR Directors, Learning and Development Managers |

| Employees Participating in Upskilling Programs | 120 | Mid-level Employees, Team Leaders |

| Government Education Officials | 50 | Policy Makers, Program Coordinators |

| Industry Experts and Consultants | 80 | Consultants, Academic Researchers |

The Mexico Corporate Education and Upskilling Market is valued at approximately USD 2.5 billion, reflecting a significant investment by companies in training programs to enhance employee productivity and adapt to evolving industry demands.