Region:Asia

Author(s):Rebecca

Product Code:KRAB5970

Pages:97

Published On:October 2025

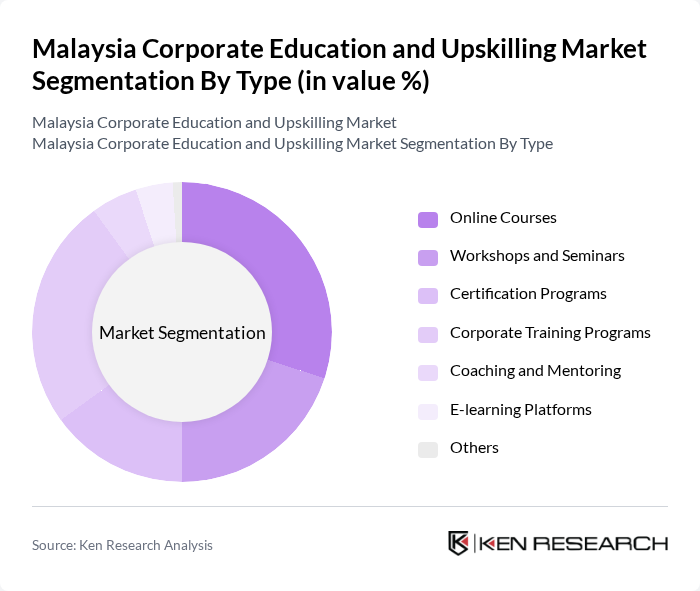

By Type:The market is segmented into various types of educational offerings, including Online Courses, Workshops and Seminars, Certification Programs, Corporate Training Programs, Coaching and Mentoring, E-learning Platforms, and Others. Each of these sub-segments caters to different learning preferences and organizational needs, with a notable trend towards digital learning solutions.

The Online Courses sub-segment is currently dominating the market due to the increasing preference for flexible learning options among professionals. The rise of digital platforms has made it easier for individuals to access a wide range of courses at their convenience, leading to a significant uptick in enrollment. Additionally, the COVID-19 pandemic accelerated the shift towards online learning, making it a preferred choice for many organizations looking to upskill their workforce efficiently.

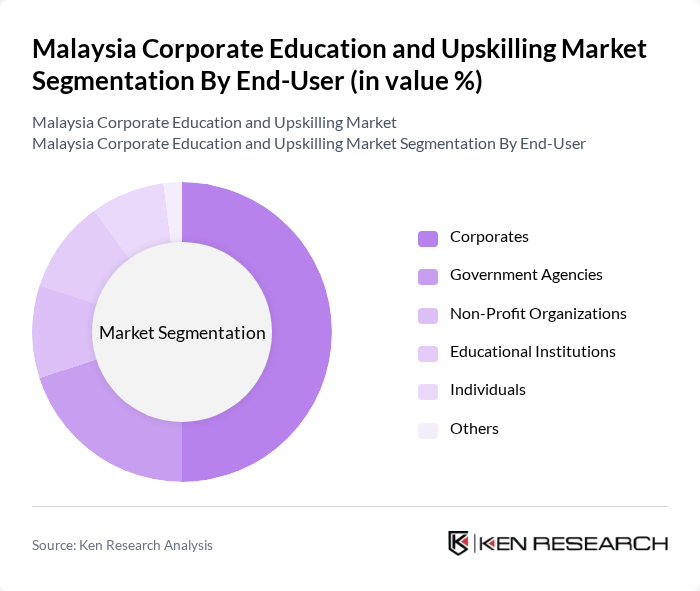

By End-User:The market is segmented by end-users, including Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Each end-user category has distinct training needs and objectives, influencing the types of educational programs they seek.

Corporates represent the largest end-user segment, driven by the need for continuous employee development and the desire to enhance productivity and innovation. Organizations are increasingly recognizing the importance of investing in their workforce to adapt to changing market demands and technological advancements. This trend is further supported by corporate training budgets that prioritize skill development as a strategic initiative.

The Malaysia Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Global Knowledge Network, TalentCorp Malaysia, Open University Malaysia, Pusat Latihan Teknologi Tinggi (ADTEC), KPMG Learning Academy, Coursera for Business, Skillsoft, Udemy for Business, APT Training, MDEC (Malaysia Digital Economy Corporation), HRDF (Human Resource Development Fund), ELS Language Centres, The Learning Lab, SEGi University, Universiti Malaya contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and upskilling market in Malaysia appears promising, driven by a strong emphasis on digital transformation and workforce development. As companies increasingly recognize the importance of continuous learning, investments in training programs are expected to rise. The integration of artificial intelligence and personalized learning experiences will enhance training effectiveness. Furthermore, the collaboration between corporate entities and educational institutions will foster innovative training solutions, ensuring that the workforce remains competitive in a rapidly changing economic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Workshops and Seminars Certification Programs Corporate Training Programs Coaching and Mentoring E-learning Platforms Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Industry Sector | Information Technology Manufacturing Healthcare Finance Retail Others |

| By Learning Format | Blended Learning Virtual Learning In-Person Training Self-Paced Learning Others |

| By Duration of Training | Short-Term Courses Long-Term Programs Ongoing Training Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | Training Managers, Business Development Executives |

| HR Departments in Large Enterprises | 150 | HR Directors, Learning and Development Managers |

| Small and Medium Enterprises (SMEs) | 80 | Business Owners, Operations Managers |

| Government Education Agencies | 50 | Policy Makers, Program Coordinators |

| Employees Participating in Upskilling Programs | 120 | Mid-level Professionals, Entry-level Employees |

The Malaysia Corporate Education and Upskilling Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for skilled labor and the need for continuous professional development among employees.