Region:Asia

Author(s):Dev

Product Code:KRAB6501

Pages:94

Published On:October 2025

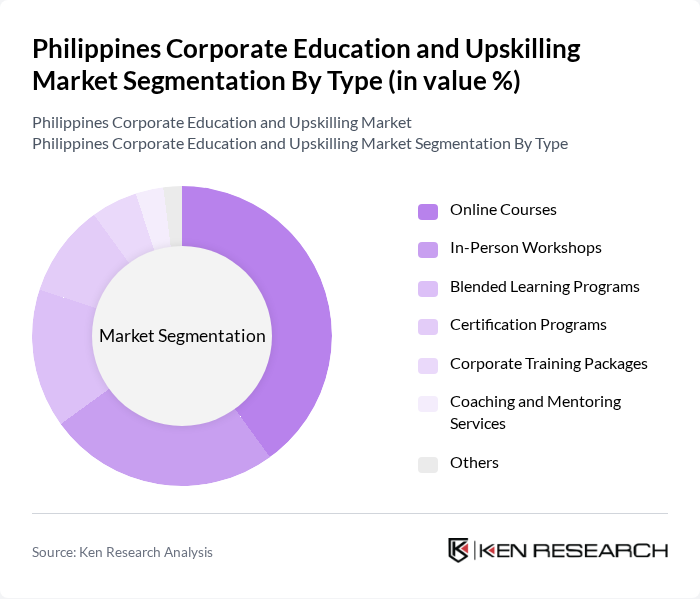

By Type:The market is segmented into various types, including Online Courses, In-Person Workshops, Blended Learning Programs, Certification Programs, Corporate Training Packages, Coaching and Mentoring Services, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing employees to learn at their own pace. In-Person Workshops remain popular for hands-on training and networking opportunities, while Certification Programs are increasingly sought after for professional advancement.

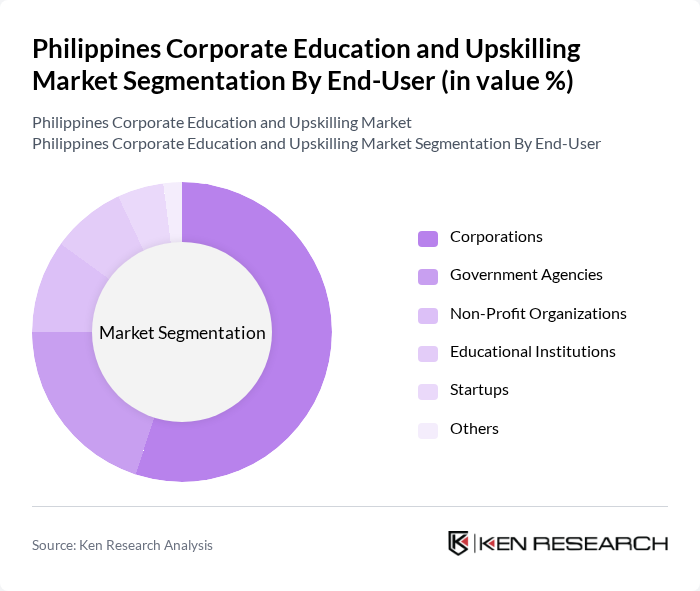

By End-User:The market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporations dominate the market as they invest heavily in employee training to enhance productivity and retain talent. Government agencies are also significant players, focusing on workforce development initiatives, while educational institutions are increasingly partnering with corporate entities to provide tailored training solutions.

The Philippines Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ateneo de Manila University, University of the Philippines, TESDA (Technical Education and Skills Development Authority), Coursera, Udemy, LinkedIn Learning, KPMG, Accenture, IBM Skills Academy, PLDT Enterprise, Globe Telecom, Smart Communications, Manila Business College, Knowledge Channel Foundation, Edukasyon.ph contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and upskilling market in the Philippines appears promising, driven by technological advancements and a growing emphasis on employee development. As organizations increasingly recognize the importance of a skilled workforce, investments in training programs are expected to rise. Additionally, the integration of AI and analytics into training methodologies will enhance learning outcomes, making education more personalized and effective. This trend will likely foster a culture of lifelong learning, essential for adapting to the rapidly changing job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses In-Person Workshops Blended Learning Programs Certification Programs Corporate Training Packages Coaching and Mentoring Services Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Industry | Information Technology Healthcare Manufacturing Retail Finance Others |

| By Training Format | Workshops Seminars E-Learning Modules Webinars Others |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training Others |

| By Delivery Method | Instructor-Led Training Self-Paced Learning Hybrid Learning Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Upskilling Initiatives in IT | 100 | IT Managers, Learning and Development Specialists |

| Manufacturing Sector Training | 80 | Operations Managers, Safety Officers |

| Service Industry Skill Development | 70 | Customer Service Managers, Training Consultants |

| Government-Funded Training Programs | 60 | Policy Makers, Educational Administrators |

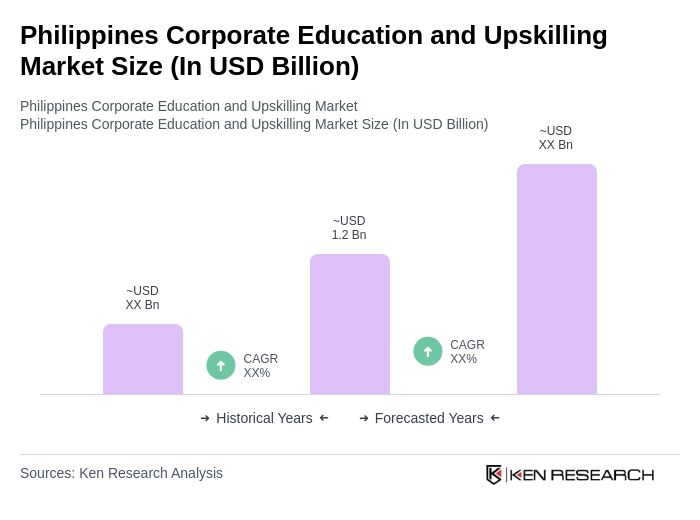

The Philippines Corporate Education and Upskilling Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled labor and the need for continuous professional development among employees across various industries.