Region:Europe

Author(s):Geetanshi

Product Code:KRAB2794

Pages:91

Published On:October 2025

By Type:The market is segmented into various types of educational offerings, including Distance Learning, Instructor-Led Training, Blended Learning, Online Courses, Workshops and Seminars, Certification Programs, Coaching and Mentoring, Corporate Training Packages, and Others. Each of these sub-segments caters to different learning preferences and organizational needs. Distance Learning remains the largest segment by revenue, driven by the flexibility and scalability of digital platforms, while Instructor-Led Training is experiencing rapid growth due to demand for interactive and personalized learning experiences .

The Blended Learning sub-segment is currently dominating the market due to its flexibility and effectiveness in combining online and in-person training methods. Organizations are increasingly adopting this approach to cater to diverse learning styles and schedules, allowing employees to engage with content at their own pace while still benefiting from face-to-face interactions. This trend is particularly prevalent in industries that require both theoretical knowledge and practical skills, such as healthcare, technology, and manufacturing .

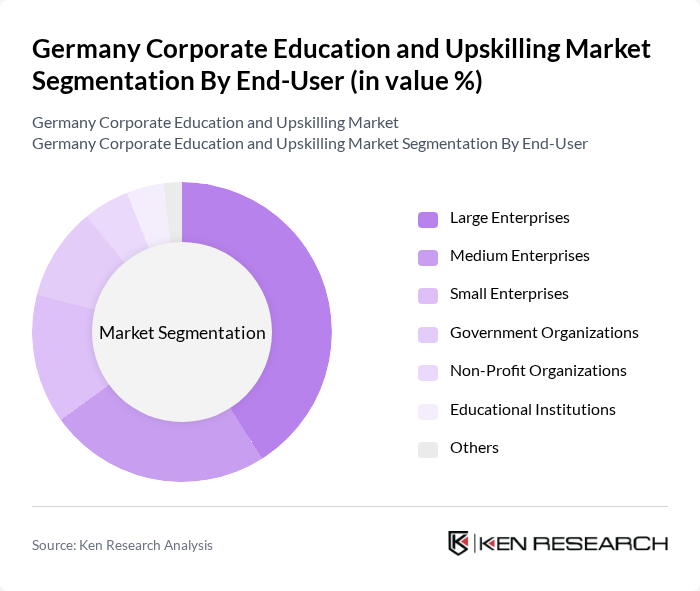

By End-User:The market is segmented by end-users, including Large Enterprises, Medium Enterprises, Small Enterprises, Government Organizations, Non-Profit Organizations, Educational Institutions, and Others. Each segment has unique training needs and budget considerations, influencing their choice of educational offerings. Corporations, particularly large enterprises, are the leading end-user segment due to their substantial investment in workforce development and compliance-driven training .

Large Enterprises dominate the market due to their substantial training budgets and the need for comprehensive upskilling programs to maintain competitive advantage. These organizations often invest in tailored training solutions that align with their strategic goals, ensuring that their workforce is equipped with the latest skills and knowledge. The trend towards digital transformation has further accelerated the demand for corporate education in large firms, as they seek to enhance employee capabilities in technology, leadership, and compliance .

The Germany Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Bertelsmann SE & Co. KGaA (incl. Relias, Udacity Europe), Learnlight, Haufe Akademie GmbH & Co. KG, Cornelsen eCademy & inside GmbH, imc AG, LinkedIn Learning (Germany), TÜV Rheinland Akademie GmbH, Deutsche Telekom AG (Telekom Training), Siemens AG (Siemens Professional Education), PwC (PricewaterhouseCoopers Germany), Capgemini SE, KPMG AG Wirtschaftsprüfungsgesellschaft, Randstad Deutschland GmbH & Co. KG, Hays AG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the corporate education and upskilling market in Germany appears promising, driven by ongoing technological advancements and a strong emphasis on lifelong learning. As companies increasingly recognize the importance of employee development, investments in training are expected to rise. The integration of AI and personalized learning experiences will likely enhance training effectiveness, while government support will further bolster initiatives aimed at closing the skills gap, ensuring a more adaptable workforce in the face of rapid change.

| Segment | Sub-Segments |

|---|---|

| By Type | Distance Learning Instructor-Led Training Blended Learning Online Courses Workshops and Seminars Certification Programs Coaching and Mentoring Corporate Training Packages Others |

| By End-User | Large Enterprises Medium Enterprises Small Enterprises Government Organizations Non-Profit Organizations Educational Institutions Others |

| By Industry | Information Technology Manufacturing Healthcare Finance Retail Telecommunications Automotive Logistics & Transportation Others |

| By Delivery Mode | In-Person Training Virtual Training Hybrid Training Mobile Learning Self-Paced Learning Others |

| By Duration | Short-Term Courses Medium-Term Courses Long-Term Programs Ongoing Training Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Freemium/Trial-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in Technology Sector | 80 | HR Managers, Training Coordinators |

| Upskilling Initiatives in Manufacturing | 60 | Operations Managers, Learning & Development Specialists |

| Employee Development in Service Industries | 50 | Training Managers, Employee Engagement Officers |

| Digital Learning Adoption Across Sectors | 70 | IT Managers, E-learning Developers |

| Impact of Upskilling on Workforce Productivity | 40 | Business Analysts, Corporate Strategists |

The Germany Corporate Education and Upskilling Market is valued at approximately USD 5 billion, reflecting significant investments by companies in training programs to enhance employee productivity and adapt to digital transformation and evolving industry requirements.