Region:Global

Author(s):Shubham

Product Code:KRAB1112

Pages:94

Published On:October 2025

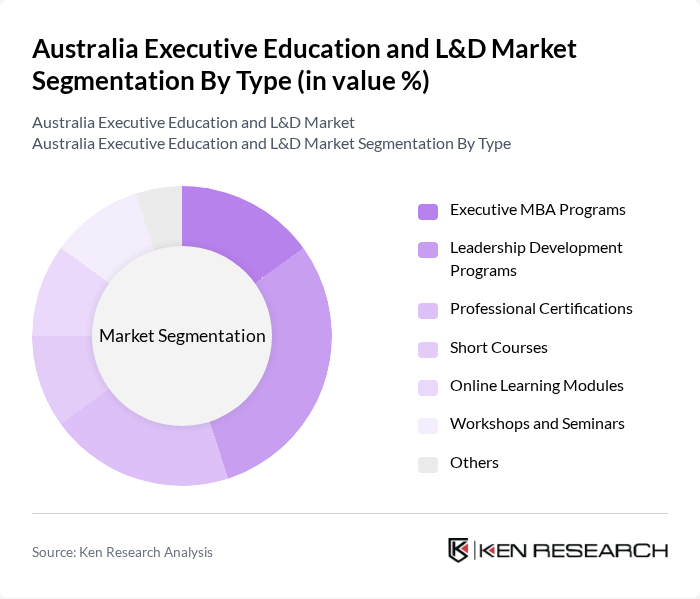

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Leadership Development Programs, Professional Certifications, Short Courses, Online Learning Modules, Workshops and Seminars, and Others. Among these, Leadership Development Programs are particularly dominant due to the increasing emphasis on effective leadership in organizations. Companies are investing heavily in these programs to cultivate strong leaders who can navigate complex business environments.

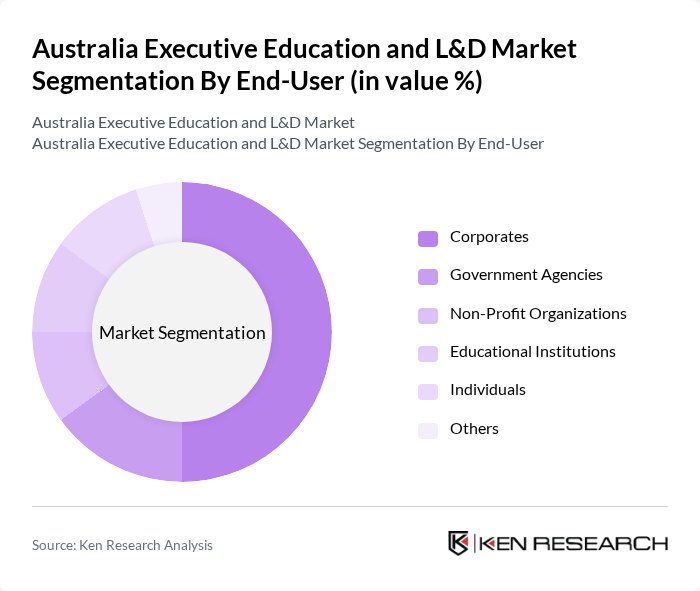

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates are the leading end-users, as they increasingly recognize the importance of continuous learning and development for their workforce. This trend is driven by the need to adapt to technological advancements and changing market dynamics, prompting organizations to invest in tailored training solutions.

The Australia Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Australian Institute of Management, Melbourne Business School, University of Sydney Business School, UNSW Business School, Deakin University, Australian Graduate School of Management (AGSM), RMIT University, Queensland University of Technology, Monash University, University of Melbourne, TAFE Queensland, University of Technology Sydney, Curtin University, Swinburne University of Technology, Charles Sturt University, AIM WA (Australian Institute of Management Western Australia), Macquarie Business School, Kaplan Professional Australia, The Learning Group, Navitas Professional contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Executive Education and L&D market is poised for transformation, driven by technological advancements and evolving workforce needs. As organizations increasingly adopt hybrid learning models, the demand for flexible, accessible training solutions will rise. Furthermore, the focus on soft skills development will gain momentum, as employers recognize the importance of interpersonal skills in a digital workplace. These trends will shape the landscape of executive education, fostering a culture of continuous learning and adaptability among professionals.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Programs Professional Certifications Short Courses Online Learning Modules Workshops and Seminars Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Industry Focus | Technology Healthcare Finance Manufacturing Retail Others |

| By Learning Objective | Skill Development Leadership Training Compliance Training Personal Development Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate L&D Strategies | 100 | Chief Learning Officers, HR Directors |

| Executive Education Program Effectiveness | 80 | Program Participants, Alumni |

| Industry-Specific Training Needs | 60 | Training Managers, Department Heads |

| Government Initiatives in L&D | 40 | Policy Makers, Education Administrators |

| Trends in Online Learning Platforms | 50 | eLearning Specialists, IT Managers |

The Australia Executive Education and L&D Market is currently valued at approximately USD 1.5 billion. This figure reflects a normalization adjustment from an earlier estimate of USD 3.5 billion, indicating a focus on upskilling and reskilling in the workforce.