Region:Europe

Author(s):Rebecca

Product Code:KRAB2869

Pages:85

Published On:October 2025

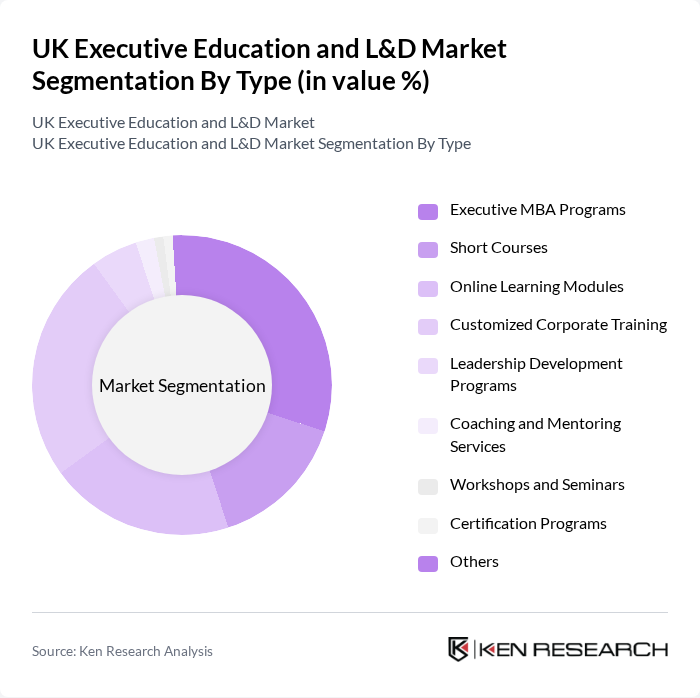

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Short Courses, Online Learning Modules, Customized Corporate Training, Leadership Development Programs, Coaching and Mentoring Services, Workshops and Seminars, Certification Programs, and Others. Among these, Executive MBA Programs and Customized Corporate Training are particularly prominent due to their tailored approach to meet the specific needs of organizations and professionals. Hybrid and online learning modules have seen accelerated adoption, reflecting a shift in learner preferences and organizational training strategies .

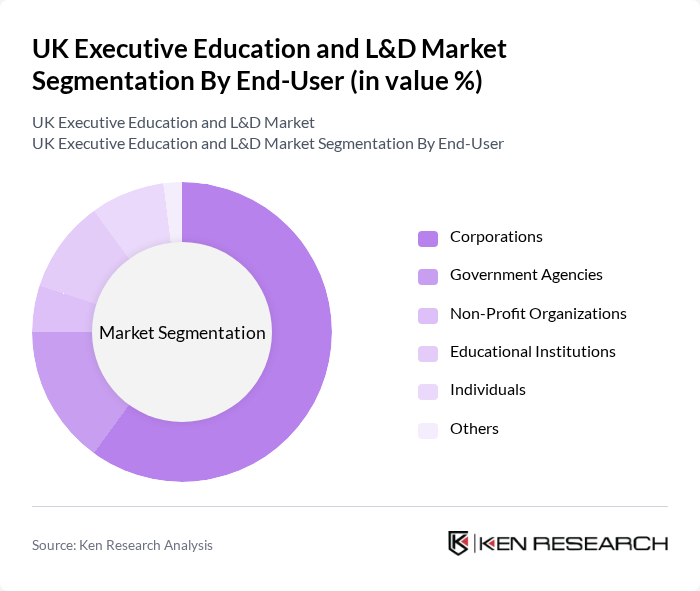

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the leading segment, driven by the need for continuous employee development and the desire to enhance organizational performance through targeted training initiatives. There is also increasing participation from individuals seeking career advancement and from public sector organizations responding to evolving workforce requirements .

The UK Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Oxford – Saïd Business School, London Business School, University of Cambridge – Judge Business School, Imperial College Business School, Cranfield School of Management, Henley Business School, Warwick Business School, Manchester Alliance Business School, Ashridge Executive Education (Hult International Business School), University of Edinburgh Business School, University of Strathclyde Business School, University of Glasgow – Adam Smith Business School, University of Birmingham – Birmingham Business School, University of Leeds – Leeds University Business School, Open University Business School contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UK executive education and L&D market appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly embrace hybrid learning models, the integration of AI and personalized learning experiences will enhance program effectiveness. Furthermore, the focus on soft skills and diversity in training will likely shape curriculum development, ensuring that educational offerings remain relevant and impactful in a rapidly changing business landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Short Courses Online Learning Modules Customized Corporate Training Leadership Development Programs Coaching and Mentoring Services Workshops and Seminars Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Industry Focus | Finance and Banking Technology Healthcare Manufacturing Retail Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Professional Certifications Others |

| By Pricing Tier | Budget Programs Mid-Range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | HR Directors, L&D Managers |

| Online Learning Platforms for Executives | 90 | Training Coordinators, E-learning Specialists |

| Industry-Specific Leadership Training | 70 | Department Heads, Program Directors |

| Networking and Professional Development Events | 60 | Event Organizers, Attendees from Corporate Sectors |

| Assessment of Learning Outcomes in Executive Programs | 50 | Program Evaluators, Alumni of Executive Programs |

The UK Executive Education and L&D Market is valued at approximately USD 3.5 billion, reflecting a significant growth driven by the demand for upskilling and reskilling in a rapidly evolving job market.