Region:Europe

Author(s):Geetanshi

Product Code:KRAB2829

Pages:90

Published On:October 2025

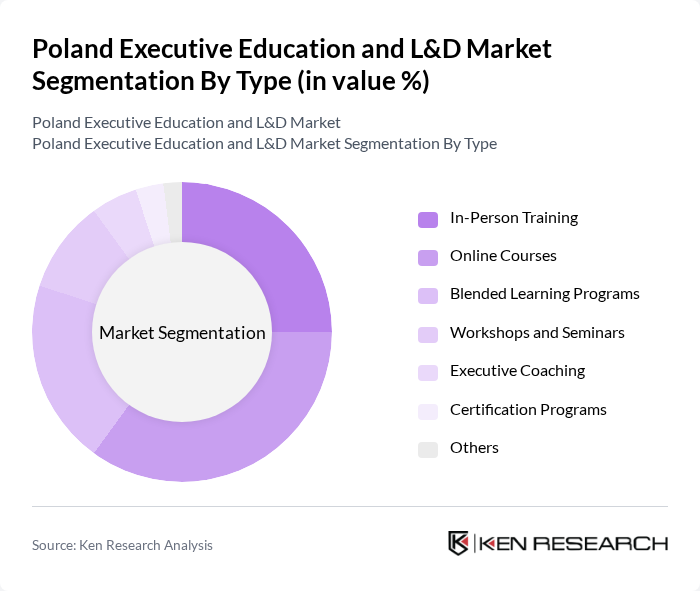

By Type:The market is segmented into In-Person Training, Online Courses, Blended Learning Programs, Workshops and Seminars, Executive Coaching, Certification Programs, and Others. Online Courses have gained significant traction due to their flexibility, self-paced structure, and accessibility, especially for working professionals. In-Person Training remains valued for its interactive and collaborative environment, particularly in corporate and leadership settings. Blended Learning Programs are increasingly preferred as they integrate the strengths of both digital and face-to-face formats, offering a comprehensive learning experience. Executive Coaching and Certification Programs are also rising in demand as organizations and individuals seek personalized development and recognized credentials .

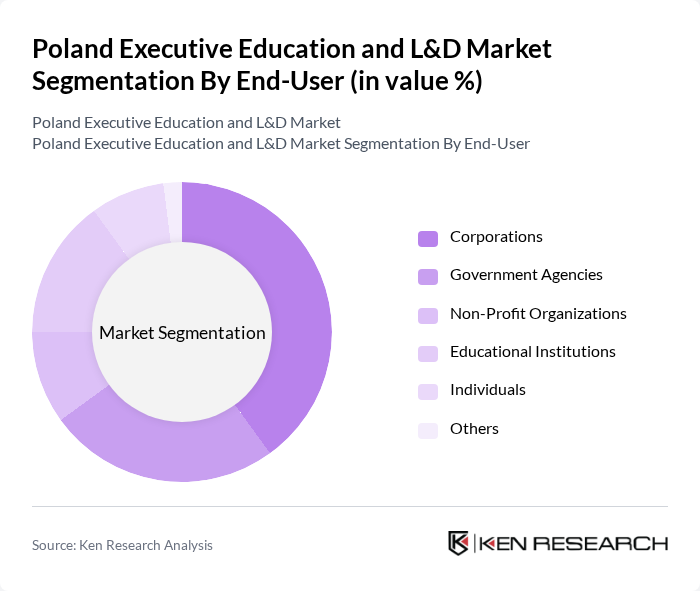

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the largest segment, driven by the need for continuous employee development, leadership training, and maintaining competitive advantage. Government agencies invest in training to enhance workforce efficiency and public sector effectiveness. Educational institutions increasingly collaborate with corporate partners to deliver tailored executive programs, while individuals pursue these offerings for career advancement and personal growth .

The Poland Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kozminski University, Warsaw School of Economics, University of Warsaw, WSB University, Leon Kozminski Academy, Business School at the University of Economics in Katowice, Executive Education at the University of Gda?sk, Krakow University of Economics, University of ?ód?, SWPS University of Social Sciences and Humanities, University of Silesia, Pozna? University of Economics and Business, University of Wroc?aw, University of Szczecin, Gda?sk University of Technology, Digital University, Vistula University, and Warsaw University of Technology Business School contribute to innovation, geographic expansion, and service delivery in this space .

The future of the executive education and L&D market in Poland appears promising, driven by the increasing integration of technology and a growing emphasis on personalized learning experiences. As organizations continue to prioritize employee development, the demand for innovative training solutions is expected to rise. Furthermore, the collaboration between educational institutions and businesses is likely to strengthen, fostering a more dynamic learning environment that aligns with industry needs and enhances workforce capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Training Online Courses Blended Learning Programs Workshops and Seminars Executive Coaching Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Industry | Technology Finance Manufacturing Healthcare Retail Others |

| By Delivery Mode | Online Learning In-Person Training Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | HR Directors, L&D Managers |

| Public Sector Training Initiatives | 90 | Government Officials, Policy Makers |

| Industry-Specific Leadership Development | 60 | Industry Leaders, Program Coordinators |

| Digital Learning Platforms | 50 | eLearning Specialists, IT Managers |

| Alumni Feedback on Executive Programs | 70 | Program Alumni, Career Coaches |

The Poland Executive Education and L&D Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for upskilling, digital learning platforms, and leadership development among Polish enterprises.