Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5890

Pages:82

Published On:October 2025

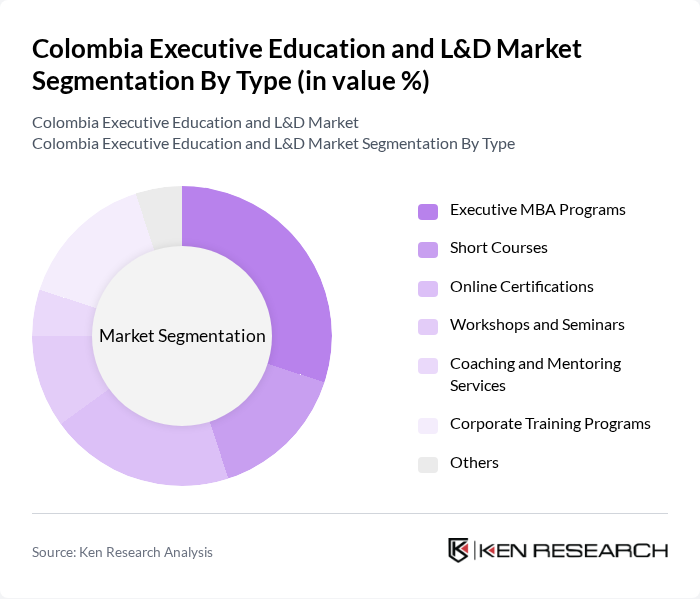

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Short Courses, Online Certifications, Workshops and Seminars, Coaching and Mentoring Services, Corporate Training Programs, and Others. Among these, Executive MBA Programs and Corporate Training Programs are particularly dominant due to their alignment with the needs of professionals seeking advanced leadership, digital, and strategic skills, and organizations aiming to enhance workforce capabilities through tailored, outcome-based learning .

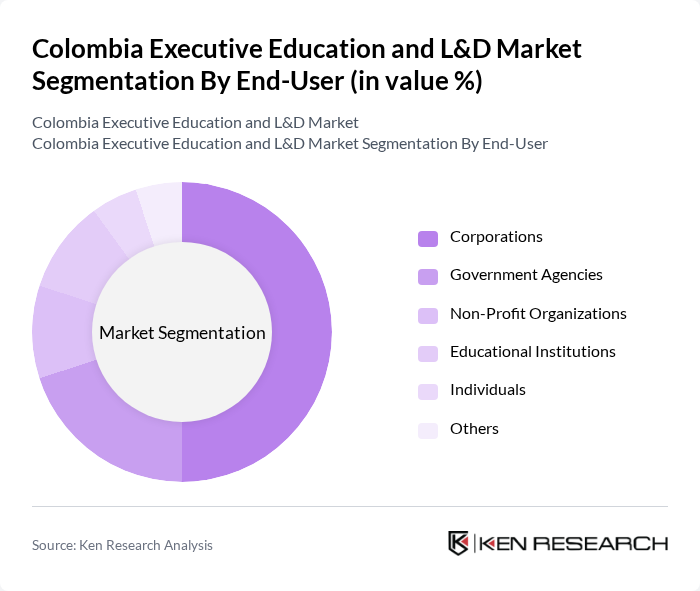

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the leading segment, driven by the need for continuous employee development, digital transformation, and the increasing focus on leadership training. Government agencies also play a significant role, as they invest in training programs to enhance public sector efficiency and modernize workforce skills .

The Colombia Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universidad de los Andes, INALDE Business School (Universidad de La Sabana), Universidad EAFIT, Pontificia Universidad Javeriana, CESA – Colegio de Estudios Superiores de Administración, Universidad del Rosario, Universidad Nacional de Colombia, Universidad de La Sabana, Universidad de Medellín, Universidad de los Andes – Executive Education, Fundación Universidad de América, Universidad de San Buenaventura, Universidad de La Salle, Universidad del Norte, Universidad de la Costa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Colombian executive education and L&D market appears promising, driven by technological advancements and a growing emphasis on personalized learning experiences. As organizations increasingly adopt hybrid learning models, the integration of artificial intelligence in educational platforms is expected to enhance learning outcomes. Furthermore, the focus on sustainability in education will likely shape program offerings, aligning with global trends and societal expectations, ultimately fostering a more skilled and adaptable workforce in Colombia.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Short Courses Online Certifications Workshops and Seminars Coaching and Mentoring Services Corporate Training Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Services Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate L&D Programs | 100 | HR Directors, Training Managers |

| Executive Education Participants | 80 | Mid to Senior-Level Executives, Program Alumni |

| Educational Institutions Offering L&D | 60 | Deans, Program Coordinators |

| Industry-Specific Training Needs | 50 | Sector Specialists, Business Development Managers |

| Government and Policy Makers | 40 | Education Policy Analysts, Workforce Development Officials |

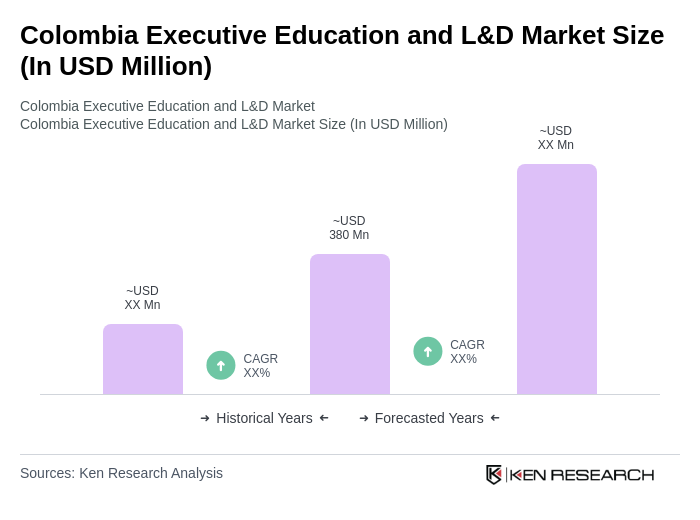

The Colombia Executive Education and L&D Market is valued at approximately USD 380 million, reflecting a significant growth driven by the demand for upskilling and reskilling among professionals in response to technological advancements and organizational needs.