Region:Asia

Author(s):Shubham

Product Code:KRAB6624

Pages:90

Published On:October 2025

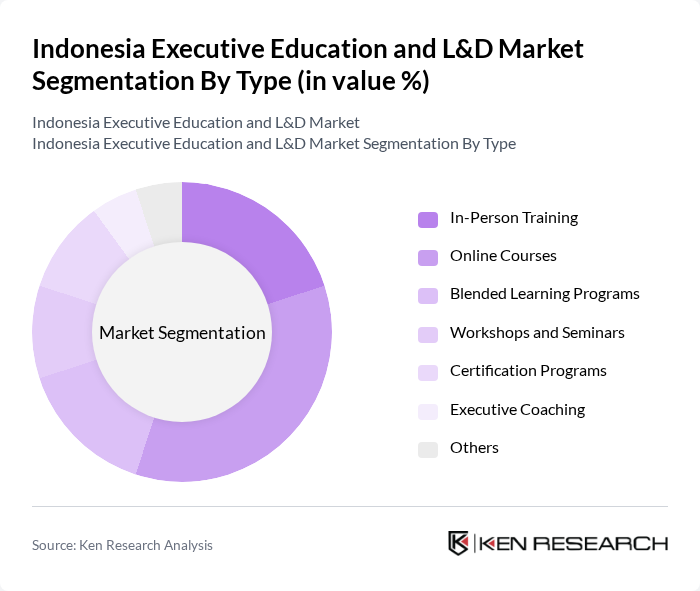

By Type:The market is segmented into various types of educational offerings, including In-Person Training, Online Courses, Blended Learning Programs, Workshops and Seminars, Certification Programs, Executive Coaching, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, catering to a diverse audience seeking professional development.

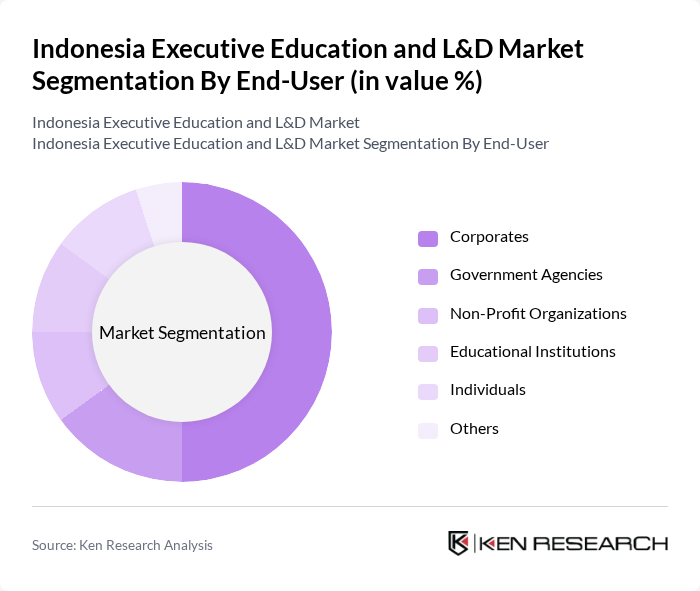

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates are the leading segment, as companies increasingly recognize the value of investing in employee training to enhance skills and drive business success.

The Indonesia Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universitas Indonesia, Prasetiya Mulya Business School, Executive Education Institute, Gadjah Mada University, Binus University, Jakarta School of Business, Indonesia Institute of Management, Swiss German University, Atma Jaya University, Telkom University, Universitas Pelita Harapan, Universitas Kristen Satya Wacana, Universitas Bina Nusantara, Universitas Airlangga, Universitas Diponegoro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Executive Education and L&D market appears promising, driven by technological advancements and a growing emphasis on lifelong learning. As organizations increasingly recognize the importance of employee development, investments in training programs are expected to rise. Additionally, the integration of artificial intelligence and personalized learning experiences will likely enhance the effectiveness of educational offerings, making them more appealing to professionals seeking to advance their careers in a competitive job market.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Training Online Courses Blended Learning Programs Workshops and Seminars Certification Programs Executive Coaching Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Industry | Finance and Banking Technology Manufacturing Healthcare Retail Others |

| By Delivery Mode | Online Learning Face-to-Face Learning Hybrid Learning Mobile Learning Others |

| By Duration | Short Courses (Less than 1 Month) Medium Courses (1-3 Months) Long Courses (More than 3 Months) Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Executive MBA Participants | 100 | Mid to Senior-Level Executives, Business Owners |

| Leadership Development Initiatives | 80 | Leadership Coaches, Program Directors |

| Online Learning Platforms | 120 | eLearning Managers, Content Developers |

| Workshops and Seminars | 90 | Facilitators, Industry Experts |

The Indonesia Executive Education and L&D Market is valued at approximately USD 1.2 billion, reflecting a significant investment by organizations in enhancing employee skills and productivity in response to the evolving job market.