Region:Global

Author(s):Geetanshi

Product Code:KRAA5251

Pages:95

Published On:September 2025

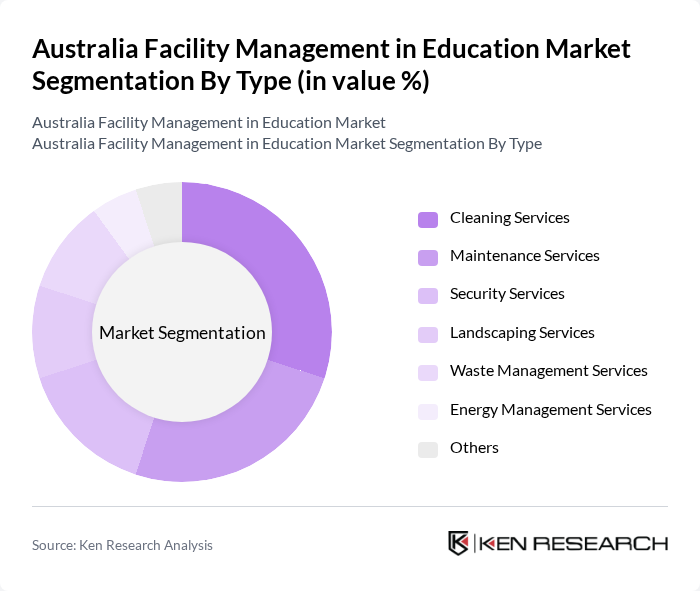

By Type:The facility management services in the education sector can be categorized into several types, including cleaning services, maintenance services, security services, landscaping services, waste management services, energy management services, and others. Each of these services plays a crucial role in ensuring that educational facilities operate smoothly and efficiently. Among these, cleaning and maintenance services are particularly dominant due to the high standards of hygiene and upkeep required in educational environments.

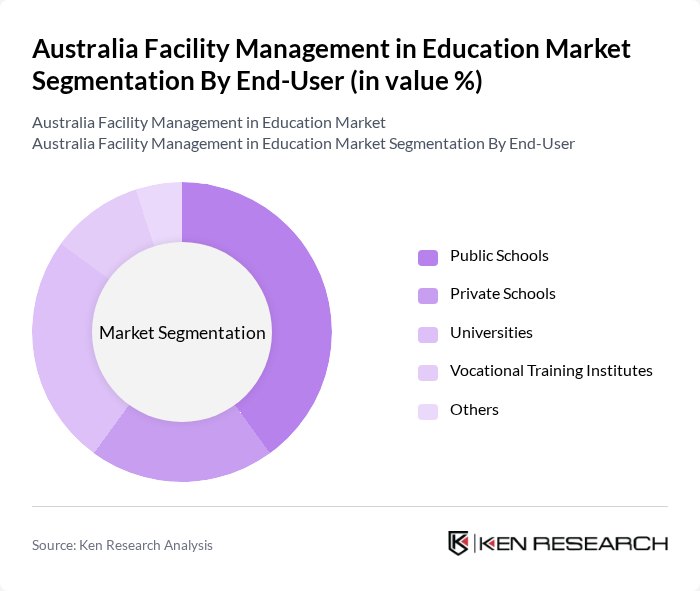

By End-User:The end-users of facility management services in the education sector include public schools, private schools, universities, vocational training institutes, and others. Each of these segments has unique requirements and expectations from facility management providers. Public schools and universities are the largest consumers of these services, driven by their need for comprehensive management solutions to maintain large campuses and ensure compliance with safety and health regulations.

The Australia Facility Management in Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Spotless Group, Programmed Maintenance Services, CBRE Group, Inc., JLL (Jones Lang LaSalle), Sodexo, Compass Group, Brookfield Global Integrated Solutions, Serco Group plc, G4S plc, Ventia, Downer EDI Limited, Aegis Facilities Management, Cushman & Wakefield, HFM Asset Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in the Australian education sector appears promising, driven by ongoing investments in infrastructure and technology. As educational institutions increasingly prioritize sustainability and efficiency, the adoption of smart technologies is expected to rise. Furthermore, the expansion of online learning facilities will necessitate innovative approaches to facility management, creating new opportunities for service providers. Overall, the sector is poised for transformation, with a focus on enhancing the educational experience through improved facilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Maintenance Services Security Services Landscaping Services Waste Management Services Energy Management Services Others |

| By End-User | Public Schools Private Schools Universities Vocational Training Institutes Others |

| By Service Model | Integrated Facility Management Single Service Providers Outsourced Services In-House Management |

| By Contract Type | Fixed-Term Contracts Performance-Based Contracts Time and Materials Contracts Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Facility Size | Small Facilities Medium Facilities Large Facilities Others |

| By Investment Source | Government Funding Private Investment Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Facility Management | 100 | Facility Managers, School Administrators |

| Higher Education Facility Services | 80 | Campus Operations Directors, Facilities Coordinators |

| Outsourced Facility Management Providers | 70 | Service Contract Managers, Business Development Executives |

| Technology Integration in Facilities | 60 | IT Managers, Facility Technology Specialists |

| Sustainability Practices in Education Facilities | 50 | Sustainability Officers, Environmental Compliance Managers |

The Australia Facility Management in Education Market is valued at approximately USD 5 billion, reflecting significant growth driven by investments in educational infrastructure, sustainability initiatives, and the demand for efficient management of educational facilities.