Region:Europe

Author(s):Dev

Product Code:KRAB0849

Pages:96

Published On:October 2025

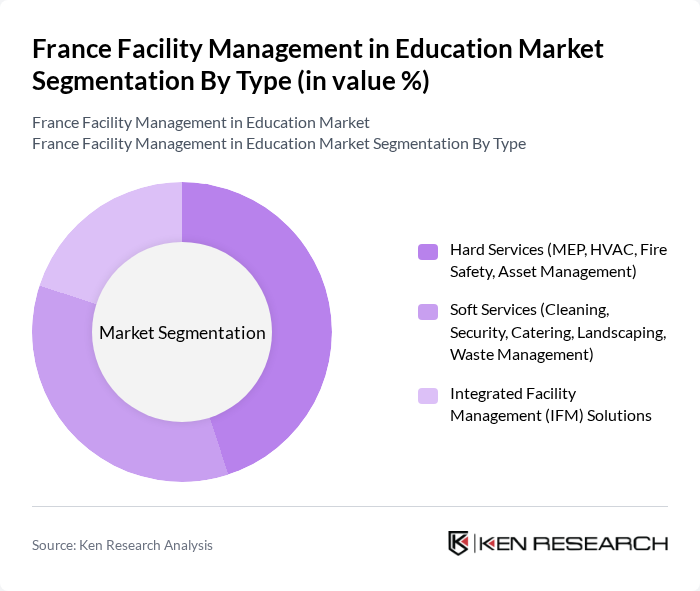

By Type:

The France Facility Management in Education Market is segmented into three main types: Hard Services, Soft Services, and Integrated Facility Management (IFM) Solutions. Among these, Hard Services, which include Mechanical, Electrical, and Plumbing (MEP), HVAC, Fire Safety, and Asset Management, dominate the market due to the essential nature of these services in maintaining the operational efficiency of educational facilities. The increasing focus on safety, compliance with energy-efficiency regulations, and the need for predictive maintenance further drives the demand for Hard Services. Soft Services, encompassing Cleaning, Security, Catering, Landscaping, and Waste Management, also play a significant role, particularly in enhancing the overall student experience and supporting health and well-being initiatives. Integrated Facility Management Solutions are gaining traction as institutions seek comprehensive service packages that streamline operations, reduce costs, and provide single-point accountability for performance and compliance.

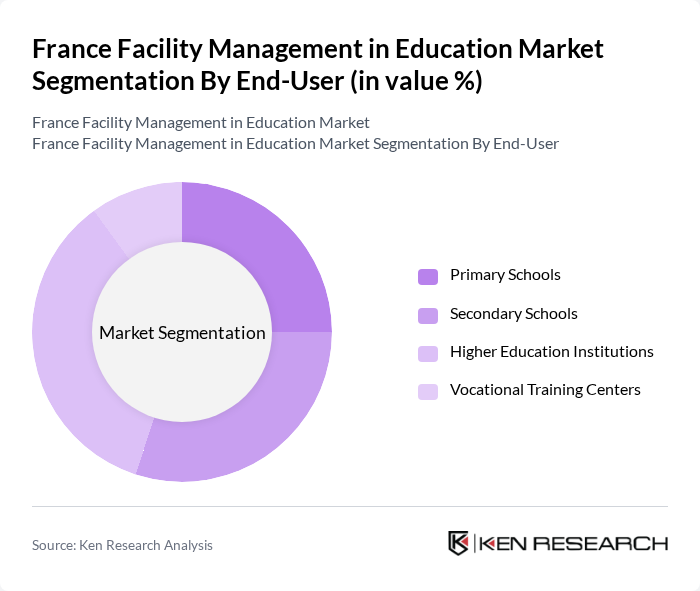

By End-User:

The end-user segmentation of the France Facility Management in Education Market includes Primary Schools, Secondary Schools, Higher Education Institutions, and Vocational Training Centers. Higher Education Institutions are the leading segment, driven by the need for advanced facility management solutions that cater to a diverse student population and complex campus environments. These institutions often require specialized services to maintain their facilities, enhance student satisfaction, and comply with regulatory standards. Secondary Schools also represent a significant portion of the market, as they increasingly adopt modern facility management practices to improve operational efficiency and safety. Primary Schools and Vocational Training Centers are growing segments, reflecting the overall trend towards improved educational infrastructure and the integration of sustainable and technology-driven facility management practices.

The France Facility Management in Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo, ISS Facility Services, Bouygues Energies & Services, GSF (Groupe Services France), Atalian Global Services, Vinci Facilities, Eiffage Énergie, CBRE, JLL (Jones Lang LaSalle), Elior Group, Cushman & Wakefield, Compass Group, SPIE Group, ENGIE Services, Onet Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in the French education sector appears promising, driven by a growing emphasis on sustainability and technological integration. As educational institutions increasingly seek to enhance operational efficiency and comply with regulatory standards, the demand for specialized facility management services is expected to rise. Additionally, the ongoing government investments in educational infrastructure will likely create new opportunities for service providers to innovate and expand their offerings, ensuring a dynamic and evolving market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (MEP, HVAC, Fire Safety, Asset Management) Soft Services (Cleaning, Security, Catering, Landscaping, Waste Management) Integrated Facility Management (IFM) Solutions |

| By End-User | Primary Schools Secondary Schools Higher Education Institutions Vocational Training Centers |

| By Service Model | Outsourced Services In-House Services |

| By Contract Type | Fixed-Term Contracts Long-Term Contracts |

| By Geographic Coverage | Urban Areas (Île-de-France, Lyon, Marseille, Toulouse, Lille) Rural Areas |

| By Pricing Model | Fixed Pricing Variable Pricing |

| By Technology Integration | Smart Building Technologies (IoT, AI, Energy Management) Traditional Facility Management Tools |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Primary Education Facility Management | 60 | Facility Managers, School Principals |

| Secondary Education Infrastructure | 50 | Administrative Heads, Operations Managers |

| Tertiary Education Campus Services | 40 | Facility Directors, Procurement Officers |

| Specialized Educational Institutions | 40 | Facility Coordinators, Sustainability Officers |

| Public vs. Private Education Facilities | 50 | Policy Makers, Educational Administrators |

The France Facility Management in Education Market is valued at approximately USD 5 billion, driven by investments in educational infrastructure, demand for efficient services, and technology integration in educational institutions.