Region:Africa

Author(s):Dev

Product Code:KRAB6040

Pages:99

Published On:October 2025

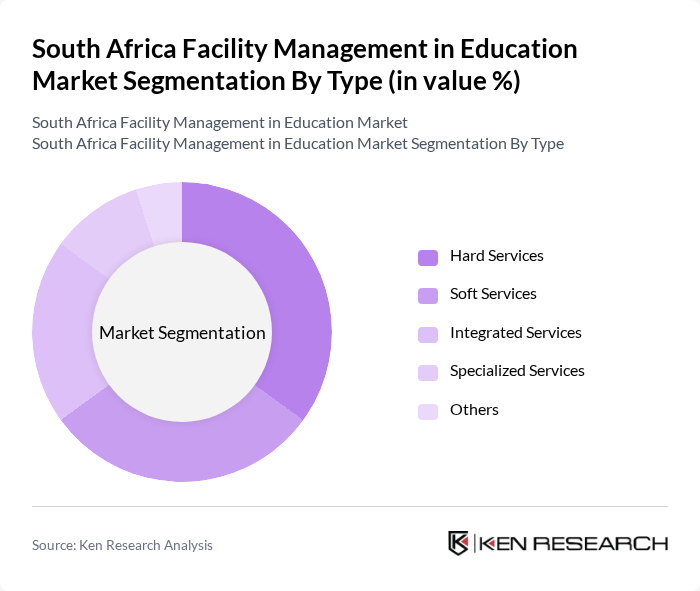

By Type:The facility management services in education can be categorized into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services focus on non-core activities such as cleaning and security. Integrated Services combine both hard and soft services for a holistic approach, whereas Specialized Services cater to specific needs like IT support. Others may include ancillary services that do not fit into the primary categories.

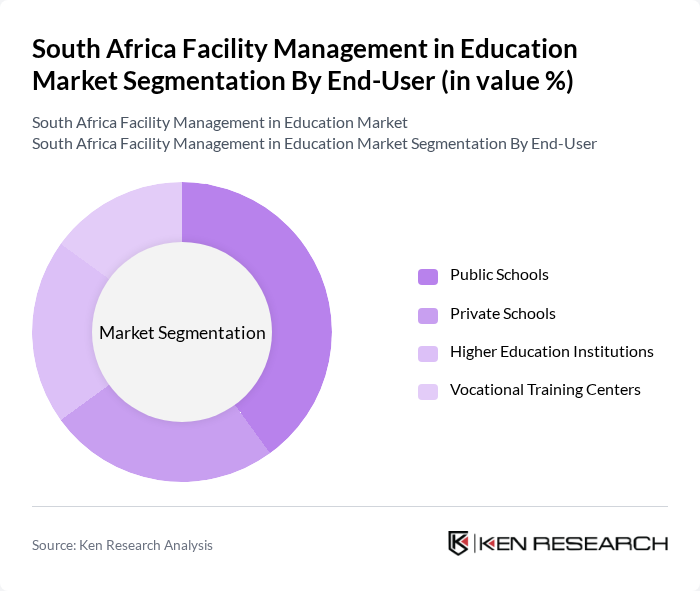

By End-User:The end-users of facility management services in education include Public Schools, Private Schools, Higher Education Institutions, and Vocational Training Centers. Public Schools represent a significant portion due to government funding and large student populations. Private Schools often seek premium services to enhance their offerings. Higher Education Institutions focus on maintaining complex facilities, while Vocational Training Centers require specialized services to support practical training.

The South Africa Facility Management in Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Facilities Management, Servest Group, Tsebo Solutions Group, G4S Facilities Management, CSG Holdings, Motseng Investment Holdings, Envirosafe Solutions, Facilities Management Solutions, AFS Facilities Management, AECOM South Africa, JHI Properties, Broll Property Group, Redefine Properties, Growthpoint Properties, Tiberius Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in South African education is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As institutions increasingly adopt integrated facility management solutions, the demand for smart technologies will rise. Additionally, partnerships with technology providers are expected to flourish, enabling educational institutions to leverage innovative solutions that enhance operational efficiency and reduce costs. This evolution will create a more conducive learning environment while addressing budgetary constraints and regulatory challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Public Schools Private Schools Higher Education Institutions Vocational Training Centers |

| By Service Model | Outsourced Services In-House Services |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Others |

| By Contract Type | Fixed-Term Contracts Performance-Based Contracts |

| By Service Frequency | Daily Services Weekly Services Monthly Services |

| By Investment Source | Government Funding Private Investment Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Facility Management | 100 | Facility Managers, Administrative Heads |

| Primary School Infrastructure Needs | 80 | School Principals, Facility Coordinators |

| Secondary School Maintenance Practices | 70 | Maintenance Supervisors, School Board Members |

| Higher Education Campus Services | 90 | Campus Operations Managers, Student Affairs Directors |

| Private Educational Institutions | 60 | Owners, Facility Management Consultants |

The South Africa Facility Management in Education Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by investments in educational infrastructure and a focus on operational efficiency within educational institutions.