Region:Africa

Author(s):Rebecca

Product Code:KRAB1759

Pages:88

Published On:October 2025

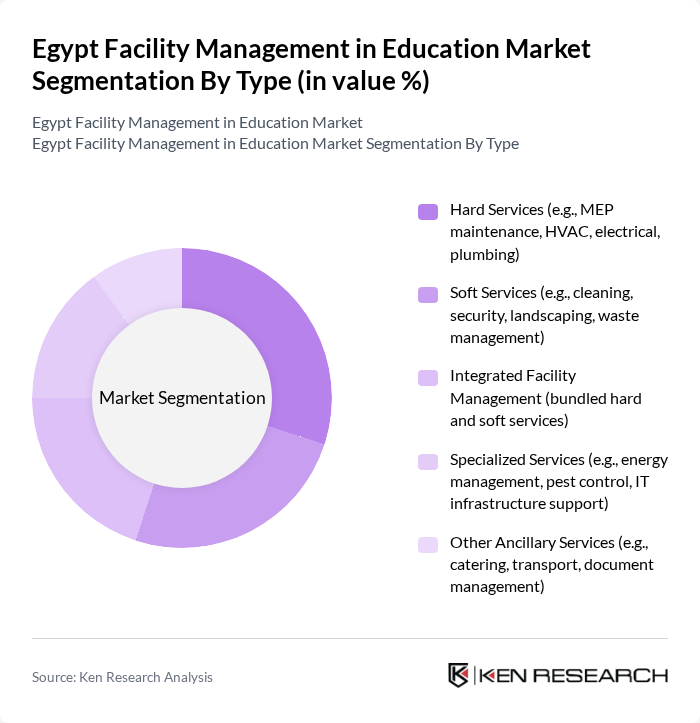

By Type:The market is segmented by service type, including hard services (such as mechanical, electrical, and plumbing maintenance), soft services (such as cleaning, security, and landscaping), integrated facility management (bundled hard and soft services), specialized services (including energy management and IT infrastructure support), and other ancillary services (such as catering and transport). Each segment is essential for maintaining safe, efficient, and modern educational environments .

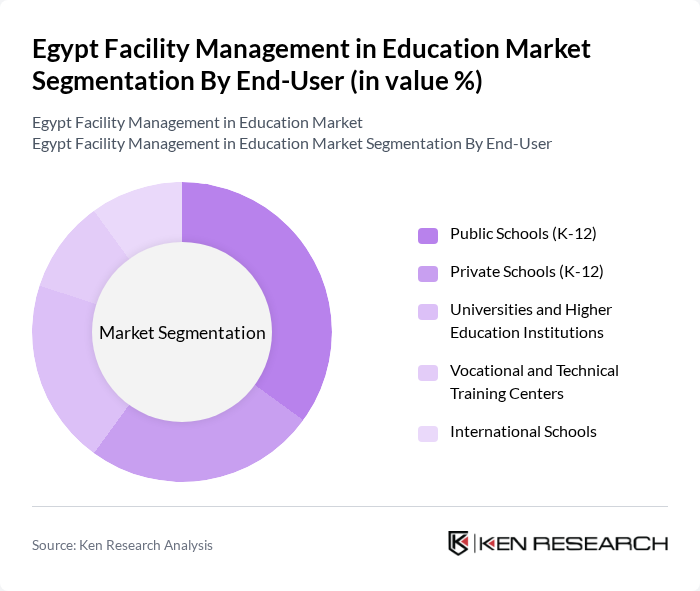

By End-User:End-users include public schools, private schools, universities and higher education institutions, vocational and technical training centers, and international schools. Each end-user segment has distinct facility management requirements, with public and private schools focusing on basic operational efficiency and safety, while universities and international schools increasingly demand advanced, technology-driven facility solutions .

The Egypt Facility Management in Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as EFS Facilities Services Egypt, Enova Facilities Management Egypt, G4S Egypt, CBRE Egypt, Egypro FME (Egypro Facilities Management & Engineering), Sodexo Egypt, ISS Facility Services Egypt, Alkan CIT Facility Management, EgyServ Facilities Management, Al Arabia for Facilities Management, G4S Secure Solutions Egypt, Mace Group Egypt, Cushman & Wakefield Egypt, JLL Egypt, Al-Futtaim Engineering Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Egypt's education sector appears promising, driven by ongoing investments in infrastructure and a growing emphasis on operational efficiency. As educational institutions increasingly adopt integrated facility management solutions, the demand for skilled professionals and advanced technologies will rise. Furthermore, the government's commitment to educational reform will likely create new opportunities for facility management firms to innovate and expand their services, ensuring a more sustainable and efficient educational environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., MEP maintenance, HVAC, electrical, plumbing) Soft Services (e.g., cleaning, security, landscaping, waste management) Integrated Facility Management (bundled hard and soft services) Specialized Services (e.g., energy management, pest control, IT infrastructure support) Other Ancillary Services (e.g., catering, transport, document management) |

| By End-User | Public Schools (K-12) Private Schools (K-12) Universities and Higher Education Institutions Vocational and Technical Training Centers International Schools |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid Model (partially outsourced) |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Geographic Presence | Greater Cairo Alexandria Other Governorates |

| By Service Duration | Short-Term Contracts (?1 year) Long-Term Contracts (>1 year) |

| By Investment Source | Government Funding Private Investment International Aid/Donor Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Facility Management | 75 | Facility Managers, Campus Operations Directors |

| School Infrastructure Management | 65 | School Administrators, Maintenance Supervisors |

| Public vs. Private Education Facilities | 55 | Policy Makers, Education Sector Analysts |

| Technology Integration in Facility Management | 45 | IT Managers, Facility Management Consultants |

| Health and Safety Standards in Educational Facilities | 70 | Health and Safety Officers, Compliance Managers |

The Egypt Facility Management in Education Market is valued at approximately USD 1.1 billion, driven by increased investments in educational infrastructure and a growing student population, necessitating modernized facilities for operational efficiency and safety.