Region:North America

Author(s):Shubham

Product Code:KRAB1327

Pages:92

Published On:October 2025

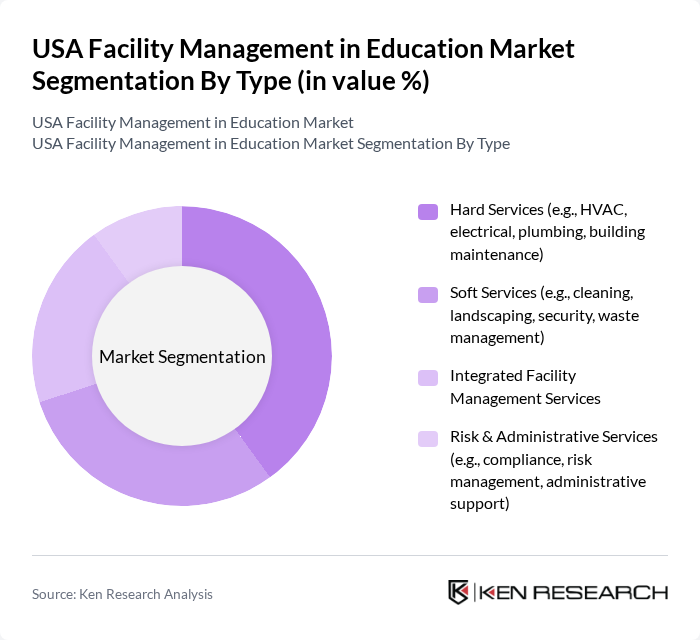

By Type:The market is segmented into various types of facility management services, including Hard Services, Soft Services, Integrated Facility Management Services, and Risk & Administrative Services. Each of these segments plays a crucial role in maintaining the operational efficiency of educational institutions. Hard Services encompass core infrastructure maintenance such as HVAC, electrical, and plumbing. Soft Services include cleaning, landscaping, and security. Integrated Facility Management Services combine multiple service lines under a single contract, while Risk & Administrative Services focus on compliance, risk management, and administrative support .

The Hard Services segment is currently dominating the market due to the essential nature of maintenance and repair services required for educational facilities. This includes HVAC systems, plumbing, and electrical services, which are critical for ensuring a safe and functional learning environment. The increasing focus on energy efficiency, sustainability, and compliance with regulatory standards in educational institutions further drives the demand for these services. As schools and universities strive to maintain their facilities in optimal condition and achieve energy savings, the Hard Services segment is expected to continue leading the market .

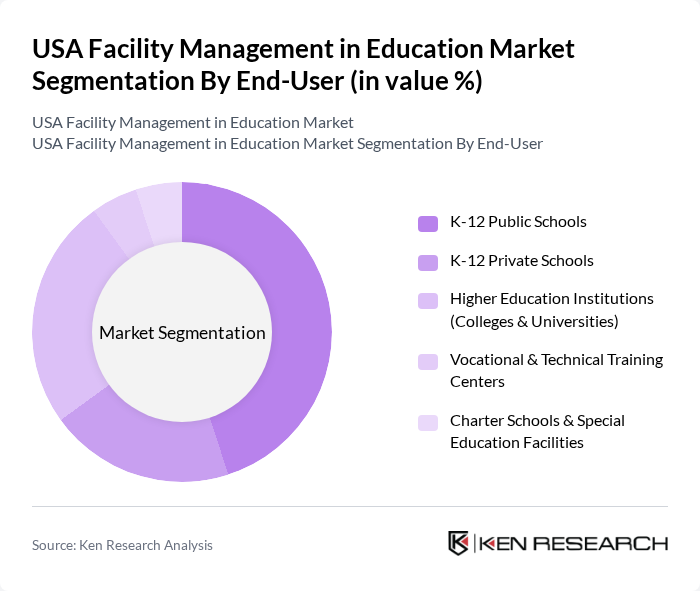

By End-User:The market is segmented by end-users, including K-12 Public Schools, K-12 Private Schools, Higher Education Institutions (Colleges & Universities), Vocational & Technical Training Centers, and Charter Schools & Special Education Facilities. Each end-user category has unique facility management needs and requirements. K-12 Public Schools require large-scale maintenance and compliance services, while higher education institutions often demand integrated and technologically advanced solutions. Vocational and technical centers prioritize specialized facility needs, and charter or special education facilities require tailored support for accessibility and safety .

K-12 Public Schools represent the largest end-user segment in the market, driven by government funding and the need for compliance with safety regulations. These institutions require comprehensive facility management services to maintain their infrastructure and ensure a conducive learning environment. The increasing enrollment rates in public schools, the emphasis on improving educational facilities, and the prioritization of health and safety standards further contribute to the growth of this segment. As a result, K-12 Public Schools are expected to maintain their leadership position in the facility management market .

The USA Facility Management in Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramark, Sodexo, ISS Facility Services, Inc., CBRE Group, Inc., ABM Industries Incorporated, Compass Group USA, GCA Services Group (now part of ABM Industries), C&W Services (Cushman & Wakefield Services), JLL (Jones Lang LaSalle Incorporated), EMCOR Group, Inc., SSC Services for Education, HES Facilities Management, ServiceMaster Clean, FacilitySource (CBRE subsidiary), DTZ (now part of Cushman & Wakefield) contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in the education sector is poised for significant transformation, driven by technological advancements and a commitment to sustainability. As institutions increasingly adopt smart technologies, the integration of IoT and data analytics will enhance operational efficiency and improve decision-making processes. Furthermore, the emphasis on health and safety standards will continue to shape facility management practices, ensuring that educational environments are conducive to learning while adhering to regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, building maintenance) Soft Services (e.g., cleaning, landscaping, security, waste management) Integrated Facility Management Services Risk & Administrative Services (e.g., compliance, risk management, administrative support) |

| By End-User | K-12 Public Schools K-12 Private Schools Higher Education Institutions (Colleges & Universities) Vocational & Technical Training Centers Charter Schools & Special Education Facilities |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid Model |

| By Facility Type | Academic Buildings (Classrooms, Lecture Halls) Laboratories & Research Centers Administrative & Office Buildings Sports & Recreational Facilities Student Housing & Dormitories Others (Libraries, Cafeterias, Auditoriums) |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Service Frequency | Daily Services Weekly Services Monthly/Periodic Services |

| By Budget Type | Capital Expenditure (CapEx) Operational Expenditure (OpEx) Grant-Funded & Special Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Facility Management | 100 | Facility Managers, School Administrators |

| Higher Education Facility Operations | 60 | Campus Facility Directors, Operations Managers |

| Facility Management Technology Adoption | 50 | IT Managers, Facility Management Software Users |

| Outsourced Facility Services | 40 | Procurement Officers, Contract Managers |

| Facility Maintenance Practices | 70 | Maintenance Supervisors, Safety Officers |

The USA Facility Management in Education Market is valued at approximately USD 48 billion, reflecting significant growth driven by investments in educational infrastructure, efficient facility operations, and compliance with safety standards.