Region:Asia

Author(s):Rebecca

Product Code:KRAA6469

Pages:93

Published On:January 2026

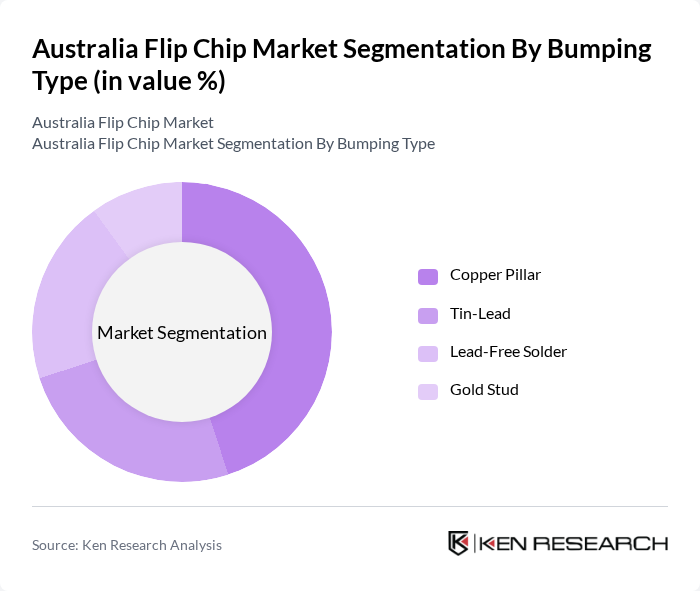

By Bumping Type:The bumping type segmentation includes various methods used to create electrical connections between the chip and the substrate. The subsegments are Copper Pillar, Tin-Lead, Lead-Free Solder, and Gold Stud. Among these, the Copper Pillar subsegment is currently leading the market due to its superior thermal and electrical performance, making it ideal for high-density applications. The trend towards miniaturization in electronics is further driving the demand for this technology.

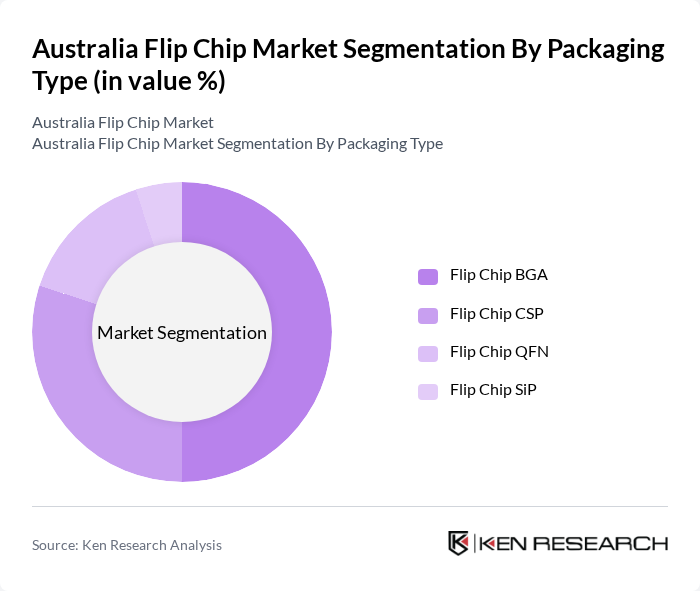

By Packaging Type:The packaging type segmentation includes Flip Chip BGA, Flip Chip CSP, Flip Chip QFN, and Flip Chip SiP. The Flip Chip BGA subsegment is dominating the market due to its widespread use in consumer electronics and telecommunications. Its ability to provide high interconnect density and improved thermal performance makes it a preferred choice for manufacturers looking to enhance device performance.

The Australia Flip Chip Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, TSMC, Amkor Technology, ASE Group, STMicroelectronics, NXP Semiconductors, Texas Instruments, Infineon Technologies, ON Semiconductor, Micron Technology, Analog Devices, Renesas Electronics, Qualcomm, Broadcom Inc., Powertech Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia flip chip market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of AI in semiconductor design is expected to enhance efficiency and innovation, while the shift towards sustainable manufacturing practices will likely attract investment. Additionally, the growth of 5G technology deployment will create new applications for flip chips, further solidifying their role in the evolving electronics landscape. Overall, the market is poised for significant transformation and growth.

| Segment | Sub-Segments |

|---|---|

| By Bumping Type | Copper Pillar Tin-Lead Lead-Free Solder Gold Stud |

| By Packaging Type | Flip Chip BGA Flip Chip CSP Flip Chip QFN Flip Chip SiP |

| By End-User | Consumer Electronics Telecommunications Automotive Industrial Medical & Healthcare |

| By Packing Technology | D IC D IC D IC |

| By Application | Integrated Circuits Sensors RF Devices Power Devices Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 45 | Product Development Managers, Supply Chain Analysts |

| Automotive Semiconductor Suppliers | 40 | Engineering Managers, Procurement Specialists |

| Telecommunications Equipment Producers | 35 | Technical Directors, Operations Managers |

| Research Institutions Focused on Semiconductor Technology | 15 | Research Scientists, Academic Professors |

| Flip Chip Assembly and Packaging Firms | 40 | Production Managers, Quality Assurance Leads |

The Australia Flip Chip Market is valued at approximately USD 1.1 billion, driven by the increasing demand for advanced semiconductor packaging solutions across consumer electronics, telecommunications, and automotive sectors.