Region:Middle East

Author(s):Rebecca

Product Code:KRAA6467

Pages:80

Published On:January 2026

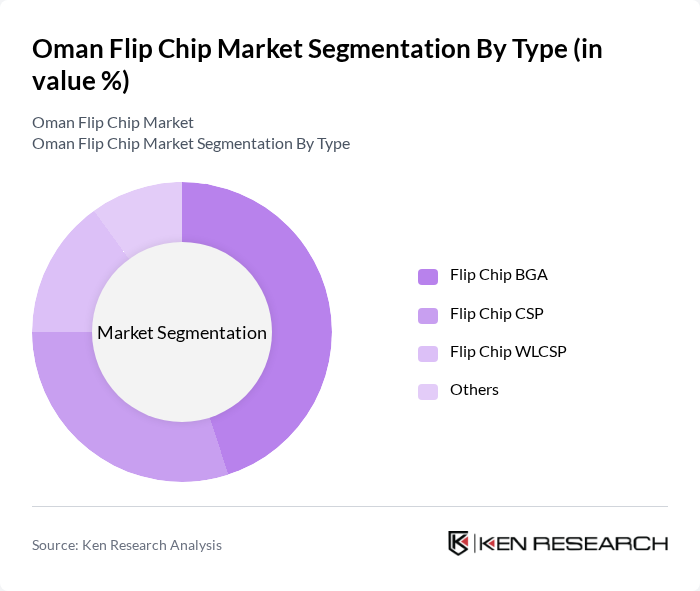

By Type:The segmentation by type includes Flip Chip BGA, Flip Chip CSP, Flip Chip WLCSP, and Others. Among these, Flip Chip BGA is the leading sub-segment due to its widespread application in high-performance computing and consumer electronics. The demand for compact and efficient packaging solutions has driven the adoption of Flip Chip BGA technology, making it a preferred choice for manufacturers. Global market trends indicate that 2.5D IC packaging and copper pillar technologies are also gaining significant traction in the broader flip chip ecosystem.

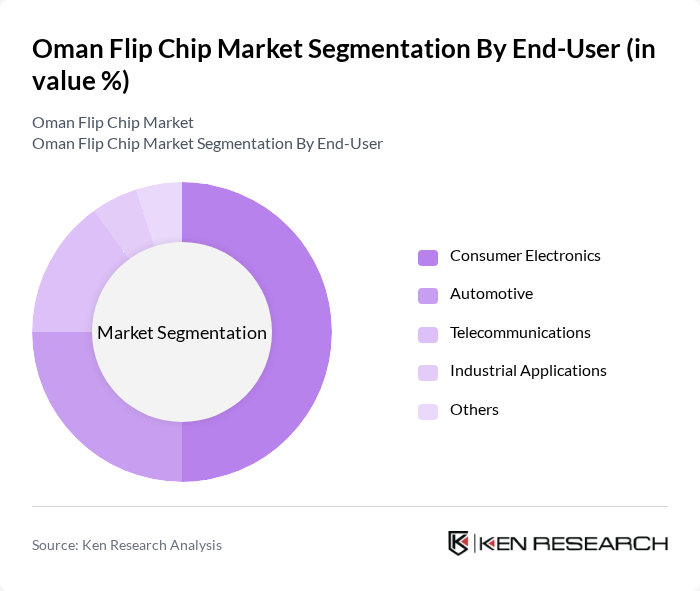

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Telecommunications, Industrial Applications, and Others. The Consumer Electronics segment is the most significant contributor to the market, driven by the increasing demand for smartphones, tablets, gaming devices, and other smart devices. The rapid technological advancements and consumer preferences for high-performance gadgets have led to a surge in the adoption of flip chip technology in this sector. Automotive applications are also experiencing accelerated growth due to the proliferation of advanced driver assistance systems (ADAS) and electric vehicle electronics.

The Oman Flip Chip Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, TSMC, Samsung Electronics, GlobalFoundries, STMicroelectronics, NXP Semiconductors, Texas Instruments, ON Semiconductor, Infineon Technologies, Analog Devices, Micron Technology, Renesas Electronics, Cypress Semiconductor, Broadcom Inc., Qualcomm Technologies contribute to innovation, geographic expansion, and service delivery in this space. Key global players including Amkor Technology and Advanced Semiconductor Engineering (ASE) also maintain significant market presence through advanced packaging and assembly capabilities.

The Oman flip chip market is poised for significant growth, driven by technological advancements and increasing demand for miniaturized electronic components. As the government implements initiatives to enhance local manufacturing capabilities, the market is expected to attract foreign investments. Additionally, the integration of AI in semiconductor design and the emergence of 5G technology will further stimulate innovation, positioning Oman as a competitive player in the global semiconductor landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Flip Chip BGA Flip Chip CSP Flip Chip WLCSP Others |

| By End-User | Consumer Electronics Automotive Telecommunications Industrial Applications Others |

| By Application | High-Performance Computing Mobile Devices Wearable Technology Others |

| By Material | Organic Substrates Inorganic Substrates Others |

| By Packaging Type | Flip Chip on Substrate Flip Chip on Flex Others |

| By Technology | Advanced Packaging Technologies D Packaging Others |

| By Region | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, R&D Engineers |

| Automotive Electronics Suppliers | 80 | Supply Chain Managers, Quality Assurance Leads |

| Telecommunications Equipment Providers | 70 | Technical Directors, Procurement Specialists |

| Research Institutions and Universities | 50 | Academic Researchers, Industry Analysts |

| Government Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

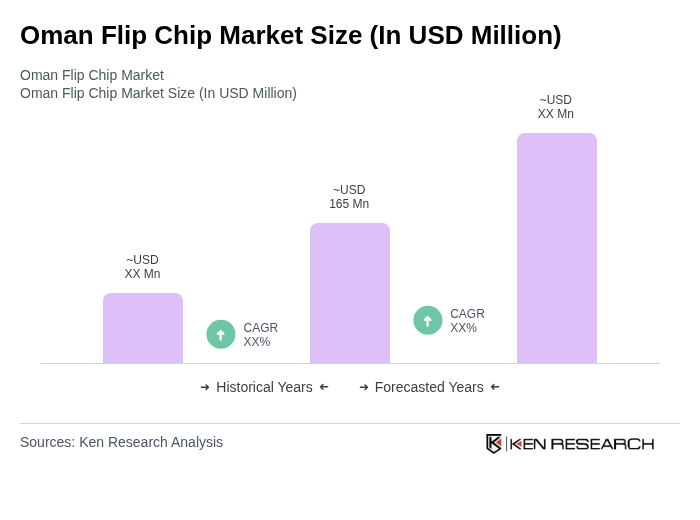

The Oman Flip Chip Market is valued at approximately USD 165 million, driven by the increasing demand for advanced semiconductor technologies in consumer electronics and automotive applications, as well as the rise in digitalization and IoT integration.