Region:Asia

Author(s):Geetanshi

Product Code:KRAB2769

Pages:83

Published On:October 2025

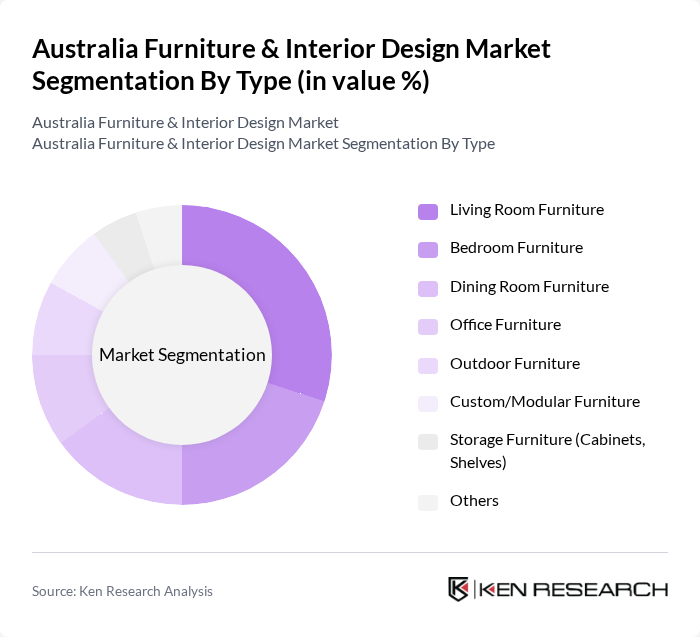

By Type:The furniture market is segmented into living room furniture, bedroom furniture, dining room furniture, office furniture, outdoor furniture, custom/modular furniture, storage furniture (cabinets, shelves), and others. Living room furniture remains the most dominant segment, driven by consumer preferences for stylish and functional designs that enhance home aesthetics. The increasing popularity of open-plan living spaces and the demand for versatile, space-saving solutions have further boosted this segment. Custom and modular furniture are gaining traction as consumers seek personalized and adaptable options to suit modern lifestyles and smaller urban dwellings .

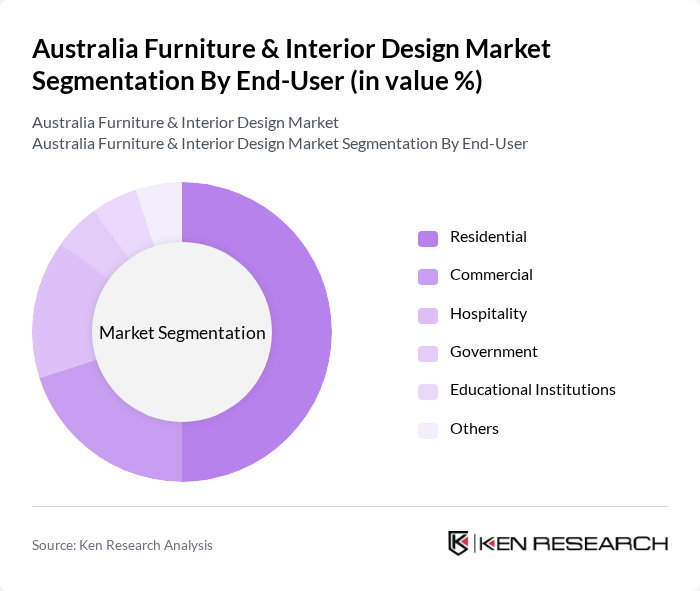

By End-User:The market is segmented by end-users: residential, commercial, hospitality, government, educational institutions, and others. The residential segment is the largest, supported by increasing home ownership, renovation activities, and consumer investment in quality furniture that reflects personal style and enhances living spaces. Commercial and hospitality segments are also expanding, driven by business investments in modern workspaces and guest experiences. Educational and government institutions continue to contribute to demand, particularly for durable and ergonomic furniture solutions .

The Australia Furniture & Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Australia, Freedom Furniture, Fantastic Furniture, Harvey Norman, Domayne, Officeworks, Amart Furniture, King Living, Jardan, Design Furniture Co Pty Ltd., Grazia & Co. Pty Ltd., Woods Furniture Pty Ltd., Advanta Group Pty Ltd., Alpha Office Furniture Pty Ltd., Koala, The Furniture Trader, Plush Sofas, Krost Furniture Pty Ltd., Matic Furniture Pty Ltd., HAY Australia, Zinus, Lama Furniture Australia, Fursys contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian furniture and interior design market appears promising, driven by urbanization and a growing emphasis on sustainability. As disposable incomes rise, consumers are expected to invest more in quality furnishings. Additionally, the integration of technology in furniture design is likely to enhance user experience, catering to the tech-savvy population. Companies that adapt to these trends and focus on innovative, eco-friendly solutions will likely thrive in this evolving landscape, ensuring long-term growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Office Furniture Outdoor Furniture Custom/Modular Furniture Storage Furniture (Cabinets, Shelves) Others |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Others |

| By Distribution Channel | Online Retail Stores Specialty Stores Supermarkets and Hypermarkets Wholesale Distributors Direct Sales Others |

| By Material | Wood Metal Plastic Fabric/Upholstery Glass Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Style | Modern Traditional Contemporary Rustic Industrial Scandinavian Others |

| By Region | New South Wales Victoria Queensland Western Australia Australian Capital Territory Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Retailers | 100 | Store Managers, Sales Representatives |

| Commercial Interior Designers | 80 | Lead Designers, Project Managers |

| Furniture Manufacturers | 60 | Production Managers, Marketing Directors |

| Consumer Focus Groups | 40 | Homeowners, Renters |

| Online Furniture Retailers | 70 | E-commerce Managers, Digital Marketing Specialists |

The Australia Furniture & Interior Design Market is valued at approximately AUD 17.0 billion, reflecting the combined value of home furniture and interior design sectors, with home furniture accounting for the majority share of this market.