Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2825

Pages:87

Published On:October 2025

By Type:The furniture market can be segmented into various types, including residential furniture, office furniture, outdoor furniture, custom furniture, luxury furniture, eco-friendly furniture, smart furniture, vintage furniture, and others. Among these, residential furniture is the most dominant segment, driven by the increasing trend of home renovations, the expansion of the real estate market, and the growing demand for stylish, multifunctional, and sustainable products. Smart furniture and eco-friendly options are gaining traction, reflecting consumer interest in technology integration and environmental responsibility.

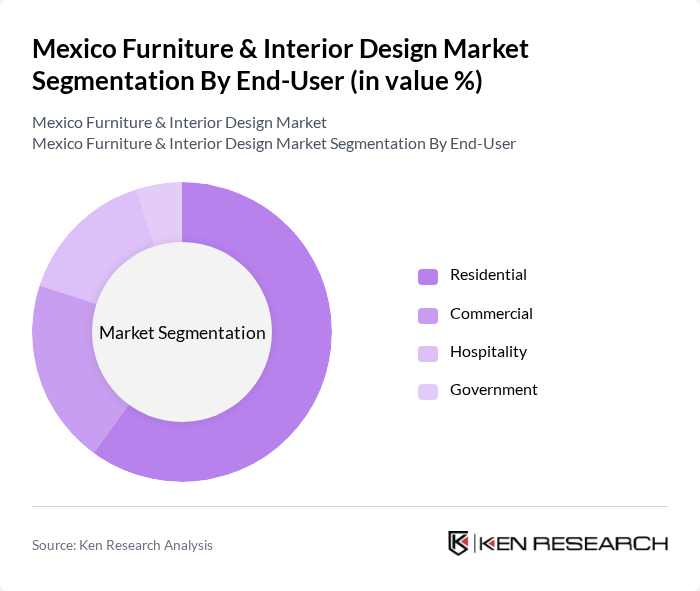

By End-User:The market can also be segmented by end-user categories, including residential, commercial, hospitality, and government. The residential segment is the largest, driven by the increasing number of households, the trend towards home improvement, and the demand for furniture that reflects personal style and enhances living environments. The commercial segment remains significant as businesses invest in office spaces and customer-facing environments to improve aesthetics and functionality.

The Mexico Furniture & Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muebles Dico S.A. de C.V., Muebles Jalisco S.A. de C.V., IKEA Mexico, Casa Palacio, Liverpool S.A.B. de C.V., Sears Mexico, Grupo Coppel S.A. de C.V., Muebles para el Hogar S.A. de C.V., Walmart de México y Centroamérica, Amazon Mexico, Office Depot Mexico, Home Depot Mexico, Muebles y Decoración S.A. de C.V., Muebles y Accesorios S.A. de C.V., Ag Furniture, EKH Furniture, Crate & Barrel Holdings Mexico contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico furniture and interior design market is poised for significant transformation as urbanization and rising incomes continue to shape consumer preferences. The integration of technology in furniture design and the growing emphasis on sustainability will drive innovation. Additionally, the increasing popularity of e-commerce platforms will facilitate access to a broader range of products, enhancing consumer choice. As these trends evolve, businesses must adapt to meet changing demands while navigating economic challenges to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Luxury Furniture Eco-Friendly Furniture Smart Furniture Vintage Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Omnichannel Retail |

| By Material | Wood Metal Plastic Fabric Composite Materials |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist Handcrafted |

| By Functionality | Multi-Functional Space-Saving Ergonomic Accessibility Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Design Enthusiasts |

| Commercial Interior Design Projects | 80 | Business Owners, Facility Managers |

| Custom Furniture Orders | 80 | Interior Designers, Architects |

| Consumer Preferences in Furniture Styles | 120 | General Consumers, Trend Analysts |

| Market Trends in Sustainable Furniture | 90 | Sustainability Advocates, Eco-conscious Consumers |

The Mexico Furniture & Interior Design Market is valued at approximately USD 10 billion, driven by urbanization, rising disposable incomes, and increased interest in home improvement and interior design. This growth reflects changing consumer preferences and lifestyle choices.