Region:Africa

Author(s):Dev

Product Code:KRAB2070

Pages:94

Published On:October 2025

By Type:The market is segmented into Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-friendly Furniture, Luxury Furniture, Contract Furniture, and Others. Residential Furniture remains the most dominant segment, driven by the increasing trend of home renovations, the growing middle-class population, and demand for stylish, functional, and space-saving furnishings. Office Furniture follows, supported by business expansion, workplace modernization, and the need for ergonomic and modular solutions. Eco-friendly and custom furniture segments are gaining traction as consumers prioritize sustainability and personalization .

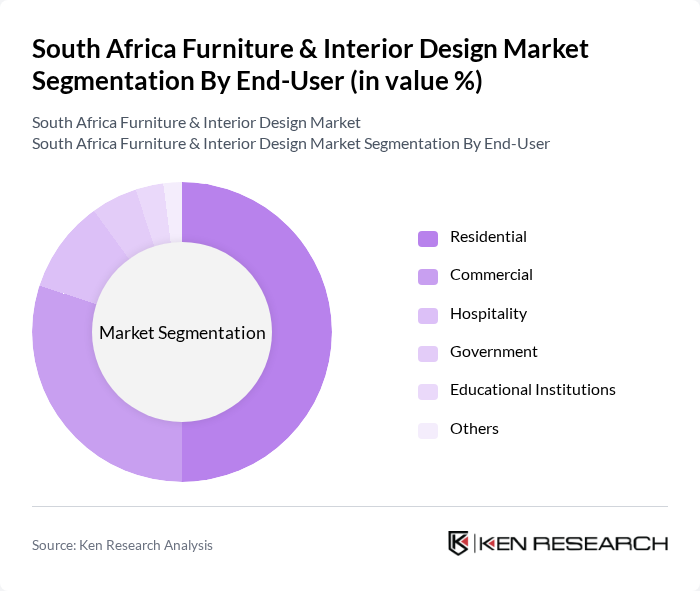

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, Government, Educational Institutions, and Others. The Residential segment leads, driven by the rising number of households, urban migration, and a strong focus on home improvement and comfort. The Commercial segment is significant, as businesses invest in modern office spaces, ergonomic furniture, and collaborative work environments to enhance productivity and employee well-being. Hospitality and government segments also contribute, reflecting investment in hotels, public spaces, and institutional infrastructure .

The South Africa Furniture & Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steinhoff International Holdings N.V., The Foschini Group, Mr Price Group, Coricraft Group, @Home (part of The Foschini Group), MRP Home (part of Mr Price Group), Homewood, Greenstone Hill Furniture, The Furniture Warehouse, Furniture City, The Bed Shop, House & Home (part of Shoprite Holdings), Dial-a-Bed, Urban Furniture, Lifestyles Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The South African furniture and interior design market is poised for transformation as urbanization and rising incomes create new opportunities. In future, the integration of smart home technology and sustainable practices will likely redefine consumer preferences. Additionally, the increasing focus on home renovations, driven by a desire for personalized living spaces, will further stimulate demand. As manufacturers adapt to these trends, the market is expected to evolve, presenting both challenges and opportunities for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-friendly Furniture Luxury Furniture Contract Furniture Others |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material | Wood Metal Plastic Fabric Composite Materials Others |

| By Style | Contemporary Traditional Industrial Rustic Modern Others |

| By Functionality | Multi-functional Furniture Space-saving Furniture Ergonomic Furniture Modular Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Retail | 150 | Store Managers, Sales Executives |

| Commercial Interior Design Projects | 100 | Project Managers, Interior Designers |

| Furniture Manufacturing Insights | 80 | Production Managers, Quality Control Supervisors |

| Consumer Preferences in Furniture | 120 | Homeowners, Renters, Interior Design Enthusiasts |

| Trends in Sustainable Furniture | 70 | Sustainability Officers, Product Development Managers |

The South Africa Furniture & Interior Design Market is valued at approximately USD 5.1 billion, reflecting a robust demand for both residential and commercial furniture driven by urbanization, rising disposable incomes, and a focus on home improvement.