Region:Middle East

Author(s):Geetanshi

Product Code:KRAB2845

Pages:100

Published On:October 2025

By Type:The market is segmented into various types of furniture, including home furniture, office furniture, hospitality furniture, educational furniture, healthcare furniture, outdoor furniture, custom/bespoke furniture, modular furniture, and others such as public spaces and retail malls. Among these,home furniture remains the most dominant segment, driven by a sustained trend of home renovations, a growing middle-class population, and government-backed housing initiatives. Office furniture follows, supported by business expansion, Saudization-driven ergonomic upgrades, and the modernization of workspaces. Hospitality furniture is rapidly growing due to giga-projects and the expansion of the tourism sector .

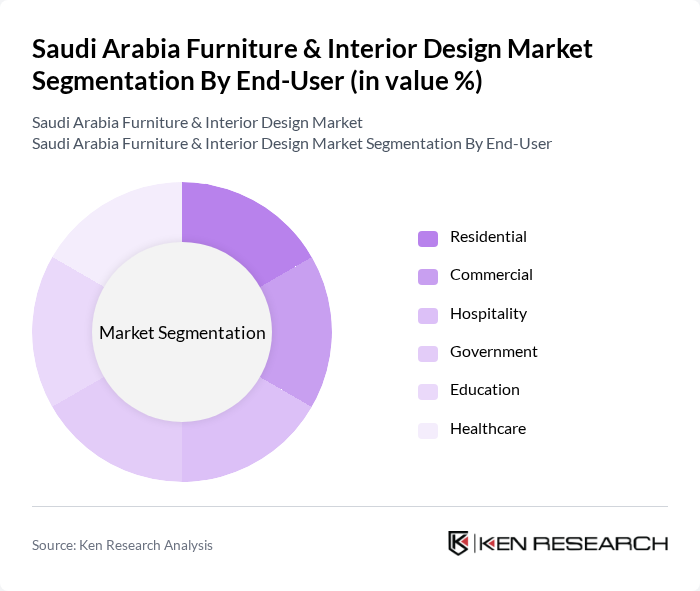

By End-User:The end-user segmentation includes residential, commercial, hospitality, government, education, and healthcare sectors. Theresidential segment is the largest, driven by an increasing number of households, homeownership initiatives, and a strong trend toward home improvement. The commercial segment is also significant, as businesses invest in modern office spaces and ergonomic upgrades to enhance productivity and employee satisfaction. Hospitality is a fast-growing segment due to the expansion of hotels and resorts under Vision 2030 .

The Saudi Arabia Furniture & Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia, Al-Futtaim Group (Homeworks, Pan Emirates), Home Centre (Landmark Group), Pan Emirates, Abdul Latif Jameel United Furniture, Al-Muhaidib Group, Al-Hokair Group, Al-Nahda International, Al-Jedaie Furniture, Al-Mutlaq Furniture, Al-Suwaidi Group, Al-Rajhi Group, Al-Muhaidib Furniture, Al-Faisal Furniture, and Al-Mahmal Furniture contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia furniture and interior design market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart furniture solutions is expected to gain traction, appealing to tech-savvy consumers. Additionally, the growing emphasis on sustainability will likely influence product offerings, with eco-friendly materials becoming more prevalent. As e-commerce continues to expand, online retail channels will play a crucial role in shaping purchasing behaviors, making it essential for businesses to adapt to these trends to remain competitive.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Furniture Office Furniture Hospitality Furniture Educational Furniture Healthcare Furniture Outdoor Furniture Custom/Bespoke Furniture Modular Furniture Others (e.g., public spaces, retail malls) |

| By End-User | Residential Commercial Hospitality Government Education Healthcare |

| By Sales Channel | Online Retail Specialty Stores Hypermarkets & Supermarkets Direct Sales Distributors/Dealers |

| By Material | Wood Metal Plastic/Polymer Upholstered Glass Other Materials (composites, engineered products) |

| By Price Range | Economy Mid-Range Premium/Luxury |

| By Design Style | Contemporary Traditional Industrial Minimalist Other Styles (e.g., Scandinavian, Classic, Modern Arabic) |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Makkah, Madinah) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Design Enthusiasts |

| Commercial Interior Design Projects | 60 | Office Managers, Facility Managers |

| Retail Furniture Sales | 80 | Store Managers, Sales Executives |

| Consumer Preferences in Furniture Design | 50 | Design Students, Home Decorators |

| Sustainability in Furniture Manufacturing | 40 | Manufacturers, Sustainability Managers |

The Saudi Arabia Furniture & Interior Design Market is valued at approximately USD 6.5 billion, driven by urbanization, real estate expansion, and rising disposable incomes, as well as government initiatives under Vision 2030.