Region:Global

Author(s):Rebecca

Product Code:KRAE3496

Pages:93

Published On:February 2026

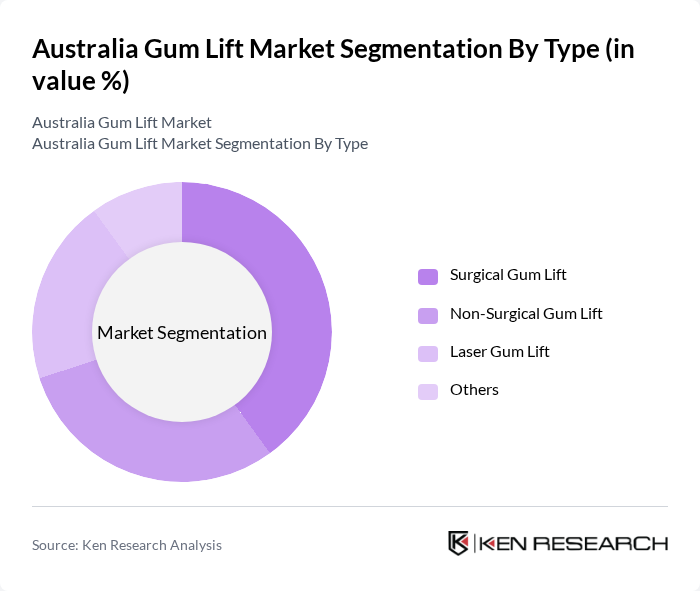

By Type:The market is segmented into Surgical Gum Lift, Non-Surgical Gum Lift, Laser Gum Lift, and Others. Each of these sub-segments caters to different consumer preferences and treatment needs. Surgical procedures are often preferred for their long-lasting results, while non-surgical options appeal to those seeking less invasive treatments. Laser gum lifts are gaining traction due to their precision and reduced recovery time.

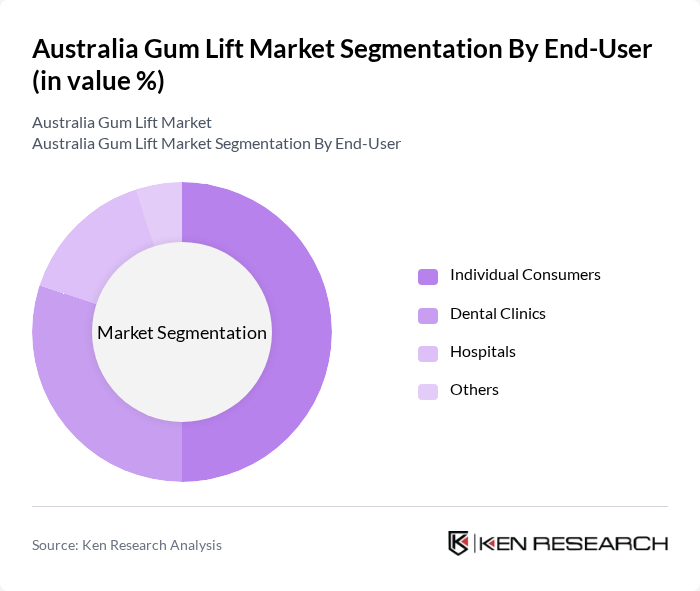

By End-User:The end-user segmentation includes Individual Consumers, Dental Clinics, Hospitals, and Others. Individual consumers represent a significant portion of the market, driven by the increasing trend of personal grooming and aesthetic enhancement. Dental clinics are the primary service providers, while hospitals cater to more complex cases requiring surgical interventions.

The Australia Gum Lift Market is characterized by a dynamic mix of regional and international players. Leading participants such as Australian Dental Association, Bupa Dental, Dental Corporation, National Dental Care, Smile Solutions, MyDental, Gentle Dental, Pacific Smiles Group, Dental on the Hill, The Smile Clinic, Sunshine Coast Dental, Melbourne Dental Clinic, Sydney Dental Clinic, Brisbane Dental Hospital, Perth Dental Centre contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia gum lift market appears promising, driven by ongoing trends in consumer preferences and technological advancements. As more Australians prioritize dental aesthetics, the demand for gum lifts is expected to rise significantly. Additionally, the integration of digital solutions in dental practices will enhance patient engagement and streamline service delivery. With a focus on personalized treatments, the market is likely to witness innovative approaches that cater to individual needs, further propelling growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Gum Lift Non-Surgical Gum Lift Laser Gum Lift Others |

| By End-User | Individual Consumers Dental Clinics Hospitals Others |

| By Age Group | 30 Years 45 Years 60 Years + Years |

| By Gender | Male Female Others |

| By Geographic Distribution | Urban Areas Rural Areas Suburban Areas |

| By Treatment Duration | Short-term Treatments Long-term Treatments Others |

| By Insurance Coverage | Insured Uninsured Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Professionals Insights | 100 | Dentists, Orthodontists, Dental Hygienists |

| Retail Market Feedback | 80 | Store Managers, Category Buyers, Sales Representatives |

| Consumer Preferences Survey | 150 | General Consumers, Gum Users, Health-Conscious Individuals |

| Distribution Channel Analysis | 70 | Wholesalers, Distributors, Supply Chain Managers |

| Market Trend Evaluation | 60 | Market Analysts, Industry Experts, Research Consultants |

The Australia Gum Lift Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased consumer awareness of oral health and advancements in dental technology.