Region:Global

Author(s):Rebecca

Product Code:KRAA0364

Pages:90

Published On:August 2025

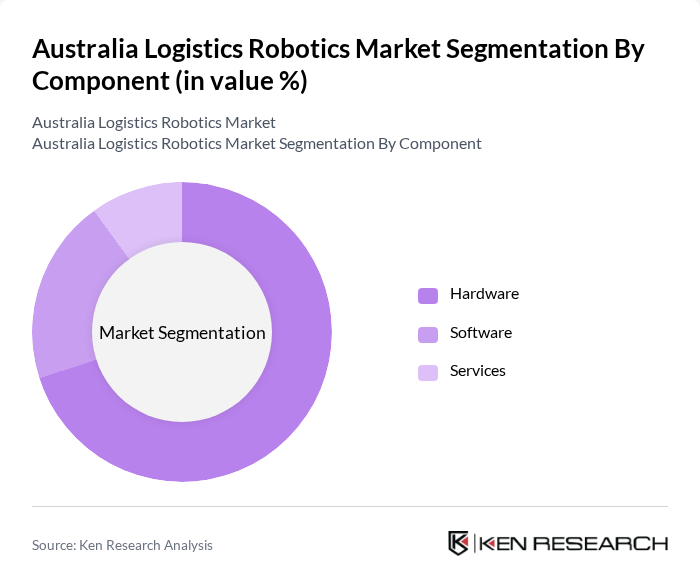

By Component:The logistics robotics market can be segmented into three main components: Hardware, Software, and Services. Each of these components plays a crucial role in the overall functionality and efficiency of logistics operations. Hardware includes the physical robots and machinery, such as AGVs and robotic arms, which are the largest and most established segment. Software encompasses the control, fleet management, and integration platforms that coordinate robotic operations and optimize workflows. Services involve support, maintenance, and integration required to ensure optimal performance and scalability of robotic solutions .

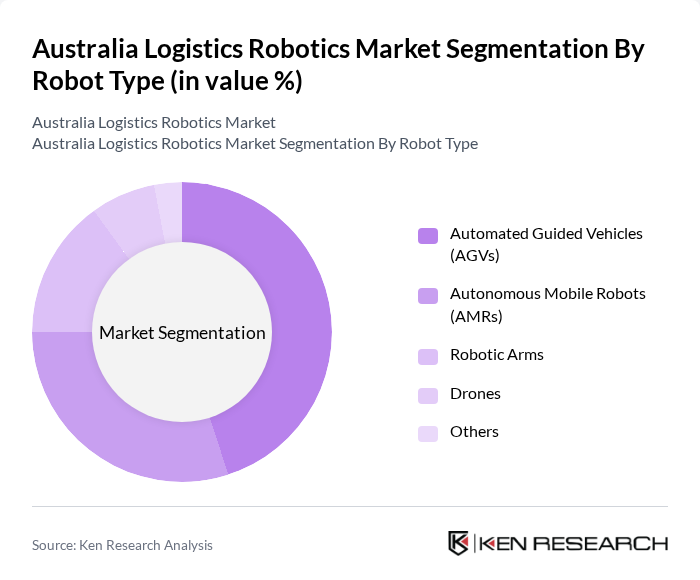

By Robot Type:The market can also be categorized based on the types of robots utilized, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms, Drones, and Others. AGVs and AMRs are the most widely deployed robot types in Australian logistics, primarily used for goods transport, order picking, and warehouse automation. Robotic arms are increasingly used for palletizing and material handling, while drones are emerging for inventory management and last-mile delivery applications .

The Australia Logistics Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Robotics (Kiva Systems), Dematic, Swisslog (KUKA Group), Locus Robotics, Geek+, GreyOrange, AutoStore, ABB, Omron Robotics, Mobile Industrial Robots (MiR), Fetch Robotics (Zebra Technologies), Seegrid, SICK AG, Honeywell Intelligrated, and Vanderlande contribute to innovation, geographic expansion, and service delivery in this space .

The future of the logistics robotics market in Australia appears promising, driven by ongoing technological advancements and increasing demand for automation. As companies continue to seek efficiency and cost reduction, the adoption of AI and machine learning will likely accelerate. Furthermore, the push for sustainable practices will encourage the development of eco-friendly robotics solutions. With government support and industry collaboration, the market is poised for significant growth, enhancing operational capabilities across the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Robot Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms Drones Others |

| By Application | Inventory Management Order Fulfillment Packaging Shipping and Receiving Palletizing & Depalletizing Others |

| By End-User Industry | E-commerce Third-Party Logistics (3PL) Retail Food and Beverage Pharmaceuticals Automotive Others |

| By Technology | Machine Learning & AI Computer Vision IoT Integration Cloud Computing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Robotics Implementation | 100 | Logistics Managers, Operations Directors |

| Warehouse Automation Solutions | 80 | Warehouse Managers, Technology Officers |

| Manufacturing Robotics Integration | 70 | Production Managers, Supply Chain Analysts |

| Healthcare Logistics Robotics | 50 | Logistics Coordinators, Facility Managers |

| Robotic Process Automation in Logistics | 60 | IT Managers, Automation Specialists |

The Australia Logistics Robotics Market is valued at approximately USD 400 million, driven by the increasing demand for automation in supply chain operations, enhanced efficiency, and cost reduction in logistics processes.