Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2025

Pages:95

Published On:August 2025

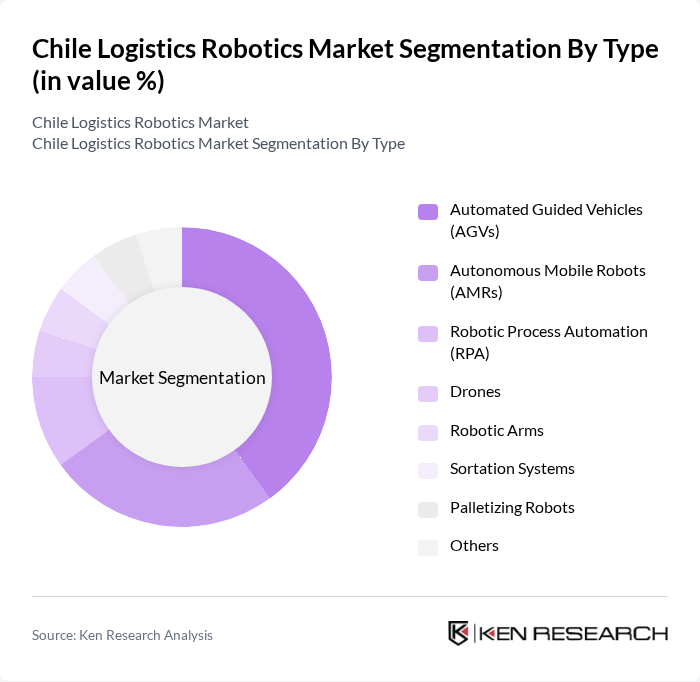

By Type:

The types of robotics utilized in logistics includeAutomated Guided Vehicles (AGVs),Autonomous Mobile Robots (AMRs),Robotic Process Automation (RPA),Drones,Robotic Arms,Sortation Systems,Palletizing Robots, andOthers. Among these, AGVs are leading the market due to their efficiency in transporting goods within warehouses and distribution centers. The growing trend of e-commerce and the need for rapid order fulfillment have significantly increased the demand for AGVs, as they help streamline operations and reduce labor costs. The rise of AMRs is also notable, as they offer flexibility and adaptability in dynamic environments, further enhancing logistics operations and supporting the shift toward automated, data-driven supply chains .

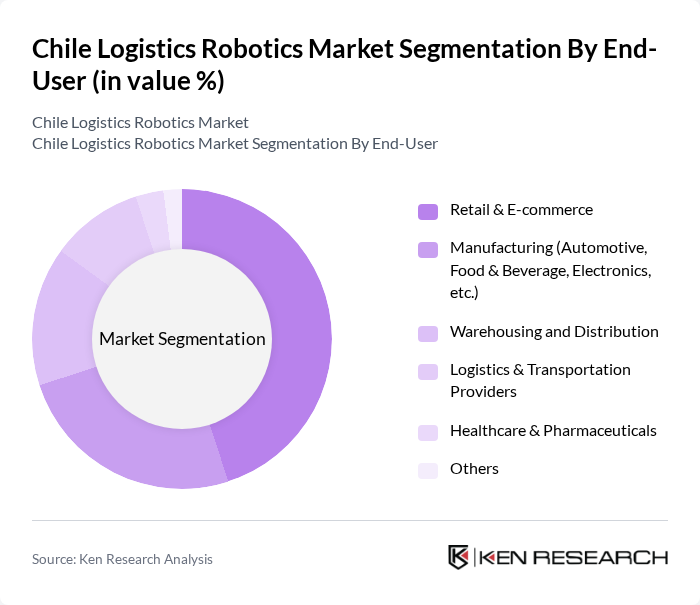

By End-User:

The end-users of logistics robotics includeRetail & E-commerce,Manufacturing (Automotive, Food & Beverage, Electronics, etc.),Warehousing and Distribution,Logistics & Transportation Providers,Healthcare & Pharmaceuticals, andOthers. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment. Companies in this sector are increasingly adopting robotics to enhance their supply chain operations, reduce delivery times, and improve customer satisfaction. The Manufacturing sector also shows significant adoption, particularly in automating repetitive tasks, improving production efficiency, and addressing labor shortages. Warehousing and distribution centers are deploying robotics to optimize inventory management and streamline goods movement .

The Chile Logistics Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Robotics, ABB Robotics, KUKA AG, Geekplus Technology Co., Ltd., Locus Robotics, Omron Robotics & Safety Technologies, Inc., Dematic (a KION Group company), Siemens Logistics, Yaskawa Electric Corporation, Universal Robots, Panasonic Corporation, Denso Robotics, Honeywell Intelligrated, Toyota Material Handling, Festo AG & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The Chile logistics robotics market is poised for transformative growth, driven by technological advancements and increasing automation demands. As companies seek to enhance efficiency, the integration of AI and machine learning into robotic systems will become more prevalent. Additionally, the expansion of smart warehousing solutions will facilitate better inventory management and order fulfillment. With a focus on sustainability, logistics firms are likely to adopt eco-friendly practices, further shaping the industry's future landscape and operational strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Process Automation (RPA) Drones Robotic Arms Sortation Systems Palletizing Robots Others |

| By End-User | Retail & E-commerce Manufacturing (Automotive, Food & Beverage, Electronics, etc.) Warehousing and Distribution Logistics & Transportation Providers Healthcare & Pharmaceuticals Others |

| By Application | Inventory Management Order Fulfillment & Picking Packaging & Palletizing Transportation & Delivery Sorting & Consolidation Others |

| By Sales Channel | Direct Sales Distributors/Integrators Online Sales Others |

| By Distribution Mode | B2B B2C Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | Santiago Valparaíso Concepción Antofagasta Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 100 | Logistics Directors, Operations Managers |

| Warehouse Robotics Implementation | 80 | Warehouse Managers, Technology Officers |

| Manufacturing Supply Chain Robotics | 60 | Supply Chain Managers, Production Supervisors |

| E-commerce Fulfillment Robotics | 70 | eCommerce Operations Managers, Logistics Coordinators |

| Robotics in Last-Mile Delivery | 40 | Last-Mile Delivery Managers, Fleet Operations Heads |

The Chile Logistics Robotics Market is valued at approximately USD 21 million, reflecting a significant growth trend driven by the increasing demand for automation in logistics and supply chain operations.