Region:Asia

Author(s):Geetanshi

Product Code:KRAA0172

Pages:85

Published On:August 2025

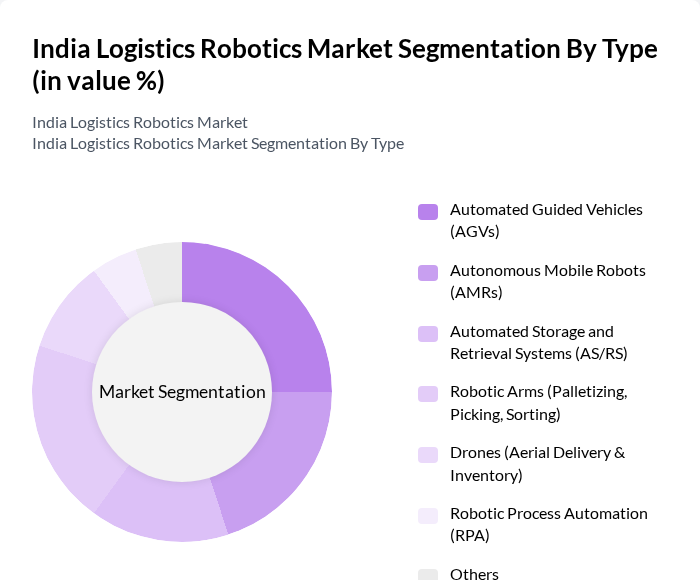

By Type:The market is segmented into various types of robotics solutions, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (AS/RS), Robotic Arms, Drones, Robotic Process Automation (RPA), and others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and reducing costs in logistics operations .

The leading sub-segment in the market is Automated Guided Vehicles (AGVs), which are widely adopted for their efficiency in material handling and transportation within warehouses and distribution centers. The growing trend of automation in logistics operations, driven by the need for faster and more accurate order fulfillment, has significantly boosted the demand for AGVs. Their ability to operate autonomously and integrate with existing warehouse management systems makes them a preferred choice among logistics providers .

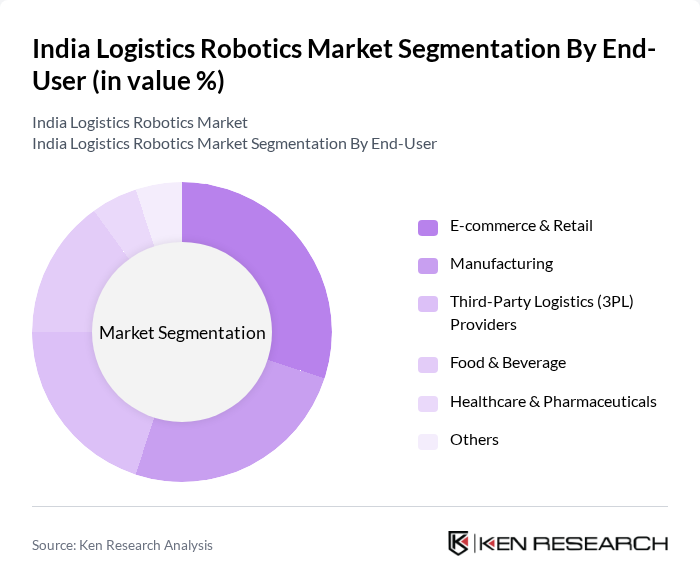

By End-User:The logistics robotics market is segmented by end-user industries, including E-commerce & Retail, Manufacturing, Third-Party Logistics (3PL) Providers, Food & Beverage, Healthcare & Pharmaceuticals, and others. Each sector has unique requirements that drive the adoption of robotics solutions to enhance efficiency and reduce operational costs .

The E-commerce & Retail sector is the dominant end-user segment, driven by the rapid growth of online shopping and the need for efficient order fulfillment processes. The increasing consumer expectations for faster delivery times and the need for accurate inventory management have led to a surge in the adoption of robotics solutions in this sector. Companies are leveraging robotics to streamline operations, reduce labor costs, and enhance customer satisfaction .

The India Logistics Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as GreyOrange, Addverb Technologies, Falcon Autotech, Locus Robotics, ABB Robotics, Omron Automation, Hi-Tech Robotic Systemz, Systemantics, Asimov Robotics, Amazon Robotics, KUKA Robotics, Panasonic India, Godrej Koerber, Geek+ Robotics, Siemens Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics robotics market in India appears promising, driven by technological advancements and increasing automation needs. As companies continue to embrace robotics, the integration of artificial intelligence and machine learning will enhance operational efficiency. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly robotic solutions. With government support and rising investments, the logistics sector is poised for transformative growth, positioning India as a leader in logistics innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Automated Storage and Retrieval Systems (AS/RS) Robotic Arms (Palletizing, Picking, Sorting) Drones (Aerial Delivery & Inventory) Robotic Process Automation (RPA) Others |

| By End-User | E-commerce & Retail Manufacturing Third-Party Logistics (3PL) Providers Food & Beverage Healthcare & Pharmaceuticals Others |

| By Region | North India South India East India West India |

| By Technology | Machine Learning & AI Computer Vision Sensor Technology IoT Integration Others |

| By Application | Inventory Management Order Fulfillment Packaging & Palletizing Sorting & Picking Last-Mile Delivery Others |

| By Investment Source | Private Investments Venture Capital Government Funding Corporate Investments Others |

| By Policy Support | Grants and Subsidies Tax Incentives Research and Development Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Robotics | 80 | Logistics Coordinators, Delivery Operations Managers |

| Robotic Process Automation in Supply Chain | 70 | Supply Chain Analysts, IT Managers |

| Cold Chain Robotics | 50 | Cold Chain Managers, Quality Assurance Officers |

| Robotics in Inventory Management | 90 | Inventory Control Managers, Procurement Specialists |

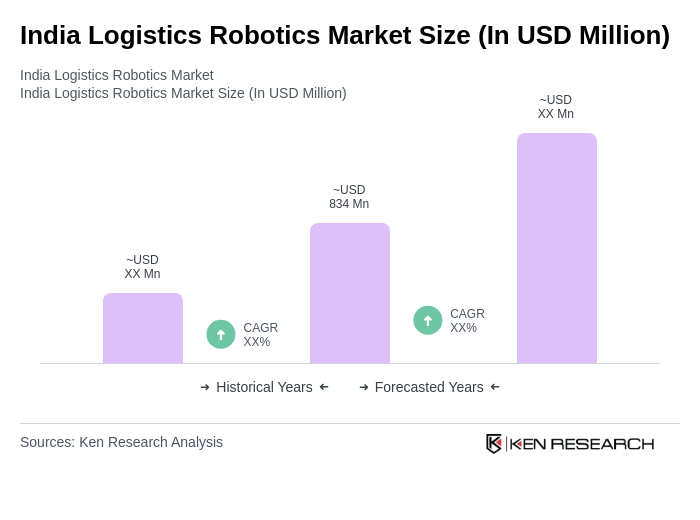

The India Logistics Robotics Market is valued at approximately USD 834 million, driven by the increasing demand for automation in supply chain operations, the rise of e-commerce, and the need for efficient inventory management solutions.