Region:Asia

Author(s):Geetanshi

Product Code:KRAA0307

Pages:89

Published On:August 2025

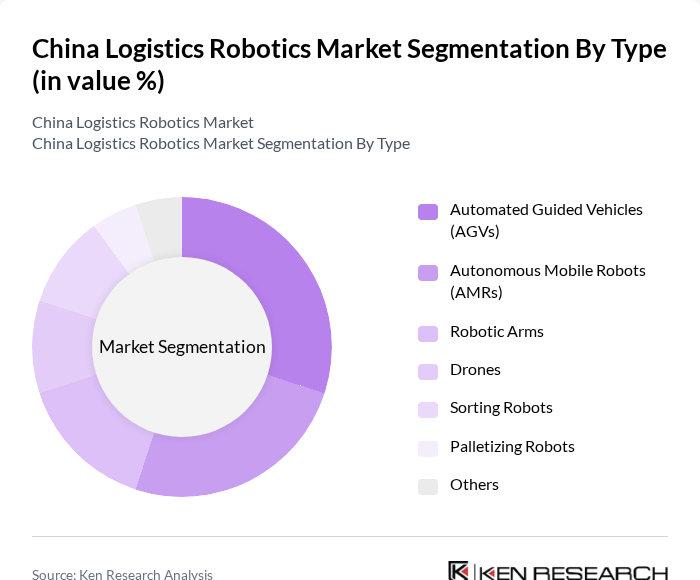

By Type:The market is segmented into various types of logistics robotics, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms, Drones, Sorting Robots, Palletizing Robots, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and automating various logistics processes .

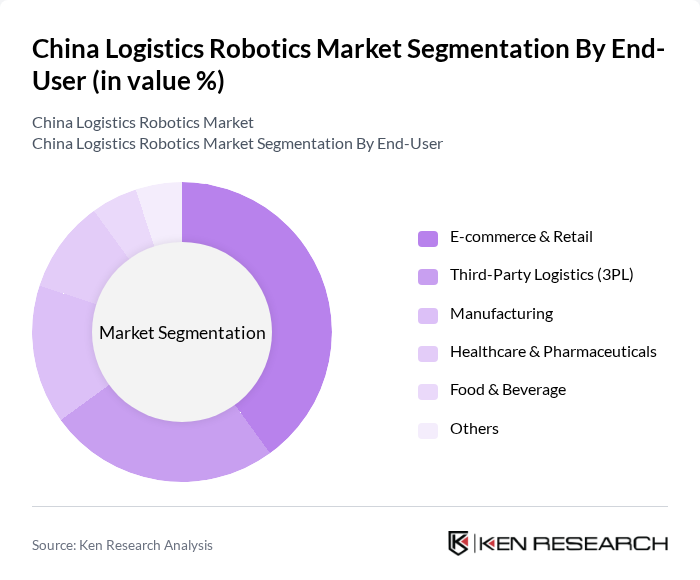

By End-User:The logistics robotics market is also segmented by end-user industries, including E-commerce & Retail, Third-Party Logistics (3PL), Manufacturing, Healthcare & Pharmaceuticals, Food & Beverage, and Others. Each sector has unique requirements and applications for robotics, driving the demand for tailored solutions .

The China Logistics Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geek+, Hikrobot, Quicktron (Kuaicang), ForwardX Robotics, HAI Robotics, LiBiao Robotics, Youibot Robotics, Standard Robots, Siasun Robot & Automation, ABB Robotics, JD Logistics, Alibaba Cainiao, Shentong (STO) Express Robotics, Efort Intelligent Equipment, YTO Express Robotics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics robotics market in China appears promising, driven by technological advancements and increasing automation adoption. As companies continue to embrace artificial intelligence and machine learning, operational efficiencies are expected to improve significantly. Furthermore, the rise of e-commerce will necessitate innovative logistics solutions, fostering a competitive landscape. With government support for automation initiatives, the market is poised for substantial growth, paving the way for enhanced productivity and sustainability in logistics operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms Drones Sorting Robots Palletizing Robots Others |

| By End-User | E-commerce & Retail Third-Party Logistics (3PL) Manufacturing Healthcare & Pharmaceuticals Food & Beverage Others |

| By Application | Warehouse Automation Order Fulfillment Inventory Management Sorting & Packaging Last-Mile Delivery Others |

| By Industry Vertical | E-commerce Automotive Electronics Food and Beverage Pharmaceuticals Others |

| By Region | North China South China East China West China |

| By Technology | AI and Machine Learning IoT Integration Cloud Computing Sensor Technology Computer Vision Others |

| By Business Model | Direct Sales Leasing Subscription Services (Robotics-as-a-Service) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 120 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Robotics | 90 | Logistics Coordinators, Delivery Operations Managers |

| Robotic Process Automation in Supply Chain | 60 | Supply Chain Analysts, IT Managers |

| Robotics in Cold Chain Logistics | 50 | Cold Chain Managers, Quality Assurance Officers |

| Integration of AI in Logistics Robotics | 70 | Data Scientists, Robotics Engineers |

The China Logistics Robotics Market is valued at approximately USD 2.2 billion, driven by the rapid growth of e-commerce, increasing automation demand in warehouses, and the integration of advanced technologies like AI and IoT.