Region:Europe

Author(s):Geetanshi

Product Code:KRAA0273

Pages:84

Published On:August 2025

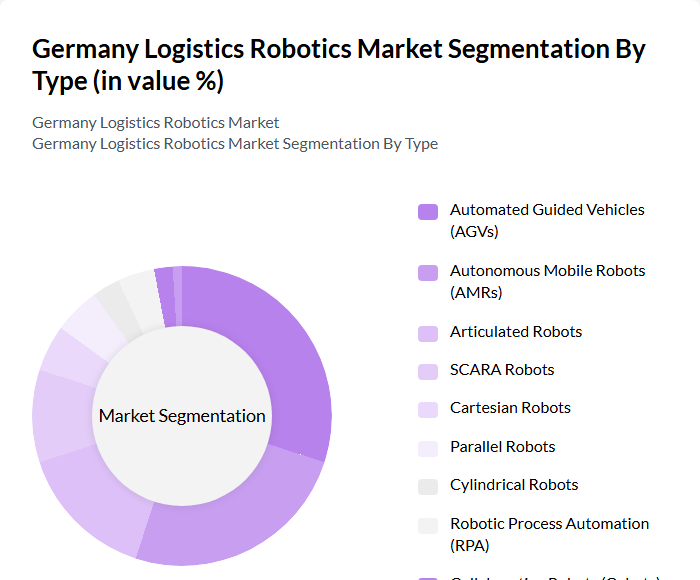

By Type:The market is segmented into various types of robotics, each serving distinct functions within logistics operations. The primary types include Mobile Robots, Articulated Robots, SCARA Robots, Cartesian Robots, Parallel Robots, and Cylindrical Robots. Mobile Robots are particularly popular due to their flexibility and ability to navigate complex environments autonomously. Articulated Robots are favored for their precision in handling tasks and currently command the largest share of the German market, while SCARA Robots are commonly used for assembly and packaging processes. The demand for these robots is driven by the need for efficiency, accuracy, and adaptability in logistics operations .

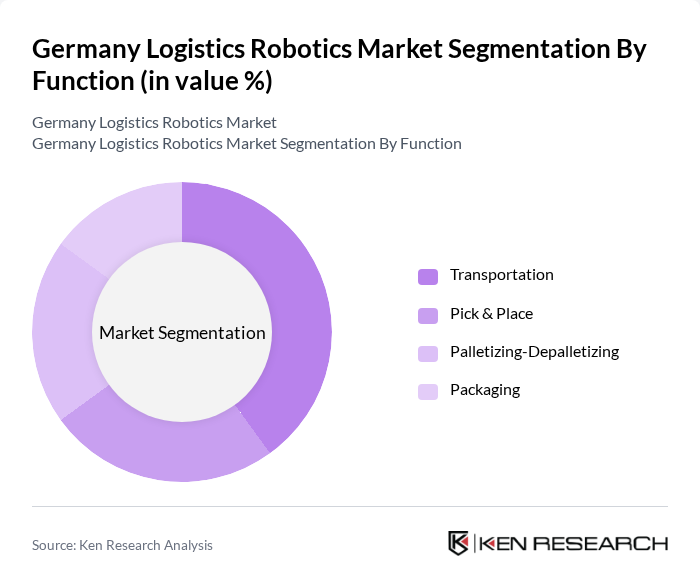

By Function:This segmentation focuses on the various functions that logistics robotics perform. The key functions include Transportation, Pick & Place, Palletizing-Depalletizing, and Packaging. Transportation robots are essential for moving goods within warehouses and distribution centers, while Pick & Place robots are utilized for sorting and organizing products. Palletizing-Depalletizing robots streamline the loading and unloading processes, and Packaging robots enhance efficiency in product packaging. The increasing demand for automation in these functions is driving the growth of robotics in logistics .

The Germany Logistics Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, Siemens AG, ABB Ltd., Dematic GmbH, Swisslog Holding AG, Honeywell International Inc., Amazon Robotics, Mobile Industrial Robots (MiR), Locus Robotics, GreyOrange, Geekplus Technology Co., Ltd., Fetch Robotics, 6 River Systems, Ocado Group, Vanderlande Industries contribute to innovation, geographic expansion, and service delivery in this space .

The future of the logistics robotics market in Germany appears promising, driven by technological advancements and increasing automation demands. As companies continue to embrace digital transformation, the integration of AI and machine learning into logistics operations will enhance efficiency and decision-making. Furthermore, the growing emphasis on sustainability will likely lead to innovations in eco-friendly robotics solutions, aligning with regulatory pressures and consumer preferences for greener logistics practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Robots Articulated Robots SCARA Robots Cartesian Robots Parallel Robots Cylindrical Robots |

| By Function | Transportation Pick & Place Palletizing-Depalletizing Packaging |

| By Payload Capacity | Below 10 kg kg to 80 kg kg to 400 kg kg to 900 kg Above 900 kg |

| By Component | Hardware Software Services |

| By End-User | E-commerce & Retail Automotive Manufacturing Healthcare & Pharmaceuticals Food & Beverage Others |

| By Application | Warehouse Management Inventory Management Order Fulfillment Packaging Transportation & Distribution Others |

| By Region | North Germany South Germany East Germany West Germany |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | Logistics Managers, Automation Engineers |

| Robotic Process Automation in Supply Chain | 80 | Supply Chain Directors, IT Managers |

| Last-Mile Delivery Robotics | 70 | Operations Managers, Delivery Coordinators |

| Robotics in Manufacturing Logistics | 90 | Production Managers, Robotics Specialists |

| Integration of AI in Logistics Robotics | 60 | Data Scientists, Technology Officers |

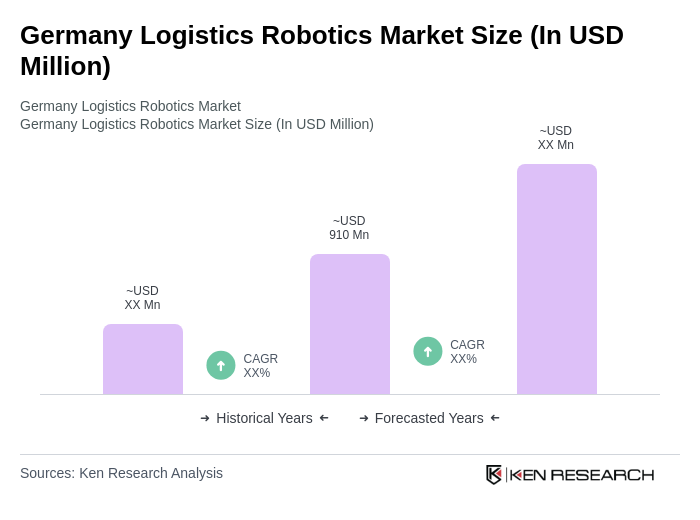

The Germany Logistics Robotics Market is valued at approximately USD 910 million, reflecting a significant growth trend driven by the increasing demand for automation in logistics and supply chain operations.