Region:Asia

Author(s):Shubham

Product Code:KRAA1763

Pages:89

Published On:August 2025

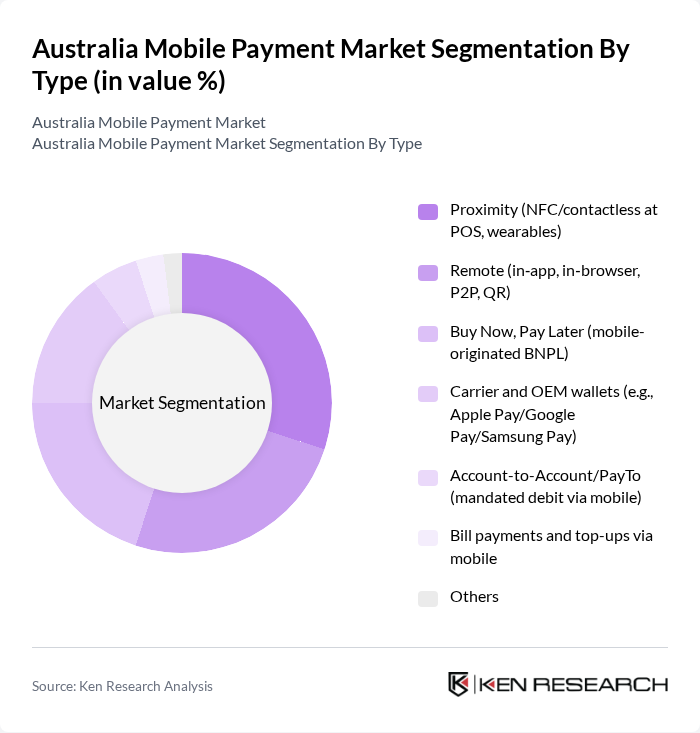

By Type:The mobile payment market can be segmented into various types, including proximity payments, remote payments, Buy Now, Pay Later (BNPL) options, carrier and OEM wallets, account-to-account payments, bill payments, and others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall market dynamics. Increasing digital wallet usage across NFC and QR, strong in?app checkout adoption, and the broad availability of Apple Pay, Google Pay, and Samsung Pay across banks and merchants are key drivers of these segments .

The proximity payment segment, particularly through NFC/contactless methods at points of sale (POS) and wearables, is currently leading the market. This dominance is attributed to the growing consumer preference for quick and convenient payment methods, near?ubiquitous contactless acceptance, and strong mobile wallet integration with major banks, which together make tap?to?pay the default in-store experience .

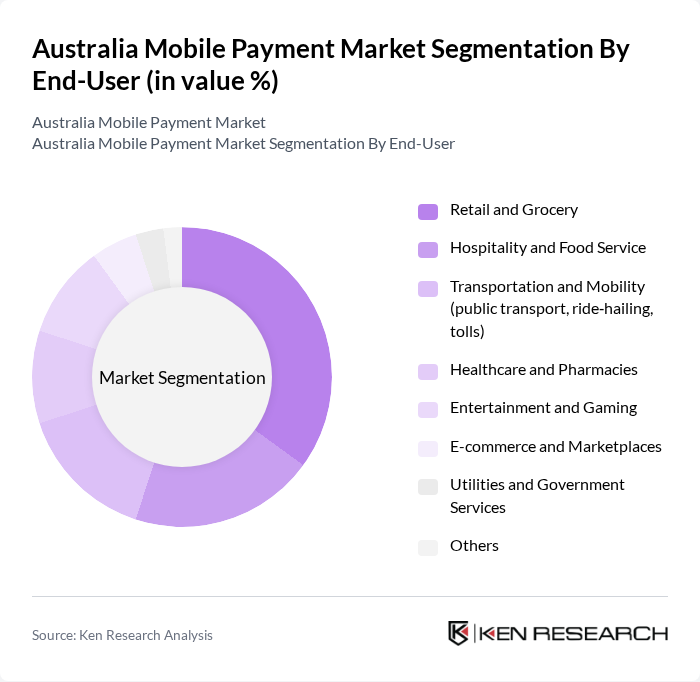

By End-User:The mobile payment market is also segmented by end-user categories, including retail and grocery, hospitality and food service, transportation and mobility, healthcare and pharmacies, entertainment and gaming, e-commerce and marketplaces, utilities and government services, and others. Each segment reflects the diverse applications of mobile payments across various industries. High-frequency categories like grocery and quick-service dining exhibit the deepest penetration of tap?to?pay and wallets, while ecommerce and marketplaces continue to push in?app wallet checkouts and BNPL adoption .

The retail and grocery segment is the largest contributor to the mobile payment market, driven by the increasing number of consumers opting for contactless payments for everyday purchases and the near?universal roll?out of contactless POS terminals, which favor mobile wallet usage for small?ticket, frequent transactions .

The Australia Mobile Payment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Pty Ltd. (Apple Pay), Google LLC (Google Pay), Samsung Electronics Australia Pty Limited (Samsung Pay), PayPal Australia Pty Ltd., Commonwealth Bank of Australia (CommBank App, Tap & Pay), Westpac Banking Corporation (Westpac Mobile Pay), Australia and New Zealand Banking Group Limited (ANZ Plus, ANZ Mobile Pay), National Australia Bank Limited (NAB Pay, NAB app), Block, Inc. (Square AU Pty Ltd.), Adyen Australia Pty Ltd., Stripe Payments Australia Pty Ltd., Afterpay Australia Pty Ltd. (a Block, Inc. company), Zip Co Limited, Zai Australia Pty Ltd. (formerly Assembly Payments), Alipay (Ant Group) Australia, WeChat Pay (Tencent) Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile payment market in Australia appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the growing trend of contactless payments, which accounted for 61% of all in-store transactions in future, indicates a shift towards more convenient payment methods. As these trends continue, the market is likely to witness further innovation and expansion, catering to the evolving needs of consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity (NFC/contactless at POS, wearables) Remote (in?app, in?browser, P2P, QR) Buy Now, Pay Later (mobile-originated BNPL) Carrier and OEM wallets (e.g., Apple Pay/Google Pay/Samsung Pay) Account-to-Account/PayTo (mandated debit via mobile) Bill payments and top-ups via mobile Others |

| By End-User | Retail and Grocery Hospitality and Food Service Transportation and Mobility (public transport, ride?hailing, tolls) Healthcare and Pharmacies Entertainment and Gaming E-commerce and Marketplaces Utilities and Government Services Others |

| By Payment Method | Card-on-file via mobile (credit/debit) Account-to-Account (NPP/PayID/PayTo) BNPL at checkout (mobile) Digital wallets (Apple Pay, Google Pay, Samsung Pay, PayPal) Direct Carrier Billing QR code payments Others |

| By Industry Vertical | Retail Banking and Financial Services Telecommunications Government and Public Sector Travel and Tourism Others |

| By Transaction Size | Micro and Small Transactions (? AUD 100) Medium Transactions (AUD 101–1,000) Large Transactions (? AUD 1,001) Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution (metro vs. regional) Others |

| By Security Features | Biometric Authentication Two-Factor Authentication Tokenization and Network Token Vaults Device and Transaction Risk Scoring/Fraud Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 150 | General Consumers, Tech-Savvy Users |

| Small Business Adoption of Mobile Payments | 100 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 80 | Fintech Executives, Product Managers |

| Banking Sector Perspectives | 70 | Bank Executives, Payments Strategy Managers |

| Consumer Attitudes Towards Security in Mobile Payments | 120 | General Consumers, Cybersecurity Specialists |

The Australia Mobile Payment Market is valued at approximately AUD 165 billion, reflecting the transaction value flowing through mobile and digital wallets. This valuation is based on a five-year historical analysis and indicates significant growth in wallet-based payments.