Region:Europe

Author(s):Rebecca

Product Code:KRAA2116

Pages:100

Published On:August 2025

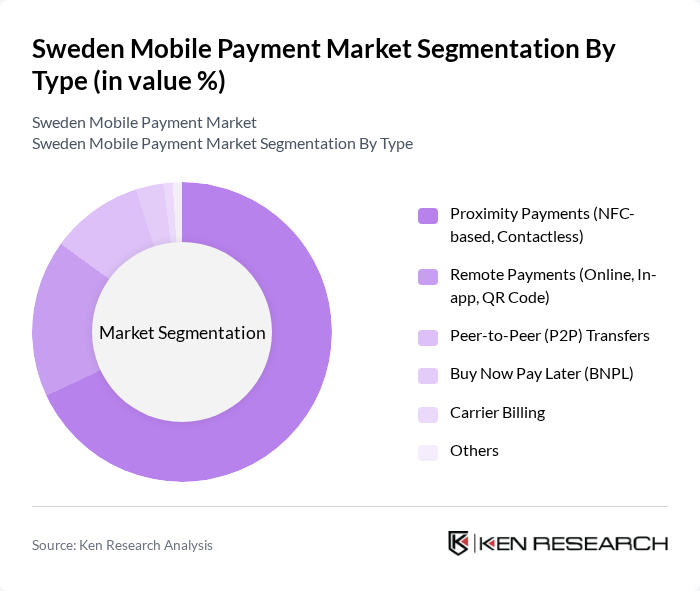

By Type:The mobile payment market can be segmented into various types, including Proximity Payments (NFC-based, Contactless), Remote Payments (Online, In-app, QR Code), Peer-to-Peer (P2P) Transfers, Buy Now Pay Later (BNPL), Carrier Billing, and Others. Among these, Proximity Payments and Remote Payments are particularly significant due to their widespread adoption in retail and e-commerce sectors. The increasing preference for contactless transactions has made Proximity Payments a dominant force, while Remote Payments are gaining traction as online shopping continues to rise. Proximity payments, supported by the ubiquitous NFC infrastructure and platforms like Swish, currently lead the market, while P2P transfers are experiencing rapid growth driven by national ID solutions like BankID .

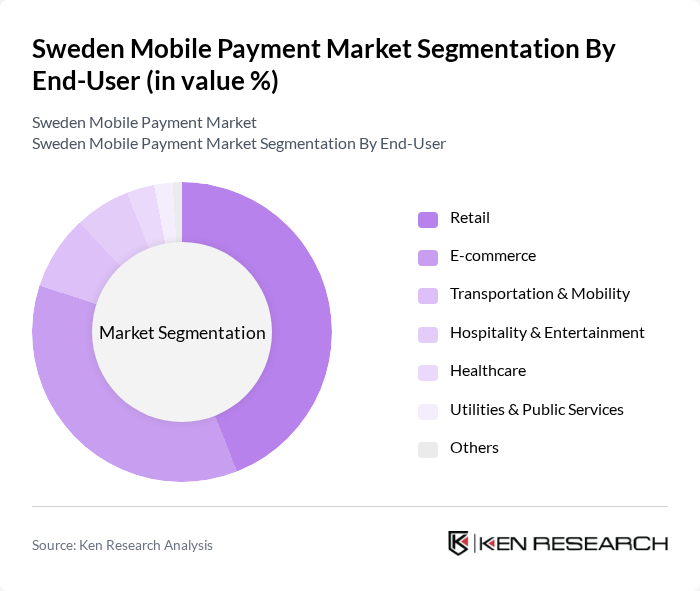

By End-User:The end-user segmentation includes Retail, E-commerce, Transportation & Mobility, Hospitality & Entertainment, Healthcare, Utilities & Public Services, and Others. The Retail and E-commerce sectors are the most significant contributors to the mobile payment market, driven by the increasing number of consumers opting for digital transactions. The convenience of mobile payments in retail settings and the growth of online shopping platforms have made these segments particularly dominant. The expansion of mobile payments into transportation, utilities, and hospitality is also notable, reflecting the broadening application of digital payment solutions across the Swedish economy .

The Sweden Mobile Payment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swish (Getswish AB), Klarna Bank AB, iZettle (Zettle by PayPal), Trustly Group AB, PayEx AB, Skandinaviska Enskilda Banken AB (SEB), Nordea Bank Abp, Svenska Handelsbanken AB, Länsförsäkringar Bank AB, Tink AB, Revolut Ltd, Payer Financial Services AB, Zimpler AB, MobilePay (Vipps MobilePay AS), DIBS Payment Services AB (Nets Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile payment market in Sweden appears promising, driven by technological advancements and evolving consumer behaviors. As digital wallets and peer-to-peer payment platforms gain traction, the market is expected to witness increased integration with e-commerce and retail sectors. Additionally, the adoption of biometric authentication and cryptocurrency payments is likely to reshape transaction methods, enhancing security and convenience. Overall, the mobile payment landscape is set for significant transformation, aligning with global trends towards digitalization and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity Payments (NFC-based, Contactless) Remote Payments (Online, In-app, QR Code) Peer-to-Peer (P2P) Transfers Buy Now Pay Later (BNPL) Carrier Billing Others |

| By End-User | Retail E-commerce Transportation & Mobility Hospitality & Entertainment Healthcare Utilities & Public Services Others |

| By Payment Method | Bank-Linked Mobile Wallets Card-Based Mobile Payments Direct Bank Transfers (e.g., Trustly, Swish) Third-Party Payment Apps (e.g., Apple Pay, Google Pay, PayPal) Mobile Carrier Billing Others |

| By User Demographics | Millennials Gen Z Gen X Baby Boomers |

| By Transaction Size | Micro Transactions (<100 SEK) Small Transactions (100–499 SEK) Medium Transactions (500–4,999 SEK) Large Transactions (?5,000 SEK) |

| By Security Features | Two-Factor Authentication Biometric Verification (Fingerprint, Face ID) Tokenization & Encryption Technologies BankID Integration |

| By Distribution Channel | Mobile Applications Online Platforms Physical Retail Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 120 | Regular mobile payment users, age 18-65 |

| Merchant Adoption of Mobile Payments | 80 | Small to medium-sized business owners |

| Fintech Industry Insights | 60 | Executives from fintech startups and established firms |

| Regulatory Impact Assessment | 40 | Policy makers and regulatory body representatives |

| Consumer Attitudes Towards Security | 100 | General consumers with varying levels of tech-savviness |

The Sweden Mobile Payment Market is valued at approximately USD 2 billion, driven by the increasing adoption of smartphones, e-commerce growth, and a preference for contactless payment methods among consumers.