Region:Global

Author(s):Dev

Product Code:KRAA1607

Pages:90

Published On:August 2025

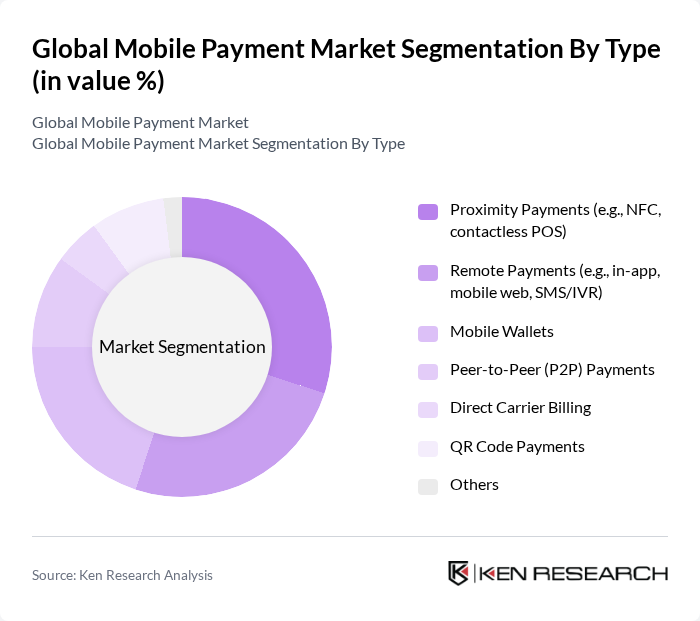

By Type:The mobile payment market can be segmented into various types, including Proximity Payments, Remote Payments, Mobile Wallets, Peer-to-Peer (P2P) Payments, Direct Carrier Billing, QR Code Payments, and Others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market. Remote payments and proximity payments together account for a substantial share, reflecting the dominance of in-app/mobile web commerce and contactless POS usage, while QR code payments are significant particularly in Asia-Pacific .

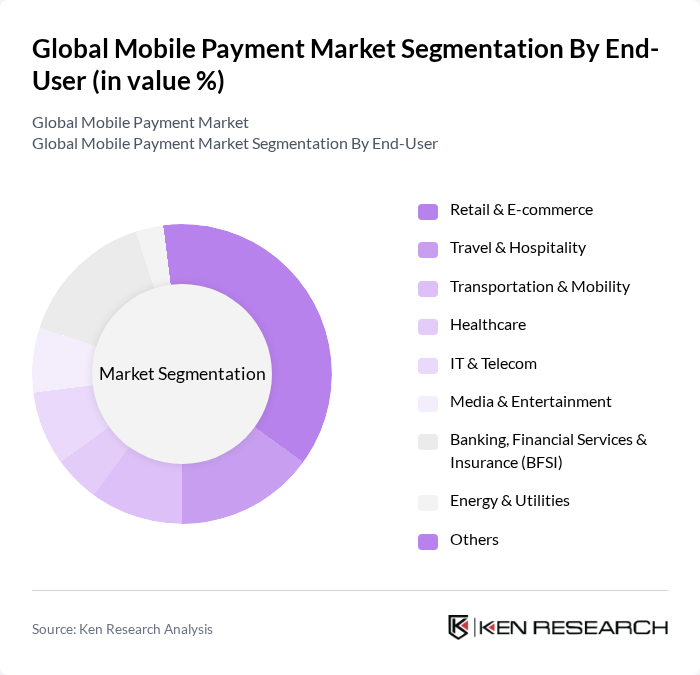

By End-User:The end-user segmentation includes Retail & E-commerce, Travel & Hospitality, Transportation & Mobility, Healthcare, IT & Telecom, Media & Entertainment, Banking, Financial Services & Insurance (BFSI), Energy & Utilities, and Others. Each sector utilizes mobile payment solutions to enhance customer experience and streamline operations. Retail & e-commerce lead due to the scale of online and omnichannel transactions, while BFSI leverages mobile for bill pay, P2P, and value-added services; media and entertainment also contribute notably via in-app and subscription payments .

The Global Mobile Payment Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (Cash App, Square), Stripe, Inc., Adyen N.V., Google Pay (Alphabet Inc.), Apple Pay (Apple Inc.), Samsung Wallet (formerly Samsung Pay), Venmo (a PayPal service), Alipay (Ant Group), WeChat Pay (Tencent Holdings Ltd.), Amazon Pay, Zelle (Early Warning Services, LLC), Wise plc (formerly TransferWise), Revolut Ltd, Klarna Bank AB, Mastercard Inc. (Mastercard Send, Tap to Pay), Visa Inc. (Visa Direct, Tap to Pay), Paytm (One97 Communications Ltd.), PhonePe Pvt. Ltd., M-Pesa (Safaricom PLC & Vodacom Group) contribute to innovation, geographic expansion, and service delivery in this space .

The mobile payment market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning will enhance fraud detection capabilities, while the rise of digital wallets and contactless payments will further streamline transactions. Additionally, as more consumers embrace subscription-based models, mobile payment solutions will need to adapt to meet evolving demands, ensuring a competitive edge in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity Payments (e.g., NFC, contactless POS) Remote Payments (e.g., in-app, mobile web, SMS/IVR) Mobile Wallets Peer-to-Peer (P2P) Payments Direct Carrier Billing QR Code Payments Others |

| By End-User | Retail & E-commerce Travel & Hospitality Transportation & Mobility Healthcare IT & Telecom Media & Entertainment Banking, Financial Services & Insurance (BFSI) Energy & Utilities Others |

| By Payment Method | Card-Based (Credit/Debit/Prepaid via tokenization) Bank Account-Based (ACH, instant payments) Wallet Balance Direct Carrier Billing Buy Now, Pay Later (BNPL) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Industry Vertical | Retail & E-commerce BFSI Telecommunications Government & Public Sector Education Others |

| By Transaction Size | Micro (? USD 10) Small (USD 10–100) Medium (USD 100–1,000) Large (? USD 1,000) Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Mobile Payments | 150 | Tech-savvy Consumers, Millennials, Gen Z |

| Merchant Integration of Mobile Payment Solutions | 120 | Small Business Owners, Retail Managers |

| Impact of Mobile Payments on E-commerce | 90 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Compliance in Mobile Payments | 60 | Compliance Officers, Legal Advisors |

| Technological Innovations in Mobile Payments | 70 | Product Development Managers, IT Specialists |

The Global Mobile Payment Market is valued at approximately USD 3.8 trillion, driven by the increasing adoption of smartphones, e-commerce growth, and a consumer shift towards cashless transactions. This trend has significantly boosted transaction volumes across various sectors.