Region:Africa

Author(s):Dev

Product Code:KRAA1567

Pages:95

Published On:August 2025

By Type:The segmentation by type includes various subsegments such as proximity payments (NFC, QR at POS), remote payments (in-app, web, USSD/SMS), mobile wallets, mobile banking, mobile POS, peer-to-peer (P2P) transfers, bill payments and top-ups, and remittances (domestic and cross-border). Among these, mobile wallets have emerged as the leading subsegment, driven by their convenience and the growing trend of cashless transactions, supported by nationwide interoperable wallet rails (Meeza Digital/Meeza QR) and telco-led wallets like Vodafone Cash and Orange Money that enable cash-in/cash-out, bill pay, and merchant payments . Consumers increasingly prefer mobile wallets for everyday purchases, leading to a significant market share .

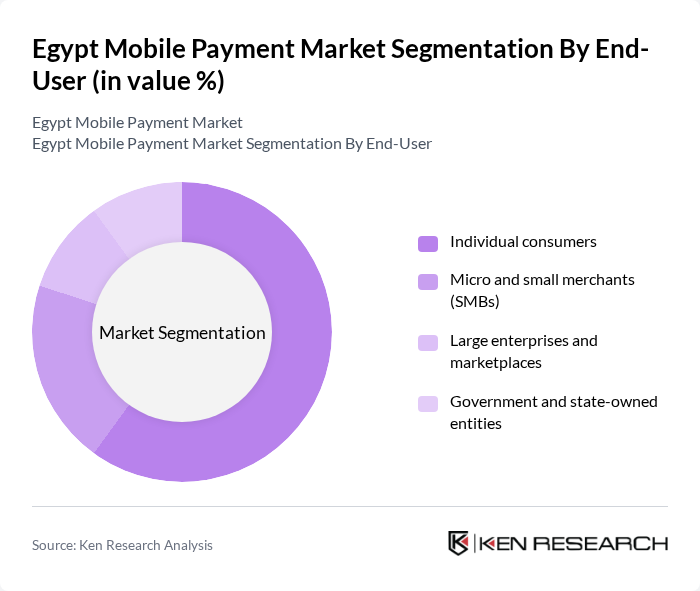

By End-User:The end-user segmentation includes individual consumers, micro and small merchants (SMBs), large enterprises and marketplaces, and government and state-owned entities. Individual consumers dominate the market, as the increasing penetration of smartphones and internet access has led to a surge in mobile payment adoption among the general public, reinforced by wallet interoperability and nationwide acceptance of QR that broaden everyday use cases for consumers . This trend is further supported by the growing number of merchants accepting mobile payments, making it easier for consumers to transact .

The Egypt Mobile Payment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking & Payment Technology Services, Vodafone Cash (Vodafone Egypt), Orange Money Egypt, valU (EFG Hermes Holding), Paymob, Aman for E-Payments, Masary, Bee Smart Payment Solutions, CIB Smart Wallet (Commercial International Bank), Banque Misr — BM Wallet, National Bank of Egypt — Al Ahly Phone Cash, QNB ALAHLI — QNB Mobile Wallet, Arab African International Bank — AAIB Phone Cash, Banque du Caire — Qahera Cash, Meeza Digital and Meeza QR (Egyptian Banks Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt mobile payment market appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security, while the rise of contactless payments will cater to evolving consumer preferences. Additionally, as the government continues to support digital payment initiatives, the market is likely to witness significant growth, fostering greater financial inclusion and economic development across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity payments (NFC, QR at POS) Remote payments (in?app, web, USSD/SMS) Mobile wallets Mobile banking Mobile POS Peer?to?peer (P2P) transfers Bill payments and top?ups Remittances (domestic and cross?border) |

| By End-User | Individual consumers Micro and small merchants (SMBs) Large enterprises and marketplaces Government and state-owned entities |

| By Application | E-commerce and in?app purchases Retail and FMCG Transportation and mobility Utilities and government fees Financial services (loan repayments, insurance) |

| By Distribution Channel | Mobile applications Agent networks and physical points Online platforms and gateways |

| By Payment Method | QR codes NFC/contactless USSD/SMS Card-on-file and tokenized cards Bank transfer/direct debit |

| By User Demographics | Age groups Income levels Urban vs rural Banked vs underbanked |

| By Policy Support | National Council for Payments initiatives CBE interoperability and QR standards KYC/AML and e?KYC frameworks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 150 | Regular Mobile Payment Users, Age 18-55 |

| Small Business Adoption of Mobile Payments | 120 | Small Business Owners, Retail Managers |

| Banking Sector Insights on Mobile Payment Trends | 90 | Bank Executives, Product Managers |

| Regulatory Perspectives on Mobile Payments | 60 | Regulatory Officials, Policy Makers |

| Fintech Startups in Mobile Payment Space | 80 | Founders, CTOs of Fintech Startups |

The Egypt Mobile Payment Market is valued at approximately USD 14.0 billion, with recent estimates suggesting it has reached around USD 14.2 billion. This growth is attributed to increased smartphone adoption, e-commerce expansion, and government initiatives promoting digital financial services.