Region:Global

Author(s):Rebecca

Product Code:KRAA3328

Pages:95

Published On:September 2025

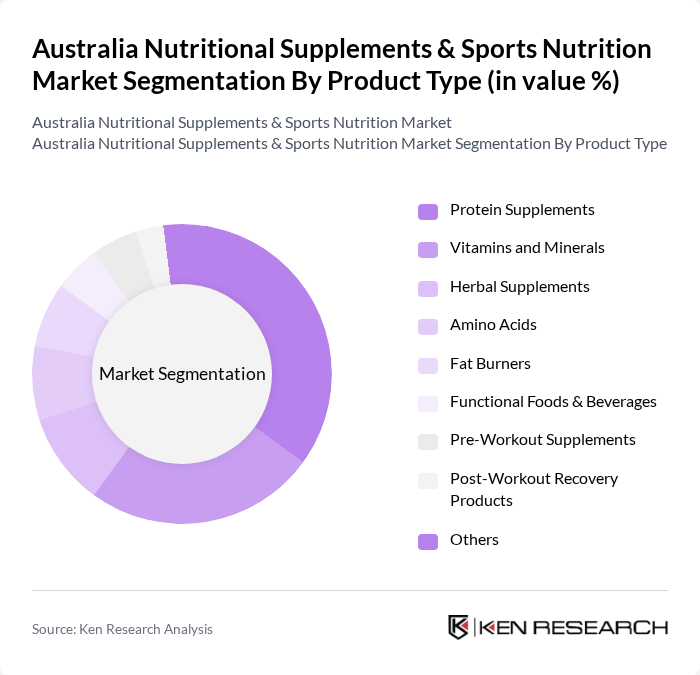

By Product Type:The product type segmentation includes various categories such as protein supplements, vitamins and minerals, herbal supplements, amino acids, fat burners, functional foods & beverages, pre-workout supplements, post-workout recovery products, and others. Among these, protein supplements are the most dominant segment, driven by the increasing popularity of fitness and bodybuilding. Consumers are increasingly seeking high-protein diets, leading to a surge in demand for protein powders and bars. The trend towards plant-based protein sources is also gaining traction, appealing to health-conscious consumers and those with dietary restrictions. Functional foods and beverages are also experiencing robust growth, reflecting consumer interest in convenient, nutrient-dense products .

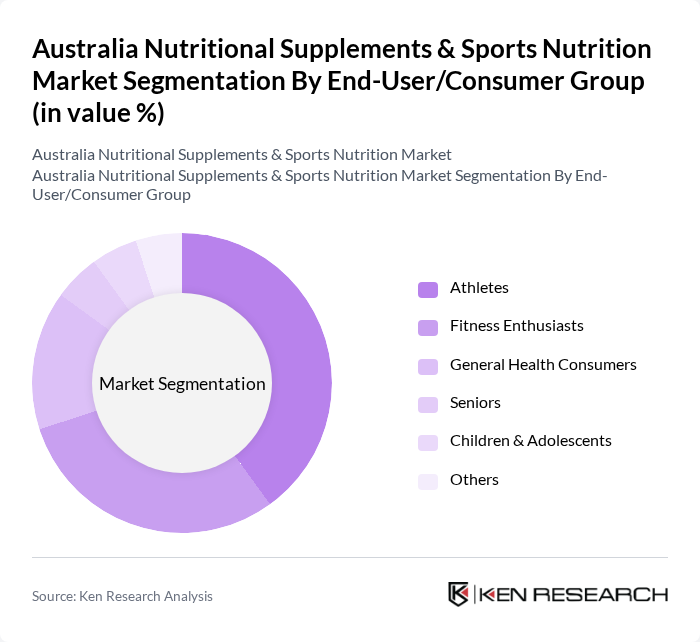

By End-User/Consumer Group:The end-user segmentation includes athletes, fitness enthusiasts, general health consumers, seniors, children & adolescents, and others. Athletes represent the largest consumer group, as they require specialized nutritional support to enhance performance and recovery. Fitness enthusiasts also contribute significantly to the market, driven by the growing trend of fitness culture and gym memberships. The increasing awareness of health and wellness among general consumers is further propelling the demand for nutritional supplements across various demographics. Personalized supplements are gaining traction among millennials and Gen Z, who prefer data-driven, preventative approaches to health .

The Australia Nutritional Supplements & Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackmores Limited, Swisse Wellness Pty Ltd., Musashi, Bulk Nutrients, Herbalife Nutrition Ltd., Optimum Nutrition (Glanbia plc), GNC Holdings, Inc., Aussie Bodies, Vital Strength, Nestlé Health Science, EHP Labs, True Protein, Nature's Way, Amway Corporation, Dymatize Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian nutritional supplements and sports nutrition market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative, personalized nutrition solutions is expected to grow. Additionally, the integration of technology in product development, such as app-based tracking and tailored supplements, will likely enhance consumer engagement and satisfaction, paving the way for new market entrants and product offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Protein Supplements Vitamins and Minerals Herbal Supplements Amino Acids Fat Burners Functional Foods & Beverages Pre-Workout Supplements Post-Workout Recovery Products Others |

| By End-User/Consumer Group | Athletes Fitness Enthusiasts General Health Consumers Seniors Children & Adolescents Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Specialty Stores Pharmacies Health & Wellness Stores Others |

| By Price Range | Premium Mid-Range Budget |

| By Formulation | Powder Capsules/Tablets Liquid Bars Gummies/Chewables |

| By Packaging Type | Bottles Pouches Tubs Sachets |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Nutritional Supplements | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Sports Nutrition Products | 85 | Store Managers, Product Buyers |

| Trends in Online Supplement Purchases | 95 | E-commerce Managers, Digital Marketing Specialists |

| Expert Opinions on Nutritional Efficacy | 65 | Nutritionists, Sports Coaches |

| Market Dynamics in Fitness Centers | 75 | Gym Owners, Personal Trainers |

The Australia Nutritional Supplements & Sports Nutrition Market is valued at approximately USD 13.5 billion, reflecting significant growth driven by increasing health consciousness, fitness activities, and preventive healthcare trends among consumers.