Region:Asia

Author(s):Rebecca

Product Code:KRAE3428

Pages:83

Published On:February 2026

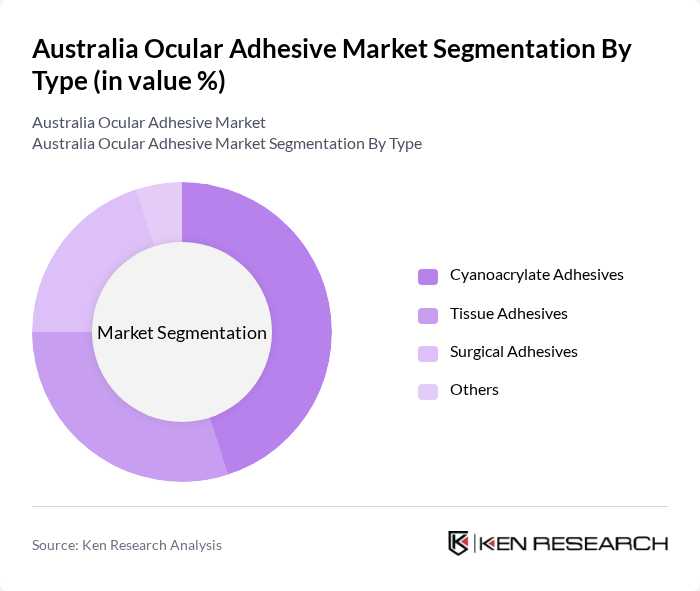

By Type:The market is segmented into various types of ocular adhesives, including Cyanoacrylate Adhesives, Tissue Adhesives, Surgical Adhesives, and Others. Cyanoacrylate adhesives are particularly popular due to their rapid bonding capabilities and ease of use in surgical settings. Tissue adhesives are gaining traction for their ability to promote healing and reduce scarring, while surgical adhesives are essential for various ocular procedures. The "Others" category includes specialized adhesives tailored for specific applications.

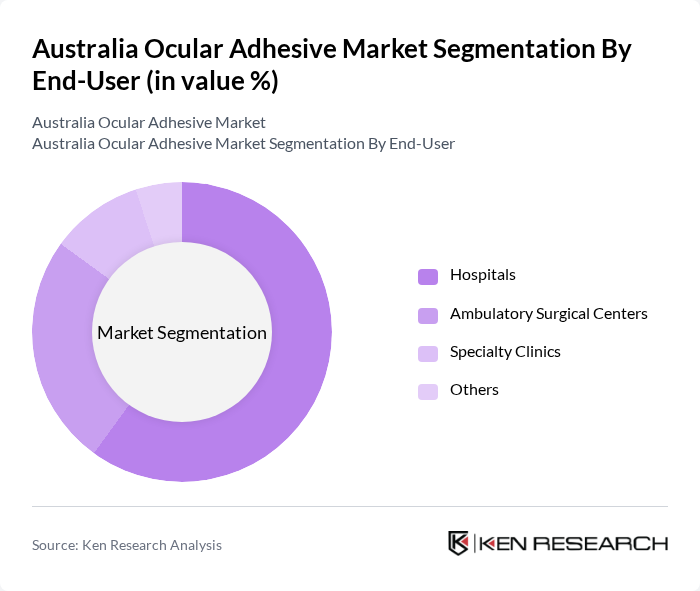

By End-User:The ocular adhesive market is segmented by end-users, including Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others. Hospitals are the primary consumers of ocular adhesives due to their extensive surgical departments and high patient volumes. Ambulatory surgical centers are increasingly adopting these adhesives for outpatient procedures, while specialty clinics focus on specific ocular treatments, driving demand for tailored adhesive solutions. The "Others" category encompasses various healthcare facilities utilizing ocular adhesives.

The Australia Ocular Adhesive Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision, Bausch + Lomb, Alcon, Medtronic, Smith & Nephew, Stryker Corporation, 3M, Abbott Laboratories, EyeTech Digital Systems, Aerie Pharmaceuticals, Ocular Therapeutix, Genentech, Regeneron Pharmaceuticals, Novartis, Zeiss Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ocular adhesive market in Australia appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the demand for minimally invasive procedures rises, the integration of bio-compatible adhesives is expected to gain traction. Additionally, the expansion of telemedicine is likely to enhance patient access to ocular care, further driving the need for effective adhesive solutions. Overall, the market is poised for growth, with innovative products and improved healthcare infrastructure playing pivotal roles.

| Segment | Sub-Segments |

|---|---|

| By Type | Cyanoacrylate Adhesives Tissue Adhesives Surgical Adhesives Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Application | Ocular Surgery Trauma Care Cosmetic Procedures Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | New South Wales Victoria Queensland Others |

| By Product Formulation | Liquid Adhesives Gel Adhesives Spray Adhesives Others |

| By Packaging Type | Single-use Packaging Multi-use Packaging Bulk Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgeons | 100 | Surgeons, Clinical Directors |

| Hospital Procurement Managers | 80 | Procurement Officers, Supply Chain Managers |

| Ocular Adhesive Manufacturers | 60 | Product Managers, R&D Heads |

| Healthcare Policy Makers | 50 | Regulatory Affairs Specialists, Health Economists |

| Clinical Researchers | 70 | Research Scientists, Clinical Trial Coordinators |

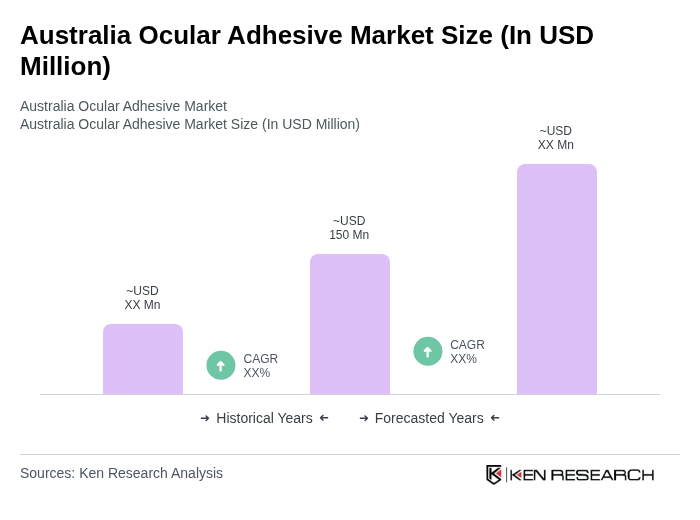

The Australia Ocular Adhesive Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing prevalence of ocular surgeries and advancements in adhesive technologies that enhance surgical outcomes.