Region:Global

Author(s):Geetanshi

Product Code:KRAB0075

Pages:100

Published On:August 2025

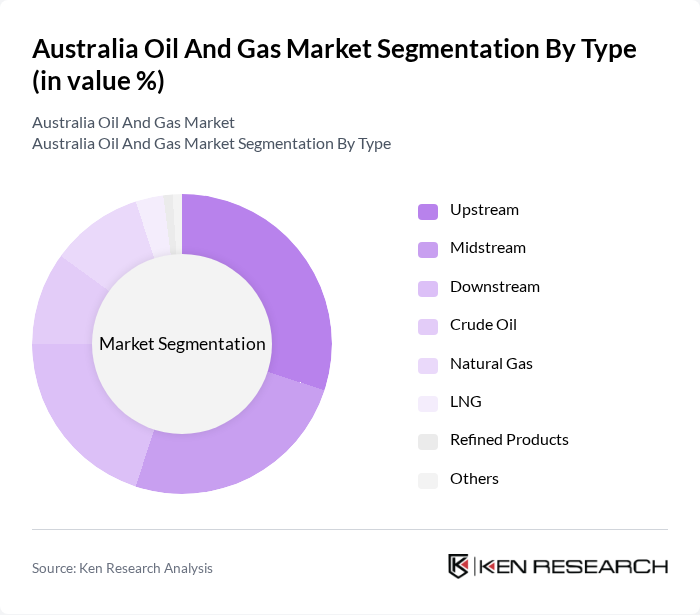

By Type:The market is segmented into upstream, midstream, downstream, crude oil, natural gas, LNG, refined products, and others. Upstream activities focus on exploration and production, while midstream and downstream activities encompass transportation, refining, and distribution. The natural gas segment is particularly significant due to increasing demand for both domestic consumption and export, supported by Australia's role as a leading LNG exporter and the ongoing transition to lower-carbon energy sources .

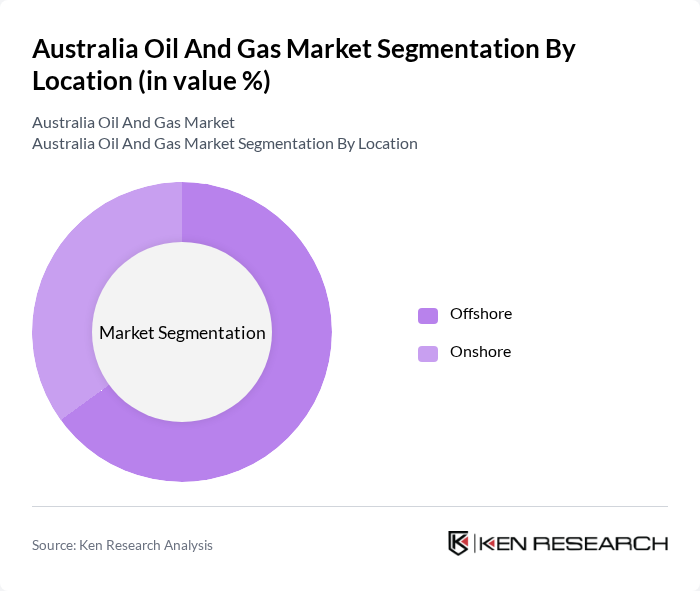

By Location:The market is also segmented by location, which includes offshore and onshore activities. Offshore operations are predominant due to the rich reserves located in the continental shelf, particularly in basins such as the Browse Basin and the Northwest Shelf. Onshore activities are significant in regions with established infrastructure and resource availability, such as Queensland's coal seam gas fields. The offshore segment is particularly crucial for LNG production, which has seen substantial growth and underpins Australia’s position as a major LNG exporter .

The Australia Oil and Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Woodside Energy Group Ltd., Santos Ltd., Beach Energy Ltd., Origin Energy Ltd., Chevron Australia Pty Ltd., ExxonMobil Australia Pty Ltd., Shell Australia Pty Ltd., INPEX Operations Australia Pty Ltd., BHP Group Ltd. (Petroleum assets now part of Woodside Energy Group Ltd.), AGL Energy Ltd., Karoon Energy Ltd., Senex Energy Ltd., New Hope Corporation Limited, Cooper Energy Ltd., Strike Energy Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Australian oil and gas market appears promising, driven by a combination of technological advancements and government support. As the sector adapts to increasing energy demands and environmental regulations, companies are likely to invest in cleaner technologies and innovative extraction methods. Additionally, the expansion of liquefied natural gas (LNG) exports is expected to enhance Australia’s position in the global energy market, fostering economic growth and attracting foreign investments.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Midstream Downstream Crude Oil Natural Gas LNG Refined Products Others |

| By Location | Offshore Onshore |

| By End-User | Power Generation Industrial Transportation Residential Commercial Others |

| By Application | Exploration Production Distribution Refining Storage & Transportation Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Northern Territory Tasmania Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Distribution Channel | Direct Sales Distributors Online Platforms Others |

| By Pricing Strategy | Cost-Plus Pricing Competitive Pricing Value-Based Pricing Others |

| By Regulatory Compliance | Environmental Compliance Safety Standards Quality Assurance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Production Sector | 60 | Production Managers, Operations Directors |

| Natural Gas Exploration | 50 | Geologists, Exploration Managers |

| LNG Export Market | 40 | Export Managers, Trade Analysts |

| Regulatory Compliance | 45 | Compliance Officers, Legal Advisors |

| Energy Policy Impact | 55 | Policy Makers, Industry Analysts |

The Australia Oil and Gas Market is valued at approximately USD 100 billion, driven by increasing energy demand, particularly for natural gas and liquefied natural gas (LNG), alongside significant investments in infrastructure and technology.