Region:Asia

Author(s):Shubham

Product Code:KRAB0564

Pages:98

Published On:August 2025

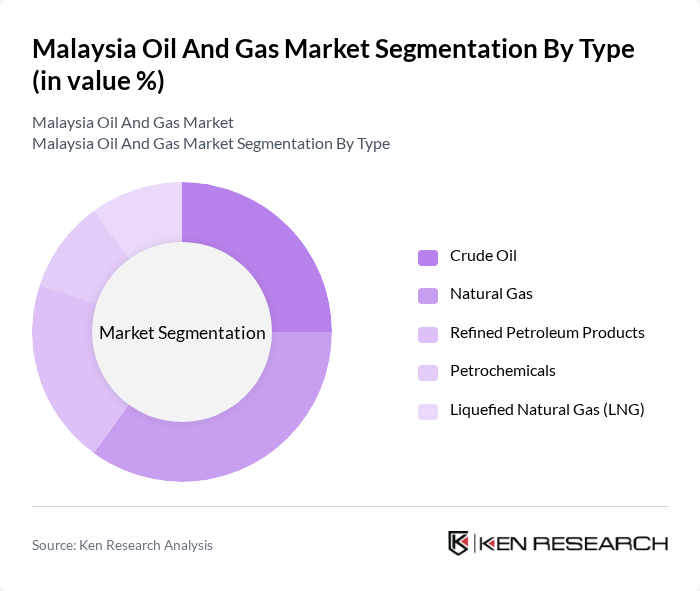

By Type:The market is segmented into various types, including Crude Oil, Natural Gas, Refined Petroleum Products, Petrochemicals, and Liquefied Natural Gas (LNG). Natural Gas is a core segment due to its central role in power generation, industrial feedstock, and LNG exports; Malaysia remains a leading LNG exporter in Asia, and domestic gas demand underpins utility and industrial usage .

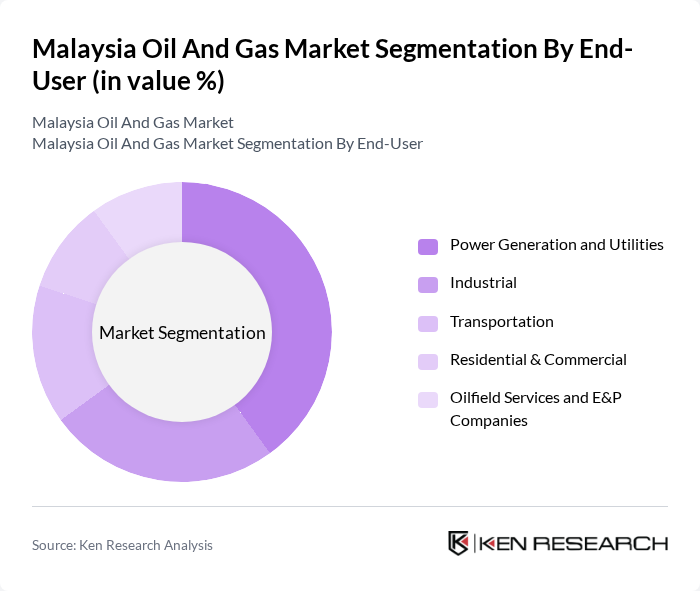

By End-User:The end-user segmentation includes Power Generation and Utilities, Industrial, Transportation, Residential & Commercial, and Oilfield Services and E&P Companies. Power Generation and Utilities is prominent given Malaysia’s gas-fired generation fleet and policy preference for lower-emission dispatch relative to coal, supported by gas supply infrastructure and LNG capabilities that reinforce system reliability .

The Malaysia Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroliam Nasional Berhad (PETRONAS), Shell Malaysia (Shell plc), ExxonMobil Exploration and Production Malaysia Inc., Murphy Oil Corporation (Murphy Sarawak Oil Co. Ltd.), Sapura Energy Berhad, Bumi Armada Berhad, Dialog Group Berhad, Hibiscus Petroleum Berhad, PTTEP Sarawak Oil Limited (PTT Exploration and Production), Repsol Exploración, S.A. (Malaysia assets), PETROS – Petroleum Sarawak Berhad, JX Nippon Oil & Gas Exploration (Malaysia) Ltd., TotalEnergies SE (TotalEnergies Malaysia), Chevron Malaysia Limited (Caltex), Malaysia Marine and Heavy Engineering Holdings Berhad (MHB) contribute to innovation, geographic expansion, and service delivery in this space .

The future of Malaysia's oil and gas market appears promising, driven by increasing energy demands and government initiatives to enhance infrastructure. The integration of digital technologies is expected to streamline operations, while a shift towards sustainable practices will shape industry dynamics. As the government emphasizes energy security and diversification, the sector is likely to witness significant investments in both traditional and renewable energy sources, fostering a balanced energy portfolio that meets future demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Refined Petroleum Products (e.g., gasoline, diesel, jet fuel) Petrochemicals (e.g., ethylene, propylene, aromatics) Liquefied Natural Gas (LNG) |

| By End-User | Power Generation and Utilities Industrial (manufacturing, petrochemical, refining) Transportation (road, aviation, marine) Residential & Commercial (city gas, LPG) Oilfield Services and E&P Companies |

| By Application | Exploration & Appraisal Production & Enhanced Oil Recovery (EOR) Midstream Transport & Storage (pipelines, terminals) Refining & Processing (refineries, gas processing) LNG Liquefaction & Regasification |

| By Investment Source | Domestic Investment (Petronas/GLCs, local private) Foreign Direct Investment (FDI) Production Sharing Contracts (PSC) & Risk Service Contracts Public-Private Partnerships (PPP) & Government Programs |

| By Distribution Mode | Direct Sales (B2B, tenders, term contracts) Wholesale & Trading (traders, bunkering) Retail (fuel stations, LPG distributors) Gas Distribution (city gas, pipelines) |

| By Pricing Strategy | Regulated Tariffs (gas and pipeline) Market-Linked Pricing (Brent/Dubai-linked) Term Contract vs. Spot (including LNG) Subsidy/Tax Structure Impact |

| By Regulatory Compliance | Local Content & Vendor Development (PETRONAS) Environmental & Emissions (EQA, ESG) Health, Safety and Environment (HSE) Decommissioning & Abandonment Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Exploration | 100 | Geologists, Exploration Managers |

| Midstream Transportation and Storage | 80 | Logistics Coordinators, Operations Managers |

| Downstream Refining and Distribution | 90 | Refinery Managers, Supply Chain Analysts |

| Oilfield Services and Equipment | 70 | Service Engineers, Procurement Specialists |

| Regulatory Compliance and Environmental Impact | 60 | Compliance Officers, Environmental Managers |

The Malaysia Oil and Gas Market is valued at approximately USD 11 billion, reflecting integrated activities across upstream, midstream, and downstream sectors, including crude oil, gas, refining, petrochemicals, and LNG exports.