Region:Africa

Author(s):Dev

Product Code:KRAC0436

Pages:96

Published On:August 2025

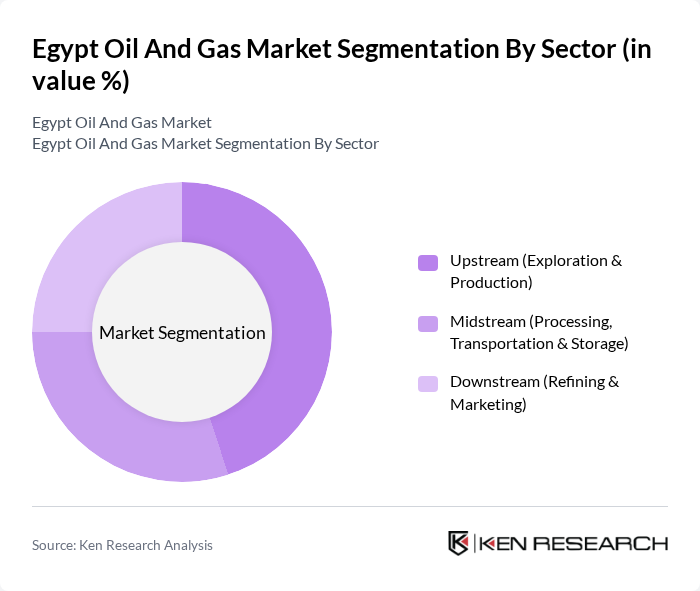

By Sector:The market is segmented into three main sectors: Upstream (Exploration & Production), Midstream (Processing, Transportation & Storage), and Downstream (Refining & Marketing). Each sector plays a crucial role in the overall oil and gas value chain, contributing to the market's growth and development.

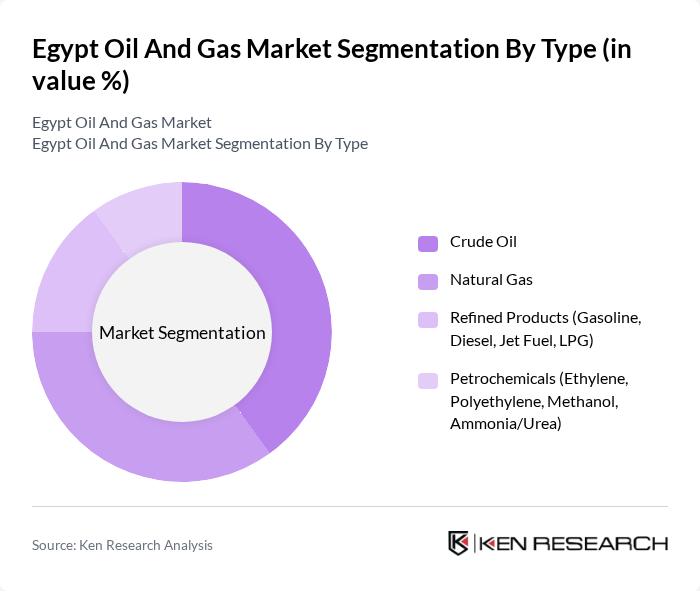

By Type:The market is further categorized by type into Crude Oil, Natural Gas, Refined Products (Gasoline, Diesel, Jet Fuel, LPG), and Petrochemicals (Ethylene, Polyethylene, Methanol, Ammonia/Urea). Each type has distinct characteristics and applications, influencing market dynamics and consumer preferences. Egypt’s portfolio is gas-weighted in upstream output, with LNG export capability (Idku, Damietta) enabling arbitrage when domestic balances allow; refiners like MIDOR and ANRPC supply key products domestically while petrochemical complexes around Alexandria and Suez contribute polymers and fertilizers.

The Egypt Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian General Petroleum Corporation (EGPC), Egyptian Natural Gas Holding Company (EGAS), Egyptian General Gas Company (GASCO), Petrojet (The Petroleum Projects & Technical Consultations Co.), Petrobel (Belayim Petroleum Company), Eni S.p.A., BP Egypt, Shell Egypt, Chevron Egypt, ExxonMobil Egypt, Apache Corporation, Wintershall Dea Egypt, TotalEnergies, Dragon Oil (Egypt), Taqa Arabia, Dana Gas, Halliburton, SLB (Schlumberger), Weatherford International, Orascom Construction, JGC Corporation, Siemens Energy contribute to innovation, geographic expansion, and service delivery in this space. Recent investment activity includes IOC-led gas developments and infill drilling, LNG supply optimization through Idku and Damietta, and ongoing refinery modernization to enhance product slate and reduce import dependency.

The future of Egypt's oil and gas market appears promising, driven by a combination of domestic demand growth and foreign investment. As the government continues to implement favorable policies and enhance infrastructure, the sector is expected to attract significant capital. Additionally, the integration of renewable energy sources and advancements in extraction technologies will play a crucial role in shaping a more sustainable and resilient energy landscape, positioning Egypt as a key player in the regional energy market.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Processing, Transportation & Storage) Downstream (Refining & Marketing) |

| By Type | Crude Oil Natural Gas Refined Products (Gasoline, Diesel, Jet Fuel, LPG) Petrochemicals (Ethylene, Polyethylene, Methanol, Ammonia/Urea) |

| By Terrain/Location | Onshore Offshore (Mediterranean, Red Sea, Nile Delta) |

| By End-User | Power Generation Transportation Industrial (Fertilizers, Petrochemicals, Cement, Steel) Residential & Commercial |

| By Application (Value Chain Stage) | Exploration Production Processing & LNG Refining Distribution & Retail |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Distribution Channel | Direct Sales (B2B Contracts, Offtake Agreements) Distributors & Wholesale Retail Outlets (Fuel Stations) Pipeline & Gas Grid |

| By Regulatory Compliance | Local Regulations International Standards Environmental Compliance Safety Regulations |

| By Pricing Mechanism | Government-Regulated Pricing (Domestic Gas, Fuels) Market-Linked Pricing (Export LNG, Crude) Long-term Contract Pricing (GSA/SPA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 100 | Field Engineers, Production Managers |

| Natural Gas Distribution | 80 | Distribution Managers, Regulatory Affairs Specialists |

| Refining Operations | 70 | Refinery Managers, Process Engineers |

| Petrochemical Sector Insights | 60 | Product Development Managers, Market Analysts |

| Energy Policy Impact Assessment | 90 | Policy Makers, Economic Analysts |

The Egypt Oil and Gas Market is valued at approximately USD 7.5 billion, driven by the country's rich hydrocarbon resources and increasing investments in exploration and production activities, particularly from major gas fields like Zohr and the West Nile Delta.