Region:North America

Author(s):Shubham

Product Code:KRAB0764

Pages:96

Published On:August 2025

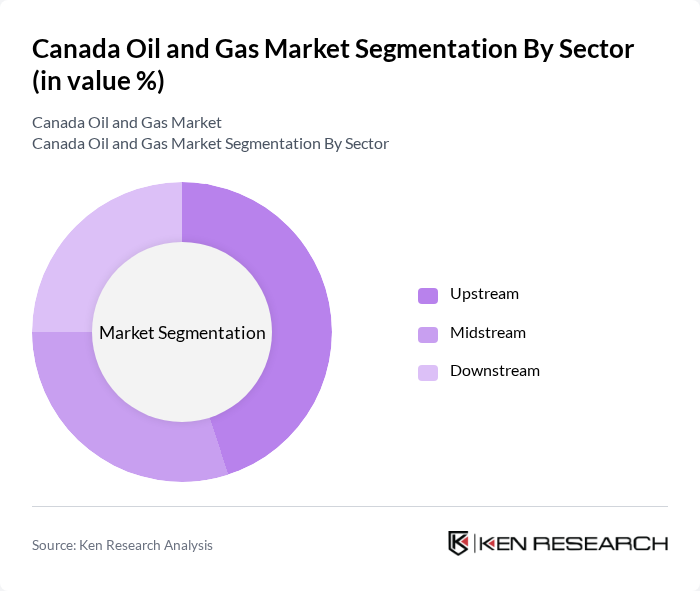

By Sector:The market is segmented by sector into upstream, midstream, and downstream activities. The upstream sector encompasses exploration and production of crude oil and natural gas, supported by major investments in oil sands and LNG projects. The midstream sector involves transportation, storage, and export infrastructure, including pipelines and LNG terminals. The downstream sector covers refining, processing, and distribution of petroleum products to end users. Each sector plays a crucial role in the value chain, with upstream and midstream segments seeing significant capital investment and technological innovation .

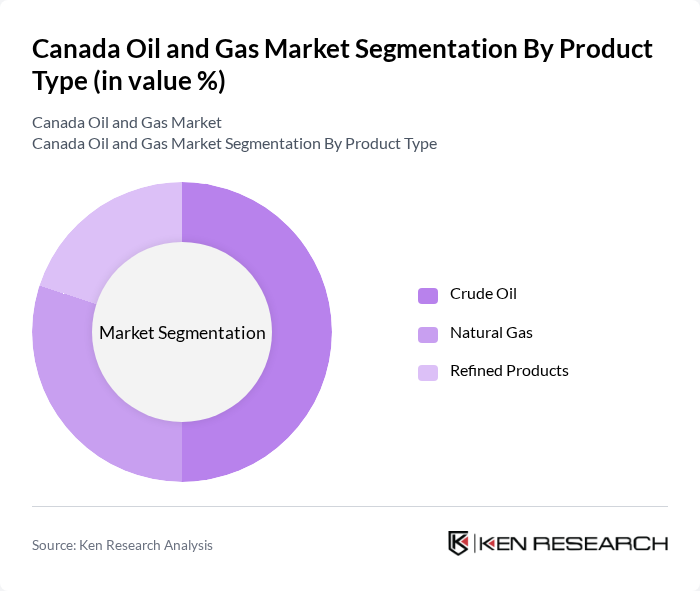

By Product Type:The market is segmented by product type into crude oil, natural gas, and refined products. Crude oil remains the dominant product, driven by robust production from oil sands and strong export demand. Natural gas is gaining market share, supported by increased LNG export capacity and its role as a lower-carbon transition fuel. Refined products, including gasoline, diesel, and petrochemicals, serve diverse industrial and consumer markets. These segments reflect evolving energy preferences and ongoing advancements in extraction, processing, and emissions reduction technologies .

The Canada Oil and Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Suncor Energy Inc., Canadian Natural Resources Limited, Cenovus Energy Inc., Imperial Oil Limited, Husky Energy Inc., Enbridge Inc., TC Energy Corporation, Pembina Pipeline Corporation, Ovintiv Inc., Vermilion Energy Inc., Crescent Point Energy Corp., Tourmaline Oil Corp., Whitecap Resources Inc., Keyera Corp., and AltaGas Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian oil and gas market appears promising, driven by a combination of technological advancements and government support. As the industry adapts to environmental regulations, companies are likely to invest in cleaner technologies and sustainable practices. Furthermore, the ongoing digital transformation will enhance operational efficiencies, allowing firms to remain competitive. With a focus on strategic partnerships and innovation, the sector is poised for growth, despite facing challenges from market volatility and environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream Midstream Downstream |

| By Product Type | Crude Oil Natural Gas Refined Products |

| By End-User | Industrial Commercial Residential Government & Utilities |

| By Application | Power Generation Transportation Heating Feedstock for Chemicals |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Regulatory Compliance | Environmental Compliance Safety Standards Compliance Quality Assurance Compliance |

| By Region | Western Canada (Alberta, British Columbia, Saskatchewan, Manitoba) Eastern Canada (Newfoundland & Labrador, Nova Scotia, Quebec) Central Canada (Ontario, Quebec) Northern Canada (Yukon, Northwest Territories, Nunavut) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Sands Production Insights | 100 | Operations Managers, Environmental Compliance Officers |

| Shale Gas Exploration Trends | 80 | Geologists, Project Managers |

| Regulatory Impact Assessments | 60 | Policy Analysts, Legal Advisors |

| Indigenous Community Engagement | 40 | Community Leaders, Stakeholder Relations Managers |

| Renewable Energy Integration | 70 | Energy Transition Specialists, Sustainability Managers |

The Canada Oil and Gas Market is valued at approximately USD 71 billion, reflecting its significant contribution to the country's gross domestic product and driven by natural resources, investments, and global energy demand.