Region:Asia

Author(s):Rebecca

Product Code:KRAA7136

Pages:81

Published On:January 2026

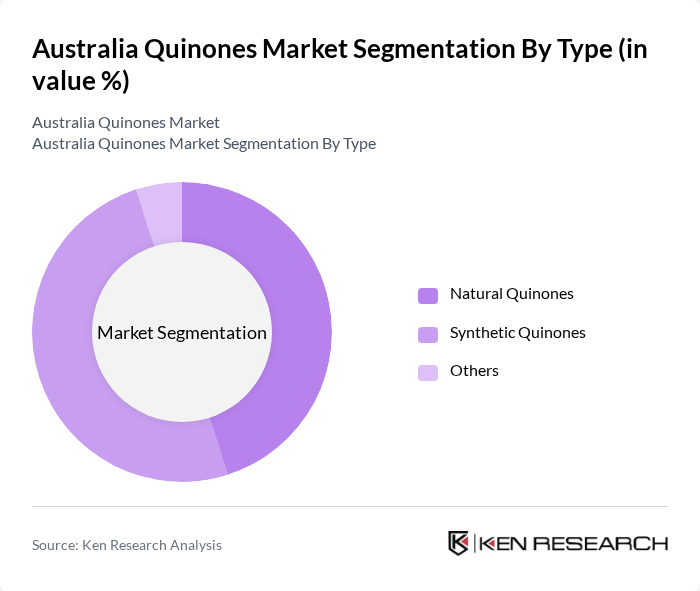

By Type:The market is segmented into Natural Quinones, Synthetic Quinones, and Others. Natural quinones are derived from plant sources and are increasingly preferred due to their perceived health benefits. Synthetic quinones, on the other hand, are widely used in various industrial applications due to their cost-effectiveness and availability. The "Others" category includes less common types of quinones that cater to niche markets.

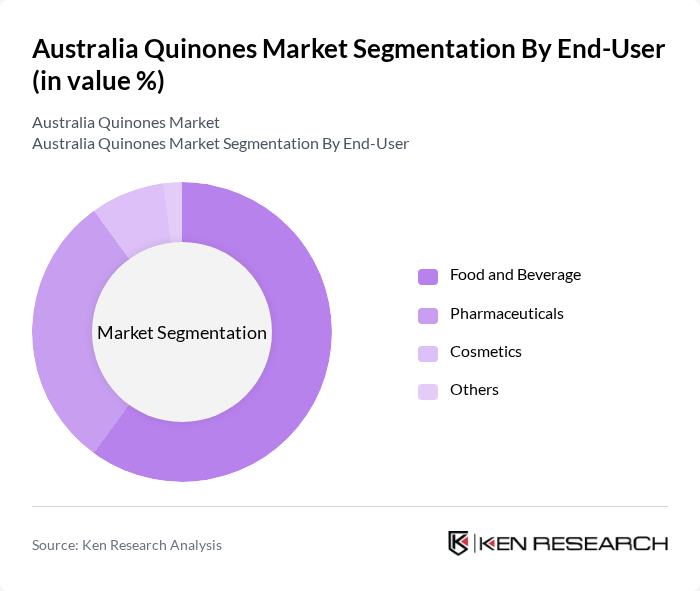

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Cosmetics, and Others. The Food and Beverage sector is the largest consumer of quinones, utilizing them for coloring and preservation. The Pharmaceuticals sector follows closely, where quinones are used for their therapeutic properties. The Cosmetics sector also shows significant demand, as quinones are incorporated for their antioxidant benefits.

The Australia Quinones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sigma Aldrich, Merck Group, BASF SE, Evonik Industries AG, Huntsman Corporation, Croda International Plc, Solvay S.A., Afton Chemical Corporation, Eastman Chemical Company, Clariant AG, AkzoNobel N.V., Lanxess AG, Albemarle Corporation, Dow Chemical Company, Mitsubishi Gas Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia quinones market appears promising, driven by increasing consumer demand for natural and sustainable products. As the food and beverage industry continues to expand, manufacturers are likely to invest in innovative applications of quinones, enhancing their appeal. Additionally, the growing trend towards e-commerce platforms will facilitate wider distribution of quinone-based products, allowing consumers easier access to these natural alternatives. This shift is expected to foster a more competitive landscape, encouraging further advancements in production technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Quinones Synthetic Quinones Others |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics Others |

| By Application | Food Coloring Nutraceuticals Personal Care Products Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | New South Wales Victoria Queensland Others |

| By Product Form | Powder Liquid Granules Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications of Quinones | 100 | R&D Managers, Product Development Scientists |

| Agricultural Chemical Usage | 80 | Agronomists, Crop Protection Specialists |

| Cosmetic Industry Insights | 70 | Formulation Chemists, Brand Managers |

| Industrial Applications and Trends | 60 | Manufacturing Engineers, Supply Chain Managers |

| Market Regulation and Compliance | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Australia Quinones Market is valued at approximately USD 1 million, based on a five-year historical analysis. This valuation reflects the increasing demand for both natural and synthetic quinones across various sectors, including food, pharmaceuticals, and cosmetics.