Region:Asia

Author(s):Dev

Product Code:KRAA7140

Pages:94

Published On:January 2026

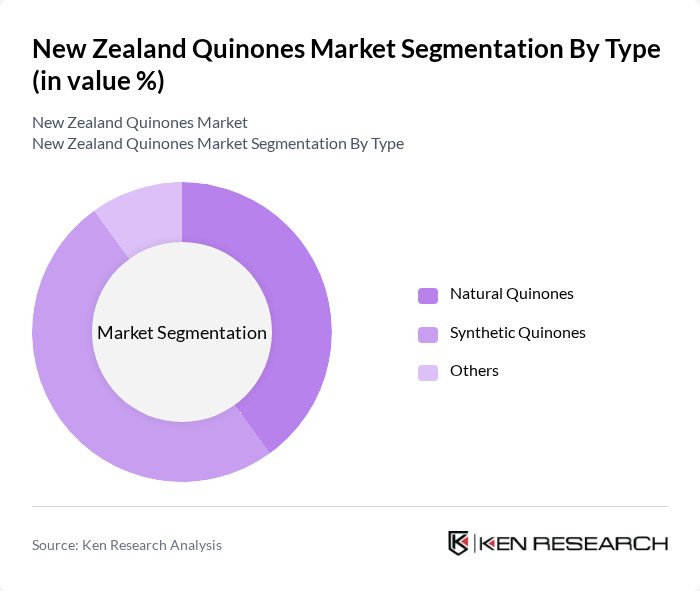

By Type:The market is segmented into Natural Quinones, Synthetic Quinones, and Others. Natural Quinones are derived from plant sources and are increasingly preferred due to their eco-friendly nature. Synthetic Quinones, on the other hand, are favored for their consistency and cost-effectiveness. The Others category includes various specialized quinones that cater to niche applications.

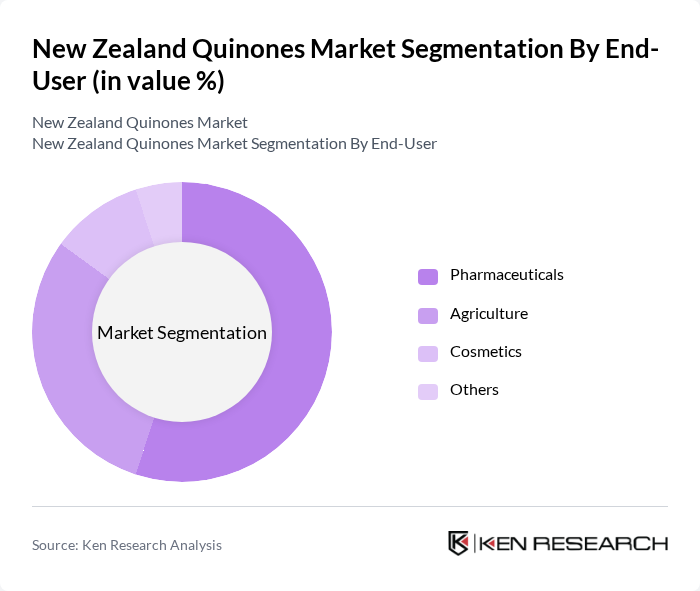

By End-User:The end-user segmentation includes Pharmaceuticals, Agriculture, Cosmetics, and Others. The Pharmaceuticals segment is the largest due to the extensive use of quinones in drug formulations. Agriculture follows closely, where quinones are used as pesticides and growth enhancers. The Cosmetics segment is growing rapidly as consumers seek natural ingredients.

The New Zealand Quinones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sigma-Aldrich, Merck Group, TCI Chemicals, Tokyo Chemical Industry Co., Ltd., Alfa Aesar, Acros Organics, ChemSpider, VWR International, Thermo Fisher Scientific, BASF SE, Eastman Chemical Company, Huntsman Corporation, Evonik Industries AG, Solvay S.A., Croda International Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the New Zealand quinones market appears promising, driven by increasing investments in sustainable practices and technological advancements. As the demand for eco-friendly chemicals rises, companies are likely to focus on developing innovative quinone derivatives. Additionally, collaborations with research institutions are expected to enhance product offerings, leading to a more competitive landscape. The market is poised for growth, with a strong emphasis on sustainability and efficiency shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Quinones Synthetic Quinones Others |

| By End-User | Pharmaceuticals Agriculture Cosmetics Others |

| By Application | Dyes and Pigments Antioxidants Photovoltaic Cells Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North Island South Island Others |

| By Product Form | Liquid Quinones Powder Quinones Others |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications of Quinones | 120 | R&D Managers, Product Development Scientists |

| Industrial Chemical Manufacturing | 100 | Production Managers, Quality Control Supervisors |

| Agrochemical Sector Insights | 90 | Agronomists, Supply Chain Coordinators |

| Environmental Impact Assessments | 80 | Environmental Compliance Officers, Sustainability Managers |

| Market Trends and Consumer Preferences | 110 | Market Analysts, Business Development Executives |

The New Zealand Quinones Market is valued at approximately USD 855 thousand, reflecting a five-year historical analysis. This valuation highlights the growing demand for quinones across various sectors, including pharmaceuticals, agriculture, and cosmetics.