Region:Middle East

Author(s):Rebecca

Product Code:KRAA7130

Pages:100

Published On:January 2026

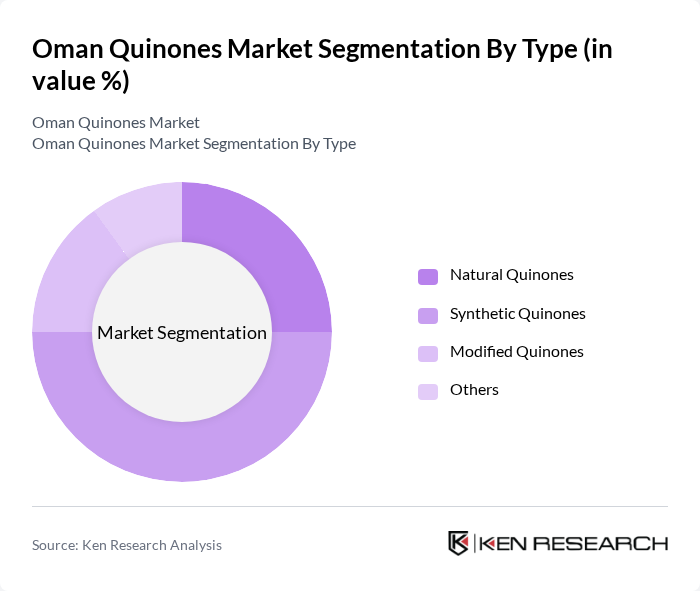

By Type:The market is segmented into various types of quinones, including Natural Quinones, Synthetic Quinones, Modified Quinones, and Others. Each type serves different applications and industries, with synthetic quinones often dominating due to their versatility and cost-effectiveness. Natural quinones, while less prevalent, are gaining traction due to the increasing demand for organic and eco-friendly products.

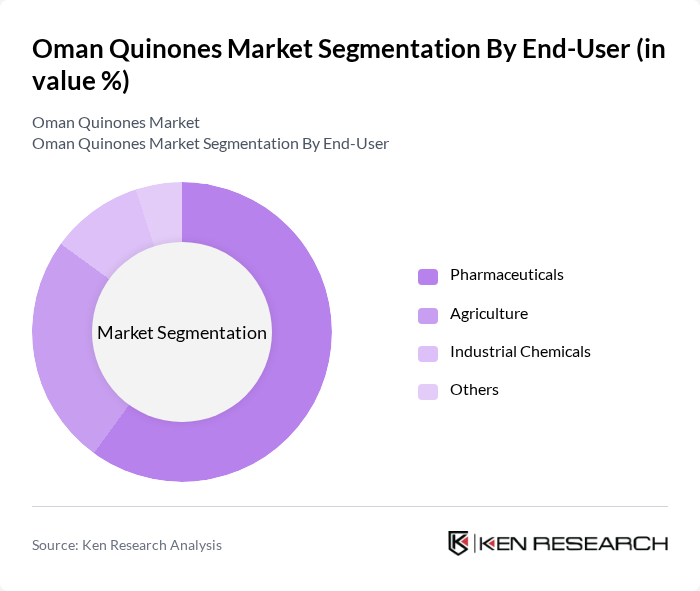

By End-User:The end-user segmentation includes Pharmaceuticals, Agriculture, Industrial Chemicals, and Others. The pharmaceutical sector is the largest consumer of quinones, driven by their application in drug formulation and development. Agriculture follows closely, utilizing quinones for pest control and as growth enhancers, reflecting the increasing focus on sustainable agricultural practices.

The Oman Quinones Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Merck KGaA, Eastman Chemical Company, Sigma-Aldrich, Huntsman Corporation, Solvay S.A., Evonik Industries AG, AkzoNobel N.V., Clariant AG, Albemarle Corporation, Lanxess AG, Croda International Plc, Mitsubishi Gas Chemical Company, and Tosoh Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman quinones market appears promising, driven by increasing investments in specialty chemicals and the pharmaceutical sector. As the government continues to support diversification efforts, the market is likely to see enhanced production capabilities and technological advancements. Additionally, the growing emphasis on sustainability and eco-friendly products will shape the industry's landscape, encouraging innovation and attracting foreign investments. Overall, the quinones market is poised for growth, aligning with broader economic trends in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Quinones Synthetic Quinones Modified Quinones Others |

| By End-User | Pharmaceuticals Agriculture Industrial Chemicals Others |

| By Application | Dyes and Pigments Antioxidants Photographic Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Product Form | Liquid Quinones Solid Quinones Powdered Quinones Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications of Quinones | 100 | R&D Managers, Product Development Scientists |

| Agrochemical Sector Insights | 80 | Procurement Managers, Agronomists |

| Dyes and Pigments Market | 70 | Production Supervisors, Quality Control Managers |

| Industrial Chemical Usage | 60 | Operations Managers, Supply Chain Analysts |

| Research and Development Trends | 90 | Academic Researchers, Industry Consultants |

The Oman Quinones Market is valued at approximately USD 715 thousand, reflecting its niche status within the broader MENA chemical market. This valuation indicates the current consumption levels and market dynamics influenced by demand in pharmaceuticals and agriculture.