Region:Global

Author(s):Geetanshi

Product Code:KRAA0316

Pages:94

Published On:August 2025

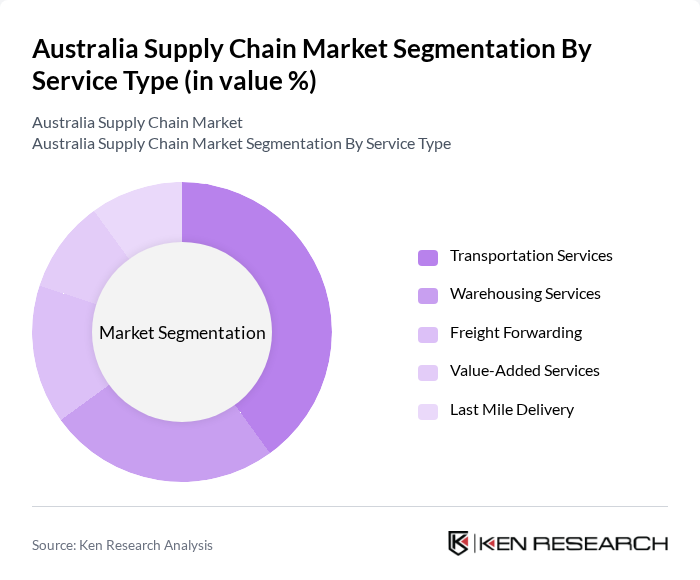

By Service Type:The service type segmentation includes Transportation Services, Warehousing Services, Freight Forwarding, Value-Added Services, and Last Mile Delivery. Transportation Services is the leading subsegment, driven by the surge in e-commerce, increased demand for timely deliveries, and the need for integrated logistics solutions. The expansion of online retail and consumer expectations for rapid fulfillment have made reliable transportation a critical component of the supply chain .

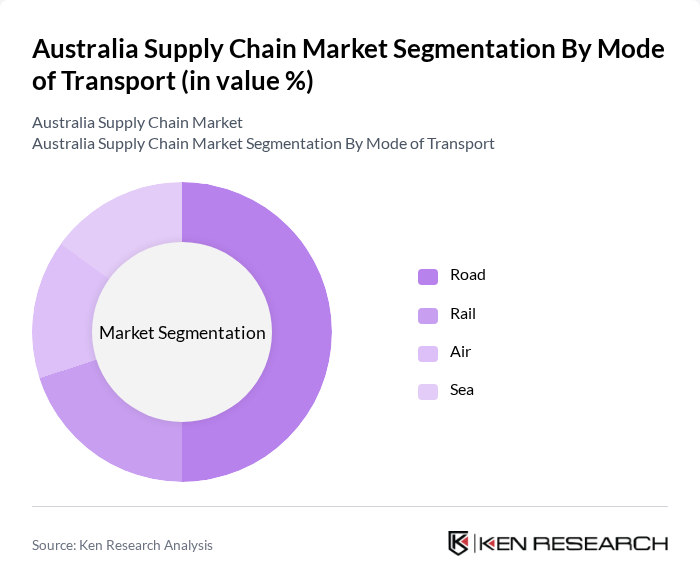

By Mode of Transport:The mode of transport segmentation encompasses Road, Rail, Air, and Sea. Road transport remains the dominant mode, accounting for the largest share of the market. Its flexibility and efficiency in servicing both urban and regional areas, combined with the growth of e-commerce and consumer demand for fast delivery, have reinforced its leading position in the supply chain. Rail, air, and sea transport continue to play vital roles in long-haul, international, and bulk logistics .

The Australia Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, DB Schenker Australia, Kuehne + Nagel Australia, CEVA Logistics Australia, Qube Holdings, Mainfreight Australia, StarTrack (Australia Post), DHL Supply Chain Australia, FedEx Express Australia, UPS Australia, Agility Logistics Australia, XPO Logistics Australia, Australia Post, C.H. Robinson Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian supply chain market is poised for transformation, driven by digitalization and sustainability initiatives. Companies are increasingly adopting automation and AI technologies to enhance efficiency and resilience. Additionally, the focus on sustainable practices is expected to grow, with investments in green logistics solutions becoming a priority. As the market evolves, businesses that embrace these trends will likely gain a competitive edge, positioning themselves for long-term success in a dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Warehousing Services Freight Forwarding Value-Added Services Last Mile Delivery |

| By Mode of Transport | Road Rail Air Sea |

| By Component | Solutions (TMS, WMS, Planning & Analytics, Procurement & Sourcing, MES) Services (Professional, Managed) |

| By Deployment Mode | On-Premises On-Demand/Cloud |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | Retail and Consumer Goods Healthcare and Pharmaceuticals Manufacturing Food and Beverages Transportation and Logistics Automotive Others |

| By Region | New South Wales & ACT Victoria & Tasmania Queensland Northern Territory & South Australia Western Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Optimization | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 40 | eCommerce Directors, Warehouse Operations Managers |

| Third-Party Logistics (3PL) Services | 45 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Analysts |

The Australia Supply Chain Market is valued at approximately USD 88 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and investments in supply chain technology and infrastructure upgrades.