Region:Central and South America

Author(s):Shubham

Product Code:KRAA1077

Pages:87

Published On:August 2025

By Type:This segmentation includes a range of services essential for the effective management of supply chains. The subsegments are Transportation Services, Warehousing & Distribution (including Value-Added Services), Inventory Management Systems, Freight Forwarding, Supply Chain Consulting & Technology Solutions, Last-Mile Delivery Services, and Reverse Logistics. Each of these segments plays a crucial role in ensuring goods move efficiently from suppliers to consumers, with a growing emphasis on digitalization, automation, and integrated logistics solutions .

The Transportation Services subsegment is currently dominating the market due to the increasing demand for efficient and timely delivery of goods. With the rise of e-commerce, companies are investing heavily in transportation solutions to meet consumer expectations for fast shipping. Additionally, the expansion of road and rail networks in Brazil has facilitated better connectivity and multimodal logistics, further driving the growth of this subsegment. The focus on reducing transportation costs while improving service quality has made this area a critical component of supply chain management .

By End-User:This segmentation focuses on the various industries that utilize supply chain services. The subsegments include Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Consumer Goods, Chemicals & Petrochemicals, Construction, and Others. Each end-user segment has unique requirements and challenges that influence their supply chain strategies, with digital transformation and sustainability becoming increasingly important across sectors .

The Retail & E-commerce segment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions. As consumers increasingly prefer online purchasing, retailers are investing in advanced supply chain technologies to enhance their delivery capabilities. This trend is further supported by the demand for faster shipping options, improved customer service, and the integration of automation and real-time tracking, making this segment a key player in the overall supply chain landscape .

The Brazil Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as JSL S.A. (Simpar Group), Tegma Gestão Logística S.A., Grupo Solistica (Femsa Logistics), DHL Supply Chain Brazil, FedEx Express Brasil, UPS Brasil, Rumo Logística, VLI Logística, BBM Logística, Expresso Nepomuceno, Sequoia Logística e Transportes S.A., Log-In Logística Intermodal S.A., Mercado Livre (Mercado Envios), Azul Cargo Express, Porto Sudeste do Brasil S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil supply chain market is poised for significant transformation as it adapts to evolving consumer demands and technological advancements. With a focus on sustainability and resilience, companies are likely to invest in innovative logistics solutions that enhance efficiency. The integration of AI and real-time data analytics will play a crucial role in optimizing operations. As infrastructure improvements continue, the market is expected to become more competitive, fostering growth opportunities for both established players and new entrants.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing & Distribution (including Value-Added Services) Inventory Management Systems Freight Forwarding Supply Chain Consulting & Technology Solutions Last-Mile Delivery Services Reverse Logistics |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Consumer Goods Chemicals & Petrochemicals Construction Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Pipeline Transport Others |

| By Service Type | Freight Services Logistics Management Supply Chain Technology Solutions Value-Added Warehousing Services Consulting Services Others |

| By Customer Type | B2B B2C Government Non-Profit Organizations Others |

| By Geographic Coverage | Urban Areas Rural Areas Regional Hubs National Coverage Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Distribution Networks | 45 | Operations Directors, Compliance Officers |

| Automotive Supply Chain Optimization | 40 | Procurement Managers, Production Planners |

| Food and Beverage Logistics | 40 | Quality Assurance Managers, Distribution Supervisors |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Warehouse Supervisors |

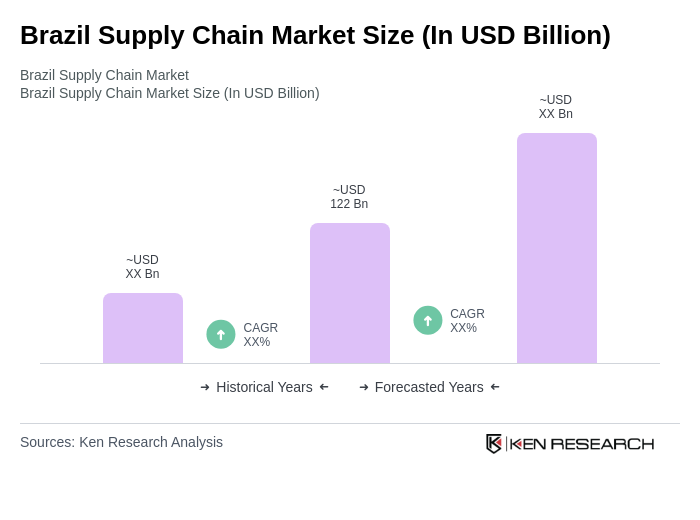

The Brazil Supply Chain Market is valued at approximately USD 122 billion, reflecting significant growth driven by the demand for efficient logistics solutions, the expansion of e-commerce, and the need for resilient supply chains.