Region:Asia

Author(s):Geetanshi

Product Code:KRAA0256

Pages:80

Published On:August 2025

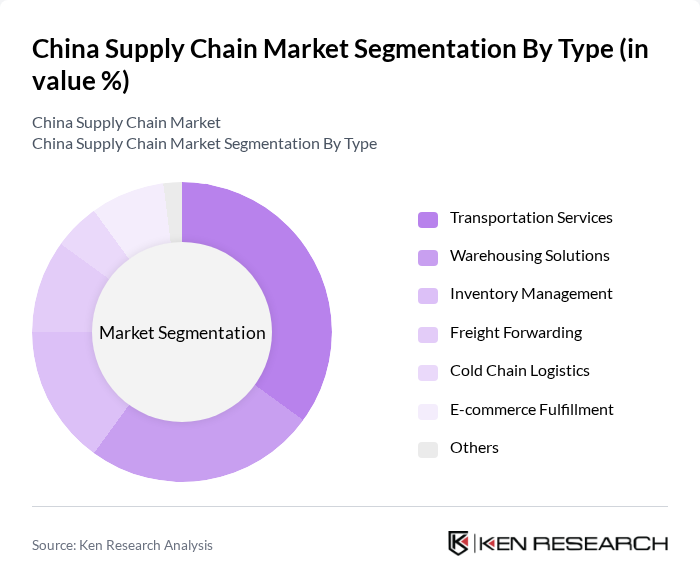

By Type:The market is segmented into various types, including Transportation Services, Warehousing Solutions, Inventory Management, Freight Forwarding, Cold Chain Logistics, E-commerce Fulfillment, and Others. Among these, Transportation Services dominate the market due to the increasing demand for efficient logistics solutions and the rise of e-commerce, which necessitates rapid delivery systems. Warehousing Solutions also play a crucial role, driven by the need for efficient storage and distribution networks to support growing retail and manufacturing sectors. The adoption of digital platforms and automation in warehousing and inventory management is also accelerating, improving operational efficiency and reducing costs .

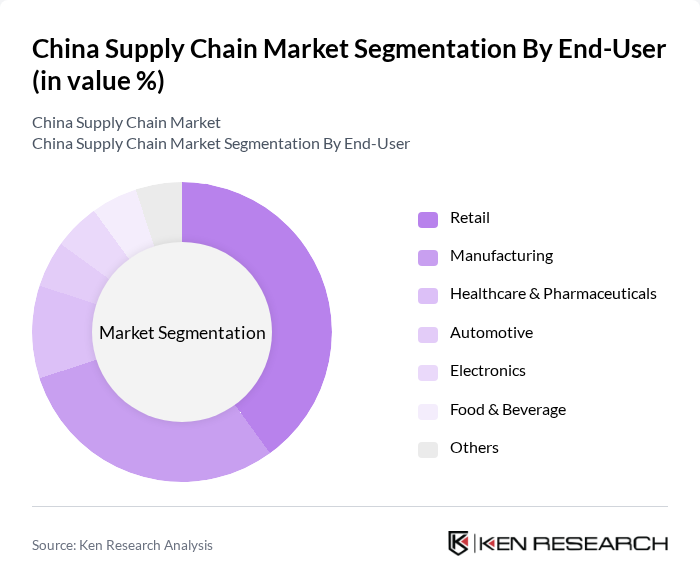

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Electronics, Food & Beverage, and Others. The Retail sector is the leading end-user, driven by the explosive growth of e-commerce and consumer demand for quick delivery services. Manufacturing also significantly contributes to the market, as companies seek efficient supply chain solutions to streamline production and distribution processes. The healthcare and pharmaceuticals segment is expanding due to increased demand for cold chain logistics and regulatory compliance, while the electronics and automotive sectors are leveraging advanced supply chain technologies to enhance resilience and efficiency .

The China Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group (Cainiao Network), JD Logistics, SF Express, ZTO Express, YTO Express, STO Express, Best Inc., Sinotrans Limited, China COSCO Shipping Corporation, China Post Group, DHL Supply Chain (China), Kuehne + Nagel (China), DB Schenker (China), XPO Logistics (Asia-Pacific), Geodis (China), Nippon Express (China), CEVA Logistics (China), Expeditors International (China) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China supply chain market is poised for transformation, driven by digitalization and sustainability initiatives. As companies increasingly adopt advanced technologies, such as AI and blockchain, operational efficiencies are expected to improve significantly. Furthermore, the emphasis on sustainable practices will reshape supply chain strategies, aligning with global environmental goals. In future, it is anticipated that 50% of logistics firms will prioritize green logistics, enhancing their competitive edge while addressing regulatory pressures and consumer expectations for sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Solutions Inventory Management Freight Forwarding Cold Chain Logistics E-commerce Fulfillment Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive Electronics Food & Beverage Others |

| By Region | North China South China East China West China Central China |

| By Technology | IoT Solutions Cloud Computing Data Analytics Robotics & Automation Blockchain Others |

| By Application | Supply Chain Management Logistics Optimization Demand Forecasting Order Fulfillment Risk Management Sustainability & Green Logistics Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Public-Private Partnerships Others |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Grants for Infrastructure Development Regulatory Support for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 100 | Supply Chain Managers, Operations Directors |

| Logistics Service Provider Insights | 80 | Business Development Managers, Logistics Coordinators |

| Retail Supply Chain Dynamics | 60 | Retail Operations Managers, Inventory Analysts |

| Technology Adoption in Logistics | 50 | IT Managers, Digital Transformation Leads |

| Cold Chain Logistics Management | 40 | Cold Chain Managers, Quality Assurance Officers |

The China Supply Chain Market is valued at approximately USD 1.7 trillion, driven by the rapid growth of e-commerce, logistics services demand, and technological advancements such as automation and AI.