Region:Europe

Author(s):Geetanshi

Product Code:KRAA0254

Pages:83

Published On:August 2025

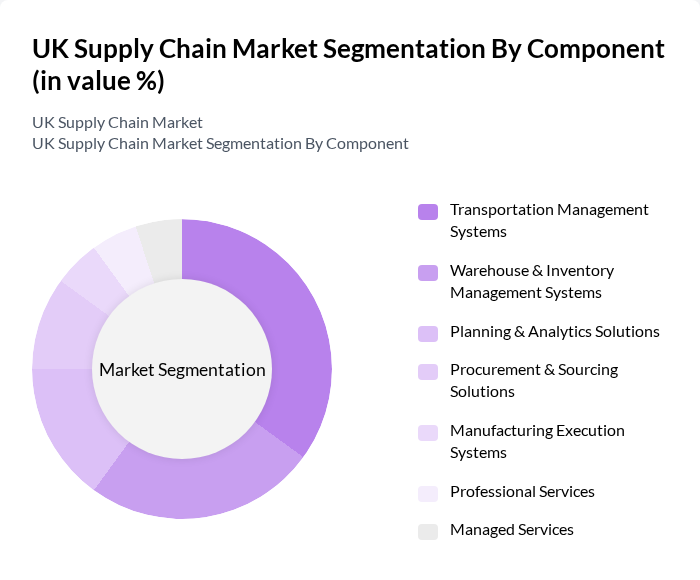

By Component:The components of the supply chain market encompass a range of systems and services that facilitate logistics and operational management. The dominant sub-segment is Transportation Management Systems, which are essential for optimizing shipping routes and reducing costs. Warehouse & Inventory Management Systems are increasingly important due to the rise of e-commerce, supporting stock level management and streamlined order fulfillment. Additionally, Planning & Analytics Solutions and Procurement & Sourcing Solutions are gaining traction as businesses seek to enhance efficiency, visibility, and data-driven decision-making .

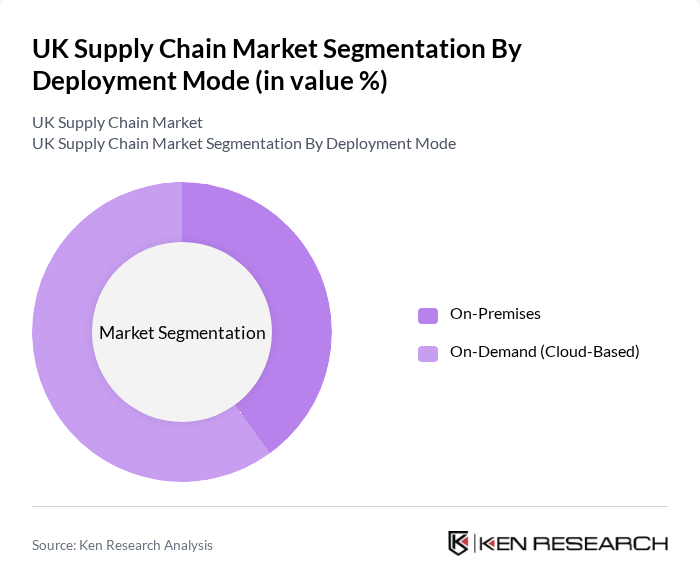

By Deployment Mode:The deployment modes in the supply chain market are primarily categorized into On-Premises and On-Demand (Cloud-Based) solutions. The On-Demand (Cloud-Based) segment is currently leading the market due to its flexibility, scalability, and cost-effectiveness, enabling businesses to adapt quickly to changing demands and access real-time data. On-Premises solutions remain relevant for organizations with specific security or customization requirements, but the market is seeing a clear shift toward cloud-based technologies .

The UK Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, UPS Supply Chain Solutions, FedEx Logistics, DSV, Wincanton, GXO Logistics, Eddie Stobart Logistics, Royal Mail Group, Clipper Logistics (now GXO), Kuehne + Nagel (UK), and Unipart Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The UK supply chain market is poised for transformative changes driven by technological advancements and sustainability initiatives. As e-commerce continues to expand, logistics providers will increasingly adopt AI and automation to enhance efficiency. Additionally, the focus on green logistics will reshape operational practices, aligning with government regulations. Companies that embrace these trends are likely to improve their resilience and adaptability, positioning themselves favorably in a competitive landscape while addressing consumer demands for sustainability and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Component | Transportation Management Systems Warehouse & Inventory Management Systems Planning & Analytics Solutions Procurement & Sourcing Solutions Manufacturing Execution Systems Professional Services Managed Services |

| By Deployment Mode | On-Premises On-Demand (Cloud-Based) |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Retail and Consumer Goods Healthcare and Pharmaceuticals Manufacturing Food and Beverages Transportation and Logistics Automotive Others |

| By Regional Distribution | London South East North West East of England South West Scotland West Midlands Yorkshire and The Humber East Midlands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 100 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Optimization | 80 | Operations Managers, Production Managers |

| Food and Beverage Distribution | 60 | Warehouse Managers, Distribution Supervisors |

| Pharmaceutical Supply Chain Compliance | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Technology and E-commerce Logistics | 40 | eCommerce Operations Managers, Logistics IT Specialists |

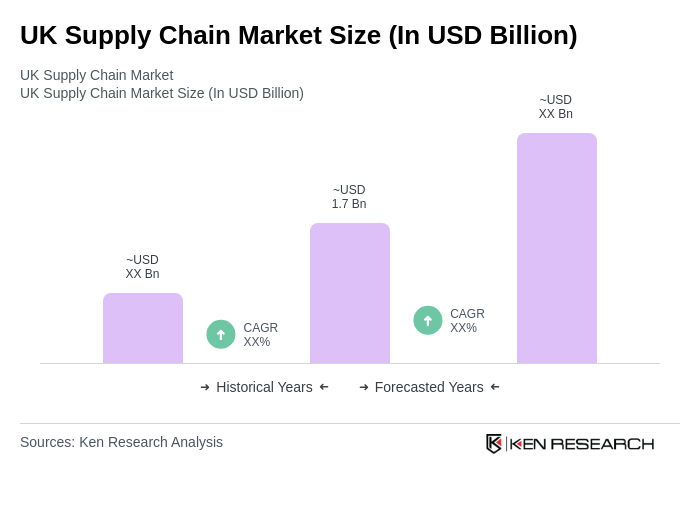

The UK Supply Chain Market is valued at approximately USD 1.7 billion, reflecting a five-year historical analysis. This growth is driven by the demand for efficient logistics solutions, automation, and the expansion of e-commerce.