Region:Asia

Author(s):Shubham

Product Code:KRAA0685

Pages:87

Published On:August 2025

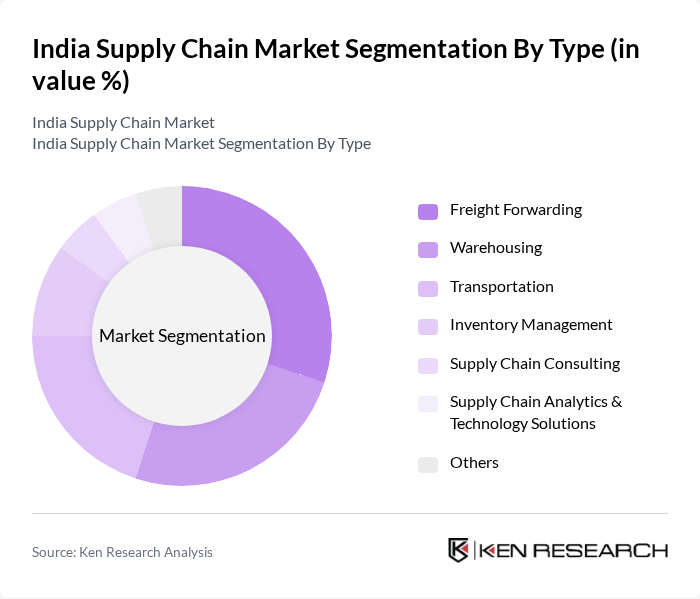

By Type:The market is segmented into various types, including Freight Forwarding, Warehousing, Transportation, Inventory Management, Supply Chain Consulting, Supply Chain Analytics & Technology Solutions, and Others. Each of these segments plays a crucial role in the overall supply chain ecosystem, supporting diverse logistical requirements such as multimodal transport, last-mile delivery, inventory optimization, and technology-driven process improvements .

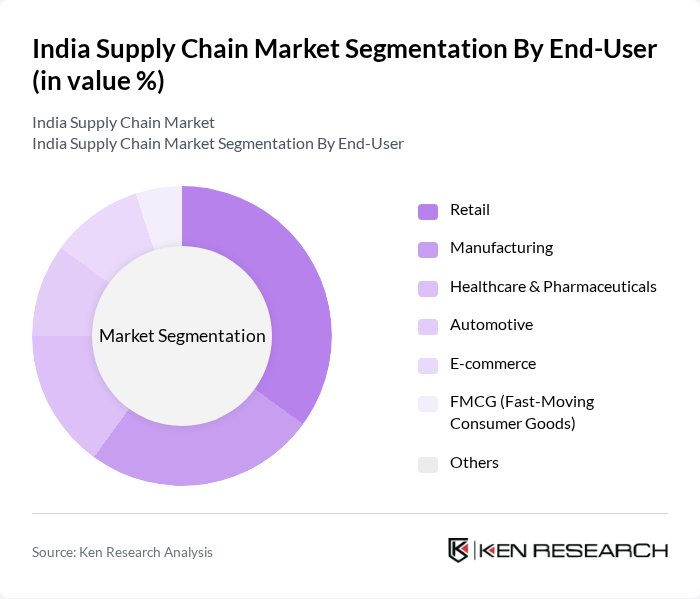

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare & Pharmaceuticals, Automotive, E-commerce, FMCG (Fast-Moving Consumer Goods), and Others. Each sector has unique supply chain requirements, influencing the demand for specialized logistics services such as temperature-controlled storage for pharmaceuticals, just-in-time delivery for automotive, and high-volume fulfillment for e-commerce and retail .

The India Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as TCI Supply Chain Solutions, Blue Dart Express, Gati Ltd., Mahindra Logistics, DHL Supply Chain India, Xpressbees, Delhivery, FedEx India, Rivigo, Ecom Express, Transport Corporation of India, Allcargo Logistics, Safexpress, Locus.sh, Shadowfax, Snowman Logistics, Redington India, TVS Supply Chain Solutions, Future Supply Chain Solutions, and DTDC Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India supply chain market appears promising, driven by ongoing technological advancements and government support. As e-commerce continues to expand, logistics providers are expected to enhance their capabilities through automation and AI integration. Additionally, the focus on sustainability will likely lead to the adoption of greener practices, aligning with global trends. Overall, the market is poised for significant transformation, with increased efficiency and responsiveness to consumer demands anticipated in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Transportation Inventory Management Supply Chain Consulting Supply Chain Analytics & Technology Solutions Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive E-commerce FMCG (Fast-Moving Consumer Goods) Others |

| By Region | North India South India East India West India |

| By Application | Retail Logistics Industrial Logistics Cold Chain Logistics E-commerce Logistics Reverse Logistics Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Multimodal Transport Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Distribution Networks | 45 | Operations Directors, Compliance Officers |

| Automotive Supply Chain Resilience | 40 | Procurement Managers, Quality Assurance Leads |

| Textile and Apparel Logistics | 42 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Warehouse Supervisors |

The India Supply Chain Market is valued at approximately USD 430 billion, driven by the growth of e-commerce, demand for efficient logistics solutions, and government infrastructure initiatives.