Region:Global

Author(s):Geetanshi

Product Code:KRAA0286

Pages:91

Published On:August 2025

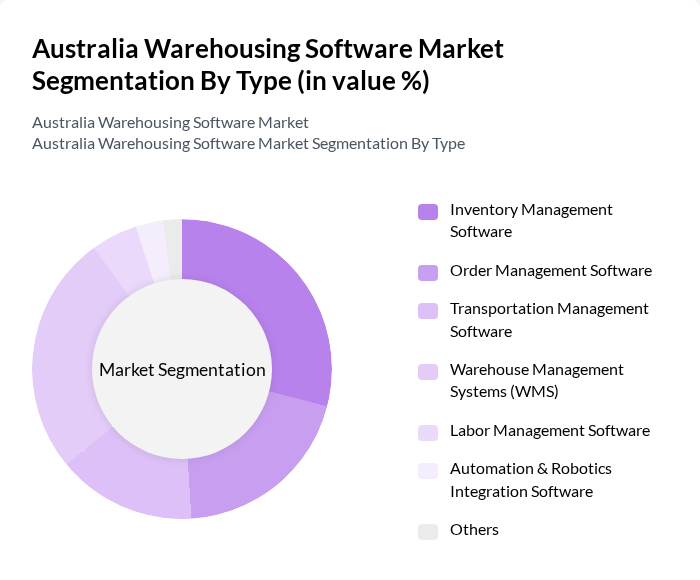

By Type:The market is segmented into various types of warehousing software solutions, including Inventory Management Software, Order Management Software, Transportation Management Software, Warehouse Management Systems (WMS), Labor Management Software, Automation & Robotics Integration Software, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and meeting the diverse needs of businesses. Inventory Management Software and WMS are particularly critical, as they enable real-time stock visibility, automated replenishment, and seamless integration with other supply chain technologies .

The leading sub-segment in the market is Inventory Management Software, which is gaining traction due to the increasing need for businesses to optimize their inventory levels and reduce carrying costs. This software allows companies to track stock levels in real-time, manage reordering processes, and minimize stockouts, thereby enhancing customer satisfaction. The growing trend of e-commerce and the integration of IoT and automation technologies have further accelerated the demand for efficient inventory management solutions, making it a critical component of warehousing operations .

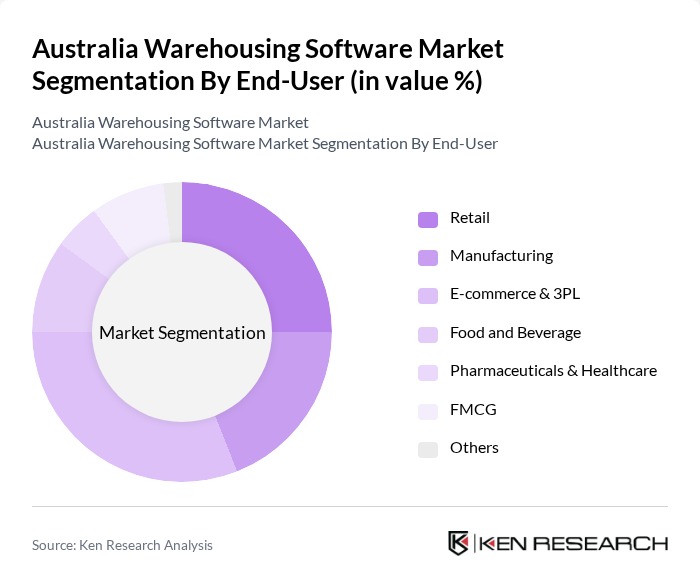

By End-User:The market is segmented by end-users, including Retail, Manufacturing, E-commerce & 3PL, Food and Beverage, Pharmaceuticals & Healthcare, FMCG, and Others. Each sector has unique requirements and challenges that warehousing software aims to address, leading to varied adoption rates across industries. E-commerce and 3PL providers, in particular, require scalable and highly automated solutions to manage high order volumes and complex fulfillment operations .

The E-commerce & 3PL segment is the dominant force in the market, driven by the exponential growth of online shopping and the need for efficient logistics solutions. As consumers increasingly demand faster delivery times and better service, e-commerce businesses are investing heavily in warehousing software to streamline their operations. This trend is further supported by the rise of third-party logistics providers who require sophisticated software to manage complex supply chains effectively .

The Australia Warehousing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, Körber Supply Chain (formerly HighJump), Microlistics (WiseTech Global), NetSuite (Oracle NetSuite), Fishbowl, 3PL Central, Zoho Inventory, Epicor, Logiwa, Cin7, eStore Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia warehousing software market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and responsiveness, the integration of AI and machine learning into warehousing solutions will likely enhance operational capabilities. Additionally, the growing emphasis on sustainability will push companies to adopt eco-friendly practices, further shaping the market landscape. The convergence of these trends will create a dynamic environment for innovation and investment in warehousing technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Order Management Software Transportation Management Software Warehouse Management Systems (WMS) Labor Management Software Automation & Robotics Integration Software Others |

| By End-User | Retail Manufacturing E-commerce & 3PL Food and Beverage Pharmaceuticals & Healthcare FMCG Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid SaaS Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory Others |

| By Integration Level | Standalone Solutions Integrated with ERP/SCM Integrated with Automation Hardware Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Functionality | Inventory Control Order Fulfillment Shipping and Receiving Reporting and Analytics Automation Control Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Management Systems | 100 | IT Managers, Operations Managers |

| Transportation Management Software | 80 | Logistics Coordinators, Supply Chain Analysts |

| Inventory Management Solutions | 60 | Warehouse Supervisors, Procurement Managers |

| Cloud-based Warehousing Solutions | 50 | IT Directors, Business Development Managers |

| Automation and Robotics in Warehousing | 40 | Operations Managers, Technology Officers |

The Australia Warehousing Software Market is valued at approximately AUD 1.1 billion, reflecting a robust growth driven by the increasing demand for efficient supply chain management and the rapid expansion of e-commerce.