Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1982

Pages:97

Published On:August 2025

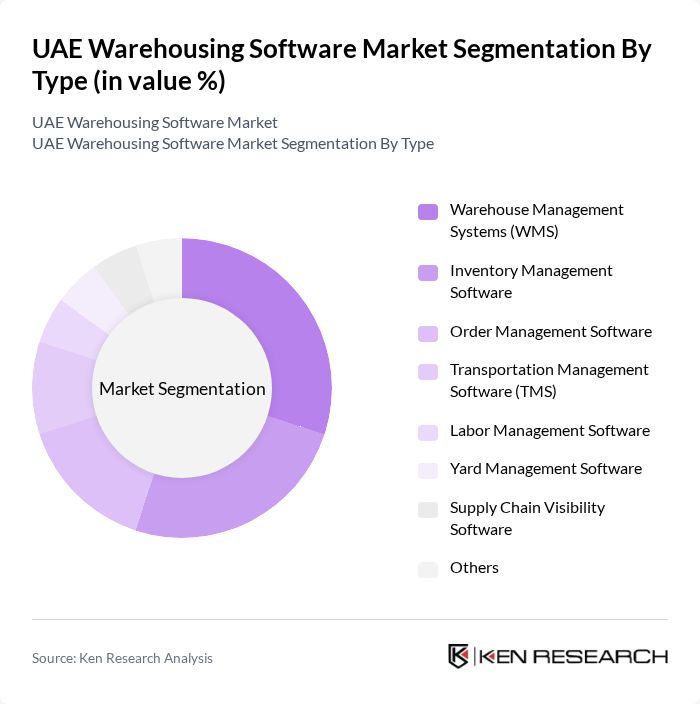

By Type:The market is segmented into various types of software solutions that address distinct warehousing functions. Key subsegments include Warehouse Management Systems (WMS), Inventory Management Software, Order Management Software, Transportation Management Software (TMS), Labor Management Software, Yard Management Software, Supply Chain Visibility Software, and Others. These solutions are critical for optimizing storage, streamlining order fulfillment, improving labor productivity, and providing end-to-end supply chain visibility .

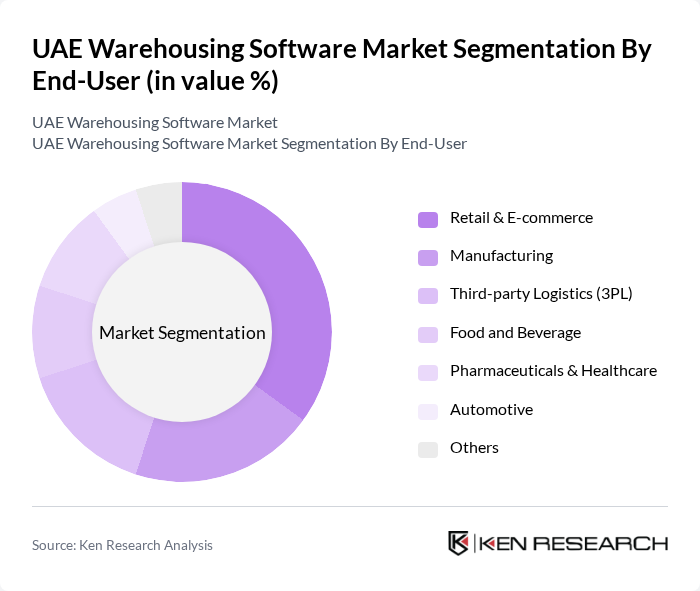

By End-User:The warehousing software market is also segmented by end-users, which include Retail & E-commerce, Manufacturing, Third-party Logistics (3PL), Food and Beverage, Pharmaceuticals & Healthcare, Automotive, and Others. Each end-user segment has distinct operational requirements, driving the need for specialized software to enhance inventory accuracy, regulatory compliance, and fulfillment speed .

The UAE Warehousing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., HighJump (Körber Supply Chain), TECSYS Inc., SkuVault, Fishbowl Inventory, 3PL Central, Logiwa, Zoho Corporation (Zoho Inventory), Cin7, Softeon, Infor WMS, Honeywell Intelligrated, SSI Schaefer, Swisslog (KUKA Group), Mantis Informatics, Consafe Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The UAE warehousing software market is poised for significant transformation as businesses increasingly embrace digital solutions. The integration of artificial intelligence and machine learning will enhance operational efficiency, while the emphasis on sustainability will drive the development of eco-friendly warehousing practices. Additionally, the rise of mobile solutions will facilitate real-time inventory management, enabling companies to respond swiftly to market demands. As these trends evolve, the market will likely witness a shift towards more innovative and adaptive warehousing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Inventory Management Software Order Management Software Transportation Management Software (TMS) Labor Management Software Yard Management Software Supply Chain Visibility Software Others |

| By End-User | Retail & E-commerce Manufacturing Third-party Logistics (3PL) Food and Beverage Pharmaceuticals & Healthcare Automotive Others |

| By Deployment Model | On-premises Cloud-based Hybrid |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Pricing Model | Subscription-based One-time License Fee Pay-per-use |

| By Integration Capability | API Integration EDI Integration ERP Integration Custom Integration |

| By Support Services | Technical Support Training Services Maintenance Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, IT Directors |

| Manufacturing Inventory Management | 70 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Software | 110 | eCommerce Managers, Logistics Coordinators |

| Cold Storage Warehousing | 50 | Facility Managers, Quality Control Supervisors |

| Third-Party Logistics (3PL) Providers | 90 | Business Development Managers, Operations Directors |

The UAE Warehousing Software Market is valued at approximately USD 210 million, driven by the growth of e-commerce, demand for real-time inventory visibility, and the adoption of advanced technologies in logistics operations.