Region:Central and South America

Author(s):Shubham

Product Code:KRAA0721

Pages:87

Published On:August 2025

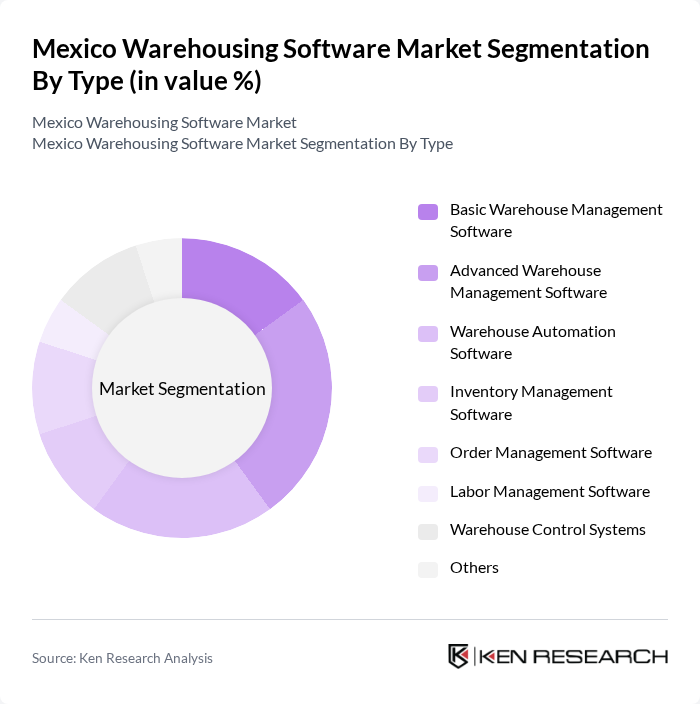

By Type:The market is segmented into various types of warehousing software, including Basic Warehouse Management Software, Advanced Warehouse Management Software, Warehouse Automation Software, Inventory Management Software, Order Management Software, Labor Management Software, Warehouse Control Systems, and Others. Each of these sub-segments addresses specific operational requirements, such as inventory optimization, order processing, labor allocation, and automation of warehouse tasks to improve overall efficiency and accuracy .

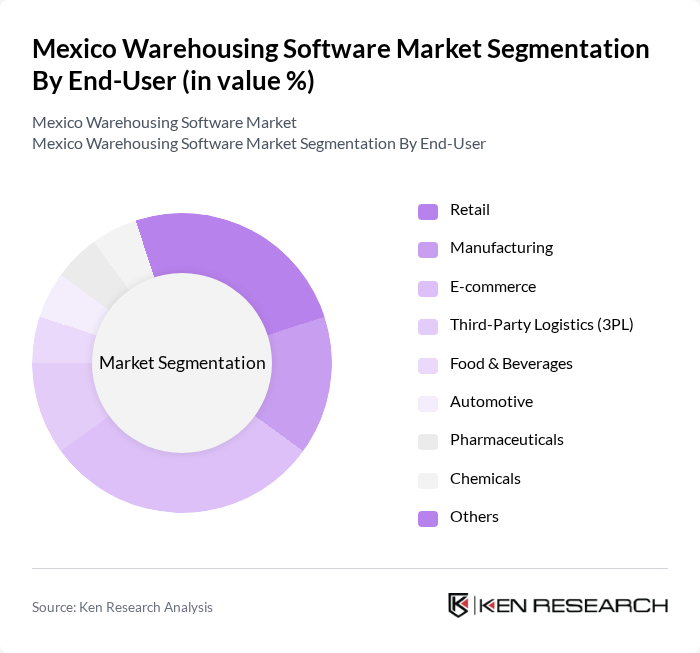

By End-User:The warehousing software market is also segmented by end-user industries, including Retail, Manufacturing, E-commerce, Third-Party Logistics (3PL), Food & Beverages, Automotive, Pharmaceuticals, Chemicals, and Others. Each sector has unique requirements that influence the choice of warehousing software, such as high-volume order fulfillment in e-commerce, strict regulatory compliance in pharmaceuticals, and temperature-controlled inventory management in food and beverages .

The Mexico Warehousing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, HighJump (Körber Supply Chain), 3PL Central, Tecsys, Mantis, Generix Group, NetLogistik, SkuVault, Fishbowl, Logiwa, Softeon contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Mexico warehousing software market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and real-time data analytics, the demand for innovative software solutions is expected to rise. Additionally, the integration of artificial intelligence and machine learning will enhance operational capabilities, allowing companies to optimize their supply chains further. This trend will likely lead to increased investments in technology, fostering a more competitive landscape in the warehousing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Basic Warehouse Management Software Advanced Warehouse Management Software Warehouse Automation Software Inventory Management Software Order Management Software Labor Management Software Warehouse Control Systems Others |

| By End-User | Retail Manufacturing E-commerce Third-Party Logistics (3PL) Food & Beverages Automotive Pharmaceuticals Chemicals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Functionality | Inventory Tracking Order Fulfillment Reporting and Analytics Integration Capabilities Automation & Robotics Integration |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-as-You-Go |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Software | 60 | Warehouse Managers, IT Directors |

| Manufacturing Logistics Solutions | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Software | 70 | eCommerce Managers, Logistics Coordinators |

| Cold Chain Management Systems | 40 | Quality Control Managers, Warehouse Supervisors |

| Third-Party Logistics (3PL) Software | 55 | Business Development Managers, IT Specialists |

The Mexico Warehousing Software Market is valued at approximately USD 130 million, reflecting a significant growth driven by the increasing demand for efficient supply chain management and advancements in technology such as AI and IoT.